UPDATED 12:03 p.m., November 27

In an uncertain economic climate where every deal has become a complex matter, Los Angeles’ real estate lawyers are more in demand than ever as they work to keep pace with changing market needs.

Even seemingly straightforward deals are no longer easy-peasy, attorneys say. Whether projects require legal teams to put layers of financing in place, sift through lawful directives or negotiate multiparty agreements, L.A.’s commercial developments are proof that the road to success is littered with legal fees.

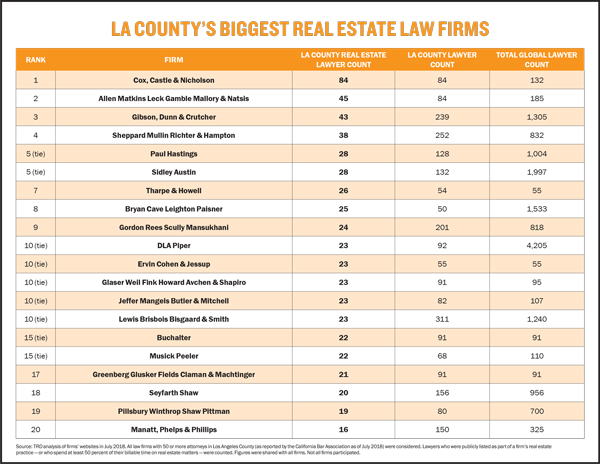

Amid the flurry of complicated transactions, The Real Deal took a look at the biggest players involved in order to see who has actually been doing the lion’s share of the legal wheeling and dealing. For this inaugural ranking of the top law firms in L.A. County, TRD analyzed those with 50 or more attorneys as reported by the California Bar Association as of July. Lawyers who were publicly listed as part of a firm’s real estate practice — or who spend at least 50 percent of their billable time on real estate matters — were counted. Figures were shared with all the firms, though not all firms participated.

Lawyers at the city’s top firms told TRD that they’re working in a development environment that is showing signs of distress, which has led to prolonged legal dealings in order to ensure that the players involved are protected from fiscal calamity.

“Most people in the real estate industry describe the current state of the cycle as somewhere between the bottom of the eighth inning and the top of the 11th,” said Susan Booth, an attorney at Holland & Knight (with just nine lawyers dedicated to real estate, the firm did not place in TRD’s ranking).

While many attorneys report that the overall volume of activity remains high, the timing of those transactions has slowed. Many purchase and loan deals that used to take two or three months to complete are now taking at least twice as long, lawyers said.

While many attorneys report that the overall volume of activity remains high, the timing of those transactions has slowed. Many purchase and loan deals that used to take two or three months to complete are now taking at least twice as long, lawyers said.

The changing needs of developers and financiers

The shifting commercial real estate landscape also means the job market is heating up for transactional and finance attorneys who have the expertise and experience to handle all the incoming complex, multiparty projects.

“Los Angeles firms continue to look for real estate attorneys at every experience level, in particular at the mid to senior level,” said Romina Filippou, a legal recruiter with the Los Angeles-based firm BCG Attorney Search. “We are seeing more real estate finance openings. Specifically, firms are seeking candidates with experience in mortgage and mezzanine debt and joint-venture equity work.”

Filippou said there are an increasing number of opportunities for attorneys in other real estate areas, too, ranging from sales and leasing to joint ventures and finance, including commercial mortgage-backed securities.

Many commercial projects have at least a two- to three-year timeline, which means that projects currently in the works may be born into a struggling market. That means the outlook for the next handful of years is also strong for legal work. For the moment, worries about a fairly imminent downturn are causing developers and lenders to become more conservative in their forecasts for leasing multitenant properties or stabilizing new construction, which is impacting financing — and for real estate attorneys, this translates into a greater workload and increased billing.

“Borrowers and lenders are definitely being much more conservative on execution and the timeline and cost to get there,” said Adam Weissburg, a partner at Cox, Castle & Nicholson —the No. 1 firm in TRD’s ranking, with 84 lawyers on staff devoting half or more of their time to real estate-related matters. The firm has been instrumental in the massive Martin Expo Town Center project in West L.A., which at over 807,000 square feet will include 619 residential units and 150,000 square feet of office space.

“Lenders that do permanent loans are also taking into account whether the property will remain viable if it becomes ‘stressed’ because of a downturn,” Weissburg said. “While people don’t know when a downturn will hit, there is a healthy concern that it is on the horizon.”

Lawyer Alain R’bibo agrees. The attorney at Allen Matkins Leck Gamble Mallory & Natsis — which ranked second on TRD’s list, with 45 real estate lawyers on staff — represents owners and operators of office, retail and industrial projects in especially complex real estate transactions, including purchases, sales, leases, joint ventures and operations.

“We’re not seeing some of the riskier underwriting we saw before the 2008 meltdown,” said R’bibo. “We are finding that what used to be a simplified $20 to $30 million deal is now commanding the type of diligence we would usually encounter with a $100 to $200 million kind of deal.”

While it doesn’t come cheap, this level of diligence is advantageous for clients who want additional protections if a deal goes south. And if anxieties about a downturn persist, or even ratchet up, that means more commercial real estate projects — even relatively small deals — will be given the same extensive attention to diligence and negotiation as monster deals, translating to an abundance of work for attorneys involved in the real estate market, insiders said.

“We’re definitely not seeing work slow down at all,” R’bibo said. “If anything, it’s been increasing. In the last year alone, I’ve personally worked on $500 million worth of transactions. It’s just been incredibly busy for a variety of client types, from institutional to high-net-worth individuals. There’s an appetite right now for the entire spectrum.”

A challenging market

While attorneys may not be experiencing a slowdown in work, they are definitely seeing fewer monster deals getting done in L.A. County (see our story on trophy tower trades on page 24).

“My sense is that people are moving slowly because they are looking around and trying to find signs that the game is still being played,” Holland & Knight’s Booth said.

R’bibo is also seeing signs of stress.

Cox, Castle & Nicholson, which came in at No. 1 on TRD’s real estate law firm ranking, is providing legal counsel for the Martin Expo Town Center.

“This is a challenging market. From a buyer’s perspective, things remain expensive,” he said. “From the lending community’s perspective, there is concern that as the market changes, deals continue to be underwritten conservatively and judiciously without taking some of the risks we saw before the 2008 meltdown.”

Insiders note that delays caused by a newfound abundance of caution began affecting big deals last year. Attorneys at L.A.’s top firms are finding that the timelines on deals of nearly every size are getting sluggish.

But there are still lots of deals happening, particularly in well-situated industrial centers and in office buildings that can be modernized. Clients with the patience to wait for a long-term payoff are the ones who are going to see the most rewards, said legal experts.

“Real estate investors are more cautious now than they were a year ago, but they are also optimistic that good opportunities remain available,” Booth said.

Bracing for change

Top law firms are working hard to differentiate themselves in front of real estate clients. Amy Wells, a partner at Cox, Castle & Nicholson, said the firm’s clients are very attuned to the market and that Cox is always looking for new opportunities for them, including off-market deals.

“We assist them in evaluating and capitalizing on potential deals,” Wells said. “We have developed streamlined procedures to enable our clients to respond quickly when opportunities arise.”

To successfully attract and retain real estate clients, law firms need to have extensive experience with analyzing and resolving — through negotiation or litigation — a wide range of complex matters that are particular to the real estate industry.

They also may need to vary in what they charge. Some law firms report separate fee scales for small real estate developers versus large real estate developers as a way to add diversity to the mix — and as a way to avoid the pitfalls of having a whale client that can drastically affect a law firm’s standing if the market dramatically slows or a deal goes south.

And, as some law firms learned in the aftermath of the 2008 economic downturn, having a number of smaller real estate clients on the roster can be a good thing. Together, these smaller fish can provide a steady and significant income base, especially if work from a whale of a client begins to slow.

Generally speaking, firms — whether they be developers or law practices — with marketing strategies that cast a wide net will be better prepared for a downturn, those in the industry said. But they also cautioned against mistaking the current market shifts for signs of a 2008-like economic meltdown in the works.

By and large, commercial real estate players of all sizes — with the help of their attorneys — are taking smart precautions that will help them weather all but the most unexpected downturns, the experts surveyed said. They insist that for every mixed-use complex or high-density infill, there’s a team of legal eagles who have advised, negotiated and researched every step of the way.

Corrections: DLA Piper was erroneously excluded from the top law firms ranking. The firm has 20 real estate lawyers in LA County. This article’s ranking has also been updated to correct clerical errors regarding the headcounts of firms that placed 15th to 20th. The corrections did not change the order of the ranking.