When an Eastdil Secured team was gearing up to market Pacific Corporate Towers, a three-building corporate office campus in El Segundo, they thought it would be a challenge to find bidders willing to pay a premium price.

The project had been built in the 1980s and featured three bulky, high-rise towers that are far from the sleek, glass-clad offerings on the market today. “It was the antithesis of that [new] product,” said Steve Somer, an Eastdil broker on the deal.

The 1.6 million-square-foot complex was also in a quiet suburb located near Los Angeles International Airport. That’s roughly 10 miles away from Santa Monica, a preferred location among institutional and private investors that commands some of the highest rents in the city.

But much to the surprise of the Eastdil team, the bidding process in El Segundo ended up “ultracompetitive,” with over 16 offers in the first round. At a $500 million price guidance, that translates to over $8 billion in capital on the table competing for a single property.

“We had one of the deepest buyer pools we’ve seen,” Somer said. The broker, who has seen the city’s growth over the years, said his team was “positive about El Segundo” but “just didn’t know how many people were ready to buy an asset that large” in the city.

After several rounds of bidding and over 70 property tours, a joint venture between Starwood Capital Group and its local operational partner Artisan Realty Advisors purchased the campus for $605.5 million in what marked the second most expensive deal in Los Angeles County in the 12-month period ending in May.

As a sleepy suburb in the South Bay traditionally known for its large aerospace and defense presence, El Segundo was home to four of the deals in The Real Deal’s ranking of the 20 most expensive office sales in the county. Another El Segundo purchase in the ranking was Swift Realty Partners’ $167.5 million buy of a three-building complex on Imperial Highway. It was the 12th-largest deal in the ranking.

David Baker, a senior vice president at Starwood, said his firm had been analyzing the El Segundo market about a year before the bidding on Pacific Corporate Towers.

“We really saw it beginning to evolve into a destination for tech and media companies, and at the same time we felt it was still early enough in that economic life cycle where we could really participate in that reinvention and create immediate scale,” Baker said.

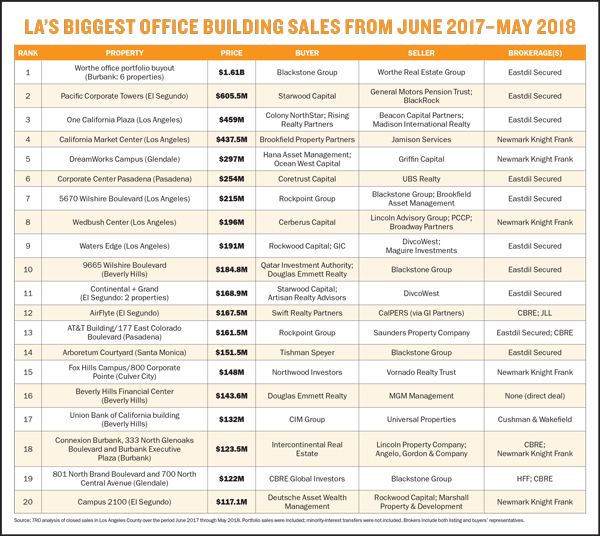

To rank the most expensive office building sales in L.A. County that closed between June 1, 2017, and May 31, 2018, TRD’s research team analyzed sales data from public and private databases. Portfolio sales were included; minority-interest transfers were not included. The brokerages attached to each deal include both listing and buyers’ representatives. Data was shared with all brokerage firms in the ranking, but not all firms participated.

The ranking reveals that investors seeking trophy tower deals turned to less traditional markets this year amid a tightening of supply in the highly desired Westside.

“West L.A. is our Central Business District in terms of desirability, and that pipeline of deals has sort of dried up,” said Kevin Shannon, a Newmark Knight Frank (NKF) broker who worked on three of the top deals in TRD’s ranking. He credited that scarcity to many of the big-ticket properties in the Westside being traded in the last few years when Blackstone unloaded the remains of its Equity Office portfolio.

“Most investors we hear from want to buy assets in West L.A.,” said Somer, who works closely with Blackstone. “The issue is there’s not a lot that trades in West L.A.”

Out of the 20 most expensive office building sales in L.A. County, only a handful were in the Westside. Investors largely flocked to Burbank, Pasadena, Glendale and El Segundo.

At the top of the list was the Blackstone Group’s majority-interest purchase of a six-property portfolio in Burbank, valued at $1.61 billion in a deal brokered by Eastdil. Jeffrey Worthe of Worthe Real Estate Group, who developed and owned the properties, retained a 20 percent interest and will continue to manage the buildings.

As an entrenched brokerage known for its emphasis on collaboration within the company, Eastdil maintained a large presence this year, brokering half of the top 20 deals. Newmark notched second place. Other big players, such as CBRE, JLL, Cushman & Wakefield and Holliday Fenoglio Fowler (HFF), trailed them with a smattering of deals priced under $170 million.

“If you look at the investment sales brokers in L.A., specifically ones that focus on office, there’s a small handful that get the lion’s share of the business,” said Mark Laderman, co-founder and managing partner at Artisan Realty. “Eastdil Secured would be at the top of the list.”

Competing for the listing

Blackstone and Eastdil have an unusually close relationship that dates back over a decade. When Blackstone sold many of its L.A. trophy towers last year, it allowed Eastdil to dominate the market, while driving up sale prices in the region.

Eastdil brokered all top five sales in 2017’s trophy tower ranking by TRD, with two of them coming from Blackstone’s Equity Office portfolio. This year, Eastdil brokered three of the top five.

Somer said Eastdil has endured a slower first half of 2018, but that’s not expected to last long. The firm recently brokered one of the largest deals ever in Santa Monica — the $616 million sale of the Blackstone-owned Santa Monica Business Park to Boston Properties, which closed after the period covered in TRD’s ranking — and there’s still a couple of “big deals that could bring in billions for L.A.” by year’s end, he asserted.

Nevertheless, Eastdil has competition. The data reveals that Newmark has been steadily upping its share of L.A.’s investment sales market. Last year, NKF notched only four office sales in the top-20 ranking, and those sales placed eighth, ninth, 18th and 20th in that list. This year, it oversaw six deals in the ranking, including those that took the fourth and fifth spots. Many attribute Newmark’s greater might to Shannon and 14 members of his team leaving CBRE to join the firm in 2016 and the hiring spree at Newmark that soon followed.

Newmark has nearly doubled the number of its investment sales brokers on the West Coast in the last year and a half, Shannon said. That includes hiring heavy hitters like Bret Hardy from Colliers, Brad Feld and Steven Salas from Madison Partners and Will Adams and Norman Lee from CBRE within a year of Shannon’s team joining NKF. He also added six more people to his own team in the last 12 months.

Louis Sohn, managing director of acquisitions at Griffin Capital, enlisted Shannon and his team to sell the DreamWorks Animation campus in Glendale, which sold to a South Korean partnership for $297 million in the fifth-priciest transaction on TRD’s ranking.

“We want the same broker, maybe not the brokerage firm,” said Sohn about his firm’s decision to enlist with Newmark and not CBRE, which had sold the 15-acre campus to Griffin in 2015.

“Eastdil has historically been one of those brokerages on the West Coast that has a large assignment,” Sohn said. “Shannon has done a great job — first at CBRE and now at Newmark — and we’re seeing a lot of activity from him.”

Shannon’s team also brokered Brookfield Property Partners’ purchase of a $437.5 million stake in the California Market Center, which was the

fourth most expensive deal in the last 12 months. Jamison Services retains a minority interest in the 1.8 million-square-foot project, located in the Fashion District Downtown.

Off-market negotiations for that sale took place over a couple of years, according to Bert Dezzutti, an executive for Brookfield’s Western region. “It was about structuring a transaction that made sense for Jamison and that

made sense for us, and that typically takes a lot more time,” Dezzutti said.

For Newmark, the deal was another feather in its cap. The company makes a quarter of its national revenue from capital markets-related transactions, said Shannon. “We’re unique in that we’re a full-service brokerage but our No. 1 focus is capital markets, and none of our full service competitors are [only focused on that],” he said.

Bob Safai, founder of Madison Partners, said Newmark has been very successful in its entry into the West Coast. There are “few of us elite brokerages competing in the landscape,” he said.

Where are the ‘megadeals’?

While huge deals are getting done, there was a marked drop in price points in this year’s top trophy tower trades compared to the year before. Last year, all of the top 10 sales in TRD’s ranking were over $310 million. This year, only four deals in the top 10 were priced above $300 million. Most insiders said the 2018 drop could be credited to Blackstone’s selling spree winding down.

Pacific Corporate Towers

Blackstone sold most its Equity Office Properties (EOP) portfolio last year, inching toward closing the chapter on one of the biggest leveraged buyouts in history. (Blackstone’s $36 billion purchase of the Equity Office portfolio closed in February 2007).

“The fact is, Blackstone’s EOP inventory has been sold off, and that’s where the megadeals are,” Shannon said. “You’re not going to see deals of that scale in most L.A. markets.”

Last year, the company sold the SunAmerica Center in Century City for $572.9 million, the Colorado Center in Santa Monica for $511.1 million and the Wells Fargo Center in Brentwood for $311 million. It also sold a two-building portfolio at 1299 Ocean and 429 Santa Monica to Douglas Emmett and the Qatar Investment Authority (QIA), raking in $352.8 million.

Having unloaded most of its blockbuster assets last year, Blackstone was left with a few smaller properties around the county. In the past 12 months, Blackstone sold 5670 Wilshire Boulevard, one of the properties

from the Trizec property portfolio it acquired in 2006, for $215 million in this year’s seventh most expensive sale. It also sold 9665 Wilshire Boulevard to Douglas Emmett and the QIA for $184.8 million, which came in as the 10th-largest deal.

Beyond Blackstone’s market dominance, industry professionals attribute the drop in $300 million-plus deals to the influx of conservative buyers that purchase in L.A. with the intent to hold long-term.

“The challenge [for potential buyers] is there’s a dearth of opportunities, because a lot of the real estate continues to get in the hands of owners who don’t sell very often,” Artisan Realty’s Laderman said.

Some of the recent buyers, such as REITS like Douglas Emmett, are likely to hold on to assets for decades because they don’t need the immediate capital, he added. “They’re rewarded by being patient and waiting.”

Michael Longo, a CBRE broker involved in Swift’s purchase in El Segundo, said the strength of the overall debt market has played a part as well. Owners, specifically on the Westside, would prefer to refinance over selling, he said, contributing to a decrease in available inventory.

This year marks a “return to normalcy,” considering 2016 and 2017 were “anomaly years” when transaction volume was at record highs, Longo said. “There are only so many buildings that can trade, and when you have such high concentration in two years, you’re bound to have lower volume.”

Turning elsewhere

Even as Blackstone shed its Equity Office holdings, its whopping $1.61 billion purchase of the Worthe portfolio proved it’s far from exiting the L.A. market. This time, however, its investment was in the Tri-Cities.

The real estate giant agreed to buy majority stakes in office properties in Burbank, including the Pinnacle 1 and Pinnacle 2 on Olive Avenue, Pointe offices and a Disney-leased property on Alameda Avenue. The sellers were various partners of Worthe.

Listing broker Somer said there was a great deal of buyer interest in the portfolio. Ultimately, Blackstone triumphed because of aligned interests with Worthe and the fact that there are “not a lot of people who have that capacity,” he added. Eastdil’s long-standing relationship with Blackstone also helped close the deal.

Not too far from the Worthe properties, the DreamWorks Animation campus in Glendale sold to Hana Asset Management and Ocean West Capital for over $297 million.

“Generally, we don’t sell a lot of properties,” said Griffin Capital’s Sohn. “DreamWorks was unique because we weren’t actually looking to sell, but we got a great offer. We thought it was time to harvest.”

Meanwhile over in Pasadena, Coretrust Capital, a Los Angeles-based firm, acquired an office complex for $254 million in this year’s sixth-priciest purchase. UBS had owned the 640,000-square-foot Corporate Center Pasadena for 30 years.

While it may be far from the bustling Westside, the Tri-Cities submarkets of Glendale, Pasadena and Burbank have been undergoing a period of growth in the last decade as rents rise and vacancy tightens, sources said.

In 2013, the average monthly asking office rent in the Tri-Cities was $2.65 per square foot, while the vacancy rate hovered at around 18 percent, according to a report from Cushman & Wakefield. By the second quarter of 2018, rental rates rose to $3.07 a square foot and vacancy dropped to 13.4 percent.

Investors are also turning to the South Bay, where El Segundo’s generous corporate tax break and attractive commercial rents have been fueling demand. “El Segundo is one of the most undervalued markets as far as asset value and opportunity,” Safai said. “A lot of the institutions are seeing that and making the bet as the market transitions from an aerospace and defense market to a bigger platform of technology giants and multimedia firms.”

This year, there were three sales above $160 million each in the city. “In five years, El Segundo will become the natural extension to Silicon Beach,” Baker said.

Case in point: Pacific Corporate Towers. Eastdil may have scored big when it secured a $600 million-plus bidding war for the office complex, but the deal had been a long time coming.

The firm first listed the property in 2011, when the General Motors Pension Trust decided it was time to unload after 30 years of ownership. “It didn’t transact, because El Segundo was a different place at the time,” Somer said.

But even at $600 million-plus price tags, demand for premium product in L.A. continues to grow, brokers said.

“L.A. still feels like a relatively good buy,” Longo said. “It has really become a darling investment market for capital on the West Coast.”