Ranking: San Francisco’s biggest general contractors

Top firm in fourth generation with Kathryn Cahill at helm

History and local connections count in San Francisco construction — especially as the city moves past the post-pandemic meltdown of its downtown office market and aims to overcome negative coverage from national news.

Firms based in the city dominated TRD’s first-ever ranking of general contractors in San Francisco. Several have been in the same family for generations.

“We’ve got relationships that go back 30 years or more,” said Bob Nibbi, CEO of third-ranked Nibbi Bros., which was founded by his grandfather in 1950. “That’s an advantage for times like these, when things get tight.”

The pandemic and subsequent negative perceptions of San Francisco are yet another chapter in the city’s ongoing boom and bust storyline, starting with its rapid Gold Rush-era development, followed by the famously destructive 1906 earthquake and fires.

The top-ranked company on the list, Cahill Contractors, started when founder J.R. Cahill was “inspired to rebuild” the city in the wake of the 1906 earthquake, according to the company’s website. These days, Kathryn Cahill Thompson, the company’s CEO since 2016, represents the fourth generation of family leadership.

Thompson and others on the list are all operating in an era of tough financing for construction loans and slow-moving projects.

“Construction is always the last to feel a recession. We’re out there building it, and in the meantime, developers are not getting the next project ready.”

San Francisco had 6,600 residential units — a staple segment for general contractors — under construction as of the first quarter of 2023, according to data from the city’s planning department. That’s down from 9,600 in the first quarter of 2020.

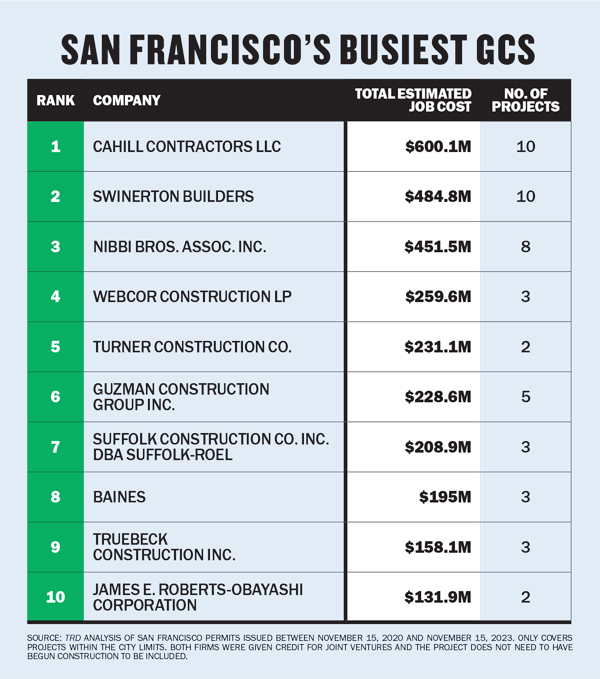

TRD’s rankings took a three-year view, tracking both the number of projects the firms are working on and the total cost of the projects. The construction projects did not need to be underway in order to count toward the total, and both firms were given credit for joint ventures. The data is based on San Francisco permits issued between November 15, 2020, and November 15, 2023, and only covers projects within the city limits.

Cahill has been general contractor on 10 permitted projects during that time, according to city records, with a combined value of about $600 million. All of those projects were for apartments, except for a $16 million Buddhist temple with a community center near the Polk Street corridor. Another notable project is in the Bayview, with 118 units of affordable housing accounting for $100 million of that total.

Swinerton Construction took the second-place spot, with 10 projects at a total of about $485 million in costs. Nearly half that total came from one project, a 16-story, 500-unit apartment building in SoMa.

The company recently announced that it would name president David Callis as CEO this month when current CEO Eric Foster retires. Swinerton is even older than Cahill, with more than 130 years of history in San Francisco.

Nibbi Brothers had eight projects permitted for a total of about $450 million. CEO Bob Nibbi is the third generation to run the company along with his brother, Michael, who is the vice president, and his father, Larry, who is chairman of the board.

Bob Nibbi said that affordable housing projects have been keeping his employees busy as the rest of the development pipeline dries up, with market-rate multifamily development “pretty much non-existent.”

With fewer projects to bid on, Nibbi is “aggressively competing” for GC work and as concrete subs on other GC’s projects, he said. But even if labor costs are down slightly, elevated material prices, higher interest rates and lower rents still mean that most projects outside of affordable housing and public sector work don’t pencil for developers, he added.

“Construction is always the last to feel a recession,” he said. “You’ve got work on the books and we’re out there building it, and in the meantime, developers are not getting the next project ready.”

Fourth-place Webcor Construction had three projects in the works according to permitting data, with a total value of nearly $260 million.

Two of the Webcor projects — an $84 million apartment tower on Treasure Island that broke ground in mid-2022 and a $45 million R&D building near Potrero Hill that topped out last year — are joint ventures with other construction firms, according to city records. Webcor’s only solo project, also on Treasure Island, is also its biggest: a 22-story mixed-use building with 250 apartments estimated to cost $130 million.

At 50 years old, Webcor is one of the younger companies on the list. It began on the Peninsula. Oracle’s headquarters in Redwood City, the Academy of Sciences in San Francisco and SFO’s Terminal One are among the most prominent projects in its history, according to the company.

Turner Construction was the only construction firm based outside the Bay Area to make the top five. The company is headquartered in New York City’s Hudson Yards, with a Bay Area office in Oakland.

Its work on a $231.1 million project developed by its New York landlord, Tishman Speyer, called Brannan Square, propelled the company onto the list. Turner built two of the three buildings at the 1 million-square-foot SoMa office and retail development, which centers around a one-acre park and recently began leasing.