In Dallas, where resilience largely defined the real estate market over the past year, top brokers navigated shifting conditions to keep the deals flowing.

Top residential real estate brokers banked on Dallas’ enduring appeal as a business hub. Fluctuations in the market didn’t change much for top-earning agents as droves of newcomers continue flocking to the nation’s ninth most populous metro, the most into any metropolitan area in the nation, according to the latest Census data from mid-2022 to mid-2023.

Dallas has intrinsic characteristics that include minimal regulatory hurdles, high job growth and lower cost of living. Currently, housing is four times more expensive in New York City, for example, and Dallasites making the median income would need to earn 125 percent more to maintain their current standard of living in the Big Apple, according to data from PayScale.

Brokers are reaping the rewards.

“The facts remain: businesses are moving here, the ease of life is great here, we have good schools and we’re still relatively cost effective — I think people feel good about that,” said Alex Perry, an agent at Allie Beth Allman & Associates.

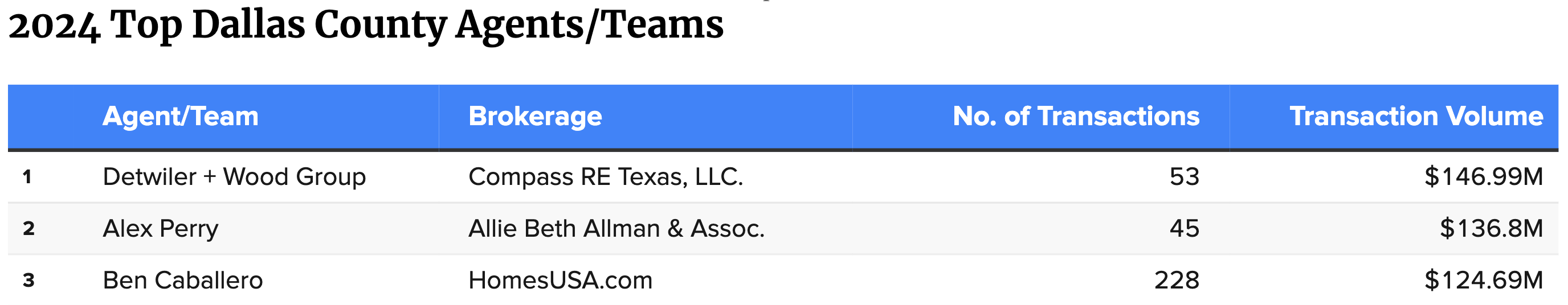

Perry took the second spot in The Real Deal’s first Dallas broker ranking, notching about $136.8 million in sales volume in Dallas County from September 2023 to September 2024. Off-market deals were not included in TRD’s analysis.

Subscribe to TRD Data to unlock this content

Subscribe to TRD Data to unlock this content

Perry found the market generally favorable, he said, despite some lulls in the summer months.

Brokerages stayed semi-competitive throughout the year, upping the ante on negotiation and outreach. These included everything from more actively prospecting for appointments, through email blasts and social media, to trimming the ranks, especially following the National Association of Realtors’ commission guideline changes in August.

Top brokers said they’ve been mostly unaffected by the new guideline changes. Agents across Texas reported their commissions increased to an average 5.76 percent, slightly up from last year’s 5.73 percent, according to a September survey from real estate data company Clever. Meanwhile, the average commission rate dropped nationally, from 5.57 percent earlier this year to 5.32 percent.

Still, brokers have noticed signs that some agents are struggling, reporting that those serving buyers appear confused over the new requirement to pen buyer representation agreements before showing a home. And home builders, not bound by multiple listing service requirements, are taking advantage.

“Builders can do what they want to, and some aren’t offering any commission or seller concessions; they make the buyer’s agent show their hand first,” said Ben Caballero, the CEO of HomesUSA.com who landed third in TRD’s rankings, with about $124.7 million in sales volume. He’s seen some buyers’ agents failing to receive commissions after forgetting to write up the representation agreement.

Texas industry leaders pointed to a recent uptick in builders attracting more buyers with aggressive financing approaches, but builders in Dallas have been relatively proactive in using mortgage rate buy-downs and offering other incentives since April of last year, Caballero said. The last few months of 2024 has seen supply for new homes rising to meet inventory levels for existing homes across the state, which remain stagnant, as buyers have been slightly more incentivized by lower mortgage rates than lower prices.

Brokerage leaders looked to sporadic periods of higher inventory — more than three months of inventory on average every quarter, and over four months in the third quarter this year — as a sign the market was returning to seasonal cycles after years of post-pandemic volatility. Median home prices stagnated near $400,000 most of the past year, while mortgage rates remained between 6 and 7 percent, too high to bring about a rush on par with the hotter years since 2020, when rates dropped as low as 2.65 percent and inventory hovered between 1.2 and 1.8 months for over a year in 2021 and early 2022.

However, moving toward the last quarter this year, the Dallas market began defying some of those expectations of a traditional seasonal cycle. From August to September, home sales increased by 4.6 percent month-over-month, according to Texas A&M’s Texas Real Estate Research Center. An expected end-of-the-year lull similar to the summer months hasn’t come, Caballero said.

“Normally, we have a slump at the end of the year, but sales activity remains level, which bodes well for a strong start to 2025,” he said. Part of that boost comes from builders’ inventory, he said.

Other trends, such as the steady encroachment of institutional investors in residential real estate across the city, have not had a notable effect on home sales, brokers said.

Demand for luxury homes propped up many top brokers’ sales, like Perry, who transacted 45 on-the-book deals in total. The city of Dallas further expanded its supremacy in the highest tranche of the homebuying market, where largely cash buyers stay insulated from high mortgage rates. As of September, 11 ultra-luxury homes, last listed north of $10 million, were sold in the Dallas-Fort Worth area, compared to Houston’s four and Austin’s one.

Perry credits his performance in the Dallas luxury scene to an ability to toe the line between maintaining privacy for sellers and making sure the right people know about a high-end listing.

“You fine-tune that art of letting people know that something’s available when it’s not necessarily being marketed to everyone,” he said. “As you grow in the business, you tend to get higher-priced listings because you learn the market better, you learn the way.”

Access data and contact information from this ranking here. TRD Data puts the power of real data in your hands.