UPDATED 4:18 p.m. January 21: On a particularly well-to-do street in San Marino sits a 7,000-square-foot Spanish Revival home with six bedrooms and bathrooms, a koi pond, tennis courts and an enormous swimming pool. Originally listed in 2017 for $9 million, it was later relisted for $7.7 million. After another 65 days on the market, the home at 2075 Lombardy Road had its price cut again to $7.6 million, and then again after another few months to $7.49 million, where it remains for sale, listed by Compass agent Jeannie Garr Roddy.

The home’s listing history is emblematic of what’s been happening for a while in many of Los Angeles County’s poshest neighborhoods. And steep price cuts aren’t the only signs of increased softening at the top of the market — sales volume for luxury listings is decreasing in some pockets, too.

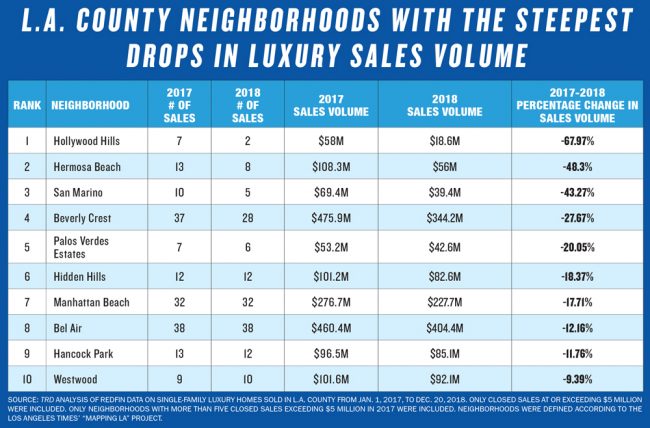

In 2017, 37 homes priced at $5 million or above in Beverly Crest were sold; last year, that number dropped nearly 25 percent to 28. In the Hollywood Hills, seven homes priced in that range were sold in 2017, but just two in 2018.

To calculate these drops in luxury sales volumes by neighborhood, The Real Deal analyzed Redfin data on single-family luxury homes sold in L.A. County from Jan. 1, 2017, to Dec. 20, 2018. Only closed sales at or exceeding $5 million were included, and only neighborhoods with more than five closed sales in that range in 2017 were analyzed. Neighborhood boundaries were defined according to the Los Angeles Times’ “Mapping L.A.” project.

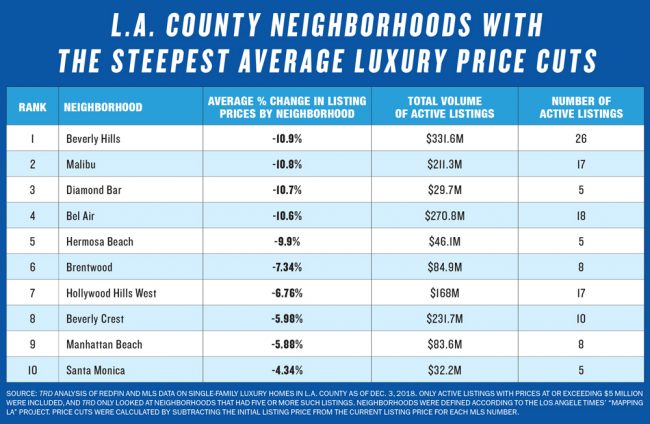

There are also several neighborhoods where many luxury home prices have been slashed. In Beverly Hills, prices of luxury homes were cut by an average of about 11 percent from when they were first listed to Dec. 3, 2018. To calculate average price cuts by neighborhood, TRD subtracted list price as of that date by the initial listing price under the same MLS number, according to Redfin data.

There are also several neighborhoods where many luxury home prices have been slashed. In Beverly Hills, prices of luxury homes were cut by an average of about 11 percent from when they were first listed to Dec. 3, 2018. To calculate average price cuts by neighborhood, TRD subtracted list price as of that date by the initial listing price under the same MLS number, according to Redfin data.

Stephen Shapiro, chairman of Westside Estate Agency in Beverly Hills, cited a few examples of recent price cuts: 1175 North Hillcrest Road in Trousdale Estates came on the market at $100 million in August 2017. A month later it was reduced to $85 million, then to $77.5 million five months later. The price came to rest at $68.2 million in October 2018, and then it was taken off the market.

Economist Selma Hepp, vice president for business intelligence at Compass, said she is definitely seeing more price reductions than there were a year ago in certain high-end neighborhoods. But she added that these pockets of reduced-price listings don’t tell the whole story of the luxury home market. Hepp said that when you look at all of L.A. County, high-end home sales did well last year — at least up until September, when she said the entire market slowed.

Hepp explained that the decline in the autumn was largely driven by fewer sales in Beverly Hills, Holmby Hills, Bel Air and other neighborhoods west of the 405. However, she said that the softening in those areas was offset by increases in the “East and West Valley, as well as south of the 210” and other neighborhoods. Hepp specified that her analysis was based on homes priced at $3 million or more, unlike TRD’s analysis, which had a higher cutoff of $5 million.

LUXURY SALES VOLUMES BY NEIGHBORHOOD 2017-2018

Interactive map: double-click magnifying glass to zoom

Beverly Hills

While Beverly Hills didn’t end up in the ranking of neighborhoods with an overall decline in high-end sales volume, it did rank as one of the neighborhoods that’s had the highest average price cuts. Hepp said the reason for this was the decline in international buyers. “The political climate has not been welcoming to foreign buyers, and I think we can see the result of that in some of those areas,” she said.

For many years now, Chinese buyers have funneled millions into L.A.’s luxury home market, but that has subsided recently due to changes in Chinese rules limiting capital outflow. Hepp explained that the rules, which went into effect in 2017, “really put a lid on the neighborhoods where Chinese buyers were buying. We saw a drop in high-end sales last year in Orange County and in the eastern cities [of L.A. County] because of this.”

A change in buyers’ preferences is another reason for the recent price cooling in Beverly Hills, according to Myra Nourmand, principal of Nourmand & Associates. She said that Trousdale Estates, the hilly part of Beverly Hills known for one-story midcentury homes, was once very popular. “A few years back, there was a sale for $70 million and there were homes selling in excess of $2,500 per square foot. Buyers wanted views, and they were paying a premium for it.”

Now there is less desire for views and more demand for homes with larger lots in the flats of Beverly Hills, she said.

Malibu and the Foothill Communities

The recent fires have also had an impact on certain areas, particularly Malibu and the foothill communities. “This year on average, 70 percent of properties sold were at a price reduction in those areas, unfortunately due to the fires,” said Hepp.

Bel Air and Sunset

Bel Air and the Sunset Strip are the hardest hit with an oversupply of new construction homes, said Ernie Carswell of Douglas Elliman, and the glut is forcing sellers to cut prices. “There are 148 luxury homes listed in this area right now — of these, 28 have reduced their prices,” said Carswell.

His advice: “If you haven’t sold in 60 days I’d recommend a 10 percent decrease in price. Already most of the competitors are doing a 5 percent cut. To pull ahead of the pack, you need to go higher than five.”

Hollywood Hills

Because the Hollywood Hills hasn’t seen as much buildup of inventory, Carswell said, that area’s prices are holding steady for now, even though luxury sales volume dropped from 2017 levels. “That neighborhood will probably have an oversupply [in late 2019], but has been saved so far because that area wasn’t the first choice for building.”

San Marino

San Marino’s prices are also softening because of the slowdown of funds coming in from China, said Tim Durkovic, president of the Durkovic Group, of Douglas Elliman: “San Marino has been a popular destination for foreign investors, and Chinese investors specifically. Couple that with a pretty good amount of inventory on the market, and this has led to the prices being cut.”

The Kardashian effect

Prices may be down in many luxury markets, but high-end home sales are actually doing quite well in a handful of neighborhoods.

While the departure of Chinese buyers hurt some areas, places such as the East and West Valley have done well because these spots are generally home to more well-heeled local buyers, such as people in the entertainment and finance industries, said Hepp.

“Also, south of the 210 had a relatively bad year in 2017 after Chinese restrictions on capital outflows, so the bounce-back [in 2018] is of relative lows,” she explained.

Over the last year, Hepp said, she’s also seen a uptick in sales of high-end homes in the Calabasas area, Hidden Hills, Encino, Tarzana and Woodland Hills, which she likes to call the Kardashian effect, since the famous family lives in Calabasas. “I’m not sure if that’s it or if it’s because you can get more for your money there,” she said.

Nourmand said that only a handful of neighborhoods can support a price point of over $10 million. “However, there have been adjacent neighborhoods with bigger lots that are making a push,” she said. “One example that comes to mind is just outside of West Hollywood. There are some lots on Orlando between Melrose and Santa Monica that are over 12,000 square feet. There was a new construction home that sold for over $8 million, and there is a home that recently hit the market for over $12 million.”

Los Feliz and Hancock Park are holding steady on pricing because there isn’t an oversupply of high-end homes, said Carswell, adding, “Any reasonably priced luxury home is doing quite well in those areas.”

27318 Winding Way in Malibu was initially listed for $11 million but is now on sale for $7.89 million.

Little Holmby, a small section of Holmby Hills, is now highly desired by young families, in part because of the great school system, and sales there are also doing well, said Carswell.

Tax laws and volatility

Certain factors have contributed to changes in the high-end market as a whole, notably new tax laws and uncertainty in the financial markets.

Because many high-end buyers pay for their homes entirely in cash, they are primarily looking at the tax cost when they buy, Shapiro said, adding that he thinks a lot of the hesitation among buyers is due to recent changes that limit property tax deductions to $10,000.

Add to this the fact that none of California’s 13.3 percent state income tax can be written off, spousal support is no longer deductible as of 2019 and homeowners can now deduct only $750,000 of their mortgage interest, and the problem is magnified. “Buyers now have to decide if they want to make a move and have it cost them a couple hundred thousand per year,” Shapiro said. “And it affects the sale of their home as well.”

But tax laws aren’t having much of an impact on the very tip-top of the market. “At a certain price range it just doesn’t matter,” Shapiro said. “Some people have so much money they are not concerned about taxes. I’m talking about people buying homes in the $50 million-and-above range.”

Financial and social volatility have also contributed to price drops in the luxury market. Hepp said the high-end home market follows the stock market more closely than other segments. “People were riding the stock market wave, and that’s why the high-end sales were doing so well,” she said. “A lot of the decline we’re seeing is simply a result of the volatility in the finance world.”

David Berg, a founding partner of the real estate team Smith & Berg Partners, agreed. “Life can change with a tweet,” he said. “There is a perception of risk on the horizon, and a segment of the buyers are trying to price that risk in, either by waiting on a price reduction or by putting in lowball offers.”

He added that toward the end of 2018, the midterm elections, recent fires and the shooting in Thousand Oaks all impacted buyer decisions. “When both social and economic factors are rocky, it can be uncomfortable for people to make big financial decisions,” Berg said. “Now the homes that would’ve been swooped up quickly six months ago are taking a little bit longer to sell, and buyers are taking longer to make up their minds.”

The deal-sweeteners

Despite the softening, Shapiro doesn’t believe in offering incentives or sweeteners in order to sell. But he’s also not a fan of overly optimistic pricing. “One of the biggest problems in real estate is the inexperienced person who just got their license. They charge the same as someone who has been doing it for 30 years, but they’ll tease the seller with a higher price,” Shapiro said. “Ultimately, they destroy their own market.”

Carswell, however, said that brokers now need to think outside of the old real estate box if they want to succeed in this market. To that end, Carswell’s team has begun “curating” its open house events. “Typical staging right now is not enough. We’ve got to compete on all fronts: price and the contents of the home.” His team has partnered with some local museums in order to get original artwork inside open houses. “We want people to say they saw a Damien Hirst on the wall, which we did have in one home,” said Carswell.

Carswell’s team also gets furniture in the home from designer brands like Pucci and Armani. Then they invite the artists who did the work on the walls, or Hollywood types. “That way you have an interesting mix of people, and word starts to spread. I see a lot of synergy and personal exchanges taking place at these events,” he said.

Berg doesn’t think the market has reached a need for incentives, as it did during the recession. “There is no blood in the water right now, and the people who are circling have a lot of faith in the market,” he said.

Correction: This article has been amended to reflect that Tim Durkovic’s Durkovic Group operates within the Douglas Elliman brokerage.