Hollywood commercial real estate is on a roll. And it’s not all about demand for office space, though the surge in occupancy by companies like Netflix certainly helps. Both mixed-use and multifamily projects are seeing their day in the sun, too, and developers have been quick to seize on the trend.

“The outlook for Hollywood is very strong,” said Michael Soto of real estate firm Transwestern. He said the area was very attractive for development not just because it is the traditional nexus of L.A.’s entertainment industry, but also because it’s centrally located and well served by public transportation.

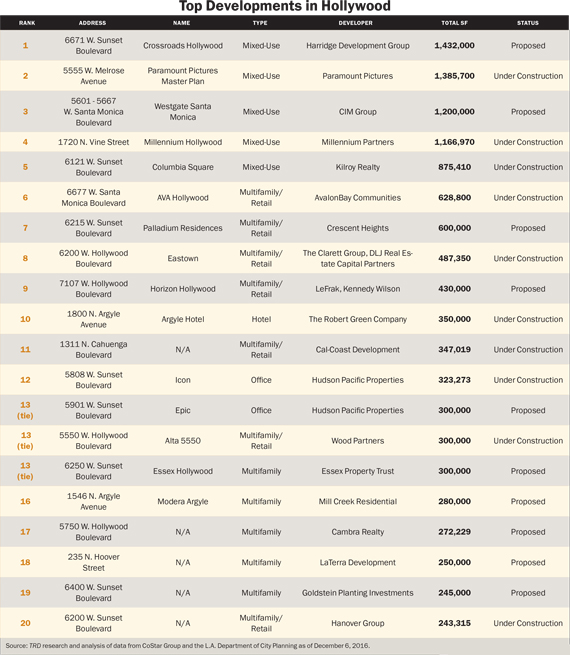

The developments in The Real Deal’s ranking of the 20 largest projects in the pipeline would add more than 10 million square feet of space to the Hollywood market, including about 6,500 residential units.

Coming in at the top of the list is Harridge Development Group’s mixed-use project Crossroads Hollywood, which would bring more than 1.4 million square feet of commercial space to Hollywood.

CIM Group’s proposed 1.2 million-square-foot mixed-use project at the former Sears site in East Hollywood puts it at No. 3 in TRD’s ranking. The latest plans for the project, located at 5601-5667 Santa Monica Boulevard, include more than 300,000 square feet of retail space and up to 700 residential units.

Over at Kilroy Realty’s Columbia Square, the demand for office space is well documented, but the project is also slated to include 25,000 square feet of retail frontage along Sunset Boulevard and a residential tower with 200 apartments.

Meanwhile, some Old Hollywood stalwarts have some new swagger of their own. Paramount Pictures recently won approval from the city for a $700 million renovation to add nearly 1.4 million square feet to its Hollywood studios, making it the largest project currently under construction in the market.

And while it doesn’t have the whole spotlight to itself, Hollywood office space really is the talk of the town, and prolific developers like Hudson Pacific Properties are coming back for seconds. The developer proposed another project down the block from the Sunset Bronson Studios lot, where Netflix leased two office towers. Epic, a 300,000-square-foot office building, would be located at 5901 West Sunset Boulevard.

“Location really does matter,” said Bill Humphrey, the general manager at Hudson Pacific Media, a unit of Hudson Pacific Properties. “Silicon Valley companies realize they need state-of-the art creative office spaces to produce the content, along with close proximity to talent in L.A.”

But high land costs may ultimately limit the ability of developers to keep up with demand, Soto said, adding that roughly half of the Hollywood office space under construction has been pre-leased.

One other potential problem? Hollywood is a hotbed of anti-development activism, lending a certain amount of uncertainty to projects in the planning stages. The 731-unit Palladium Residences, for example, has been slapped with a NIMBY lawsuit.

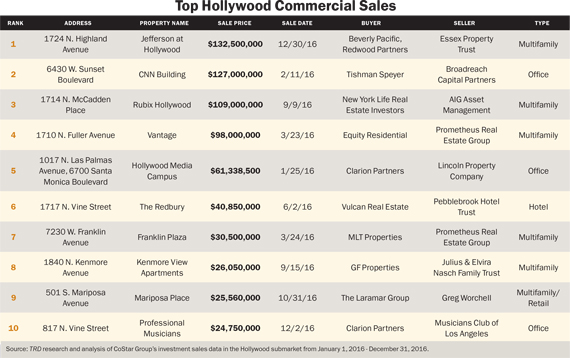

However, investment sales continue to infuse both cash and revamped product into the market. Tishman Speyer paid $127 million for the 14-story, 204,000-square-foot CNN building at 6430 West Sunset Boulevard, valuing the building at $600 a foot in a market where the average price paid the previous year was $442, according to CoStar Group.

Just as on the new development front, many of the top sales were multifamily properties. The priciest sale of a Hollywood commercial building was the $132.5 million Beverly Pacific and Redwood Partners shelled out for Jefferson at Hollywood, an apartment building at 1724 North Highland Avenue.