With a handshake between leaders in the Oval Office on Oct. 11, the U.S. and China entered into a tentative truce in a nearly two-year-long trade war.

Tariffs remain in place on imports to both countries, but the agreement signals that the situation could stabilize in the short term.

While industry professionals wait for a final end to the trade war, they’ve developed a number of contingencies — in particular, using Vietnam as an intermediary for goods and investments. Since it began in 2018, the tariff tussle has exacerbated a pullback in Chinese capital in effect since the Chinese government began to restrict the outflow of funds from the country in 2017.

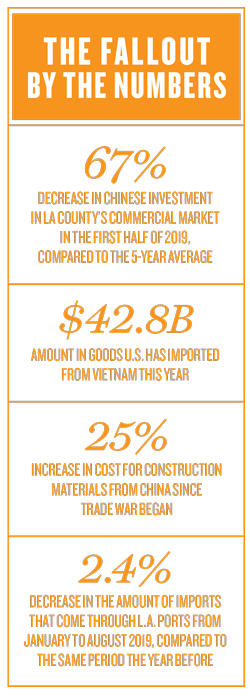

Los Angeles-area developers had previously benefited from billions of dollars in Chinese investment. From 2013 to 2018, Chinese investment into L.A. County commercial assets for the first half of the year averaged $123.5 million, according to CBRE data. In the first half of this year, that number dropped a stunning 67 percent to just $40.5 million. Capital controls were the primary culprit, the analysis found.

Fears that the trade war will damage the Chinese economy further are motivating nationals seeking to move money out of the country, but capital controls continue to make it a challenge, said UCLA economist William Yu.

Yu said the Chinese government is typically happy to let investors buy stakes in U.S. companies in some sectors — particularly those in the tech sphere — but commercial real estate investments not so much.

Yu said the Chinese government is typically happy to let investors buy stakes in U.S. companies in some sectors — particularly those in the tech sphere — but commercial real estate investments not so much.

“If they feel that you are making speculative investments by leveraging Chinese money and you fail, the cost might be borne by the Chinese taxpayer because the money is coming from state-owned banks,” he said.

Yu pointed to Anbang Insurance Group as an example. The government had already started to limit foreign investments in early 2017 when news broke that Chinese authorities were investigating allegations of fraud by Anbang’s then-Chair Wu Xiaohui, who spearheaded the company’s three-year-long, multibillion-dollar U.S. real estate shopping spree.

When a Chinese court sentenced Wu to 18 years in prison for embezzling $1.6 billion from the company and raising $10.2 billion illicitly, prosecutors specifically pointed out concerns for the national economy, saying Wu compromised “the safety of investors’ capital” and “crushed national financial security.”

Since then, some Chinese investors have pulled back. Dalian Wanda Group sold its One Beverly Hills project to rival developer Beny Alagem last fall for a reported $420 million. Greenland USA is reportedly seeking a buyer for one of the three residential towers at its massive Metropolis project. Financing issues are reportedly why work has been stalled at Oceanwide Plaza, a project by Chinese developer Oceanwide Holdings.

The rise of Vietnam

Vietnam has become a key middleman for investors on both sides of the conflict, according to Michael Smith, director of international trade at the World Trade Center Los Angeles.

Builders and subcontractors stateside are importing more building materials from Vietnam to avoid the tariffs, and Chinese investors are putting money into the Vietnamese suppliers.

“What would have flowed to the U.S. goes to Vietnam to fund supply chain businesses,” Smith added. “The longer [the trade war] draws out, the more focus shifts to new areas and on developing contingencies.”

The costs of construction materials imported from China, including cabinets, light fixtures and countertops, are up about 25 percent since the trade war started, according to Chris Tourtellotte, managing director of Century City-based developer La Terra.

“You can mitigate some of that, but not all of it, by sourcing materials from other distributors in the U.S. and Vietnam, but it’s still more expensive than before,” Tourtellotte said.

The U.S. has imported $42.8 billion in goods from Vietnam so far this year, compared to around $31.9 billion during the same period last year, the strongest year for Vietnamese imports in history, according to the U.S. Department of Commerce.

Kitchen sinks and light fixtures aren’t all that Vietnam is exporting to the U.S. As Chinese capital dries up in L.A., some Vietnamese investors are stepping up.

“We’ve hosted a number of Vietnamese delegations looking for investment opportunities over the last several months,” Smith said.

But Vietnam can’t entirely fulfill the U.S. appetite for investment capital and materials. Imports through the ports of L.A. and Long Beach — the nation’s two busiest — were down by 2.4 percent this year through August, according to a Q3 report by NAI Capital.

“The trade war and tariffs are undoubtedly influencing the ports’ cargo volume,” the report read.

Even if U.S. and Chinese leaders put an end to the economic conflict, two years of trade warring could permanently change the supply chain. China’s share of the supply chain will at least be reduced and “may be eventually dismantled” if the trade war rolls on, Yu said.

In the long term, China will either have to buy more from the U.S, to balance the two countries’ trade, or the supply chain will move elsewhere.

“I don’t expect they will rebuild the supply chain in China,” he said.” It’s beyond economics, it’s geopolitical.”