The booming Los Angeles housing market has become the new frontier for residential brokerages from other parts of the country, particularly New York. Over the past few years, firms such as Douglas Elliman, New York’s largest brokerage, and Compass, an aggressive venture-capital-backed startup from the Big Apple, have trotted into the L.A. market, opening flashy new offices and trying to woo top agents from veteran L.A. companies.

Their entry comes five years after two powerful agents, Mauricio Umansky and Billy Rose, formed their own company, The Agency, adding to a field that includes existing behemoths such as Sotheby’s International Realty and Coldwell Banker.

All of a sudden, the market is looking extremely crowded and competition for top talent is at an all-time high.

The free-for-all has sent commission splits skyrocketing and margins sinking, brokerage chiefs told The Real Deal. With so many firms vying to sign top producers, hiring managers are being forced to come up with ever more generous offers and compelling reasons for a broker to jump ship.

Brokers are getting used to the new gold standard and have taken advantage of market conditions by hopping between firms.

“I have had brand-new agents coming in requesting, and some even expecting, a split that I would not give anyone, regardless of their productivity,” said Colin Keenan, a senior vice president at Douglas Elliman’s Beverly Hills office. “There is a sense of entitlement and an impatience. People just want to see an offer. They don’t necessarily want to be schmoozed and wined and dined, although they’ll take that, too, if it’s offered.”

But most realize it’s a race to the bottom. With L.A.’s standard commission splits already much higher than their counterparts in cities such as New York, brokerage operators can’t afford to get into a “how low can you go?” tug-of-war. At the end of the day, they have to make money.

“It’s a very dangerous thing for the industry as a whole,” said John Aaroe, founder of John Aaroe Group, a high-end brokerage. “The brokerage business is one in which you make your money on the nickel, not on the dollar. You can’t give dollars away when you make your profits in nickels.”

That’s particularly true since the high-end L.A. market has more recently shown signs of topping out.

The median price for a luxury single-family property — defined as being among the top 10 percent of sales based on price — dropped by 0.3 percent in the second quarter, while the median price for the overall market increased by 5.7 percent, according to Elliman data.

“Some brokerages have realized that they’re biting off more than they can chew,” said Sunny Magner, Elliman’s vice president of people and culture. “At the price you have to pay to get these top producers, it’s sometimes just not worth it.”

Some of the region’s top agents are also wary of the industry’s revolving door.

Ben Bacal, a top-producing agent at Rodeo Realty, said he’s not playing the game.

“I think it’s a bunch of hype and rumors and people should just focus on selling real estate,” he said. “Everyone thinks moving firms will help their business so much, but it won’t.”

Jade Mills, Coldwell Banker’s top agent and one of the industry’s most sought-after producers, agrees. “I’ve never changed companies,” she said. “How successful you are as an agent comes from you as a person. It doesn’t really come from the company. It’s the agent and her personal relationships.”

The Big Splash

Many of the most active top producers in the L.A. market are actually owners or partners in their own firms, making poaching more challenging. Three of the top agents are Jeff Hyland of Hilton & Hyland, Kurt Rappaport of Westside Estate Agency and Umansky. Those agents cannot be wooed, short of acquiring their entire companies.

That leaves newcomers with a small pool of heavy hitters to pick off, from firms such as Coldwell Banker and Sotheby’s International Realty.

Douglas Elliman’s swanky Beverly Hills office, which opened in 2014.

When Elliman — one of the nation’s oldest and largest real estate brokerages, currently led by Chairman Howard Lorber — launched in Beverly Hills in 2014, the firm was eager to make a splash. It quickly nabbed brothers Josh and Matt Altman, stars of Bravo’s hit series “Million Dollar Listing,” from 23-year-old Hilton & Hyland, which ranks second on TRD’s list of top luxury brokerages in L.A. County.

Stephen Kotler, Elliman’s chief revenue officer of residential brokerage, relocated to the West Coast from New York to oversee the expansion and is reportedly looking to hire 80 to 100 more brokers within the next year. He said he spends half his time working toward recruiting brokers from competing firms.

Some say the situation is becoming a free-for-all. Just as TRD was heading to print at the end of August, David Findley and David Kelmenson of Partners Trust hopped to The Agency, the Beverly Hills firm that came in third on TRD’s ranking.

But Compass, in particular, has taken poaching to a new level, picking up agents en masse from firms such as The Agency and Coldwell Banker. The heads of competing firms are so upset, they’ve nicknamed the company “Comp-ASS.”

From Coldwell, Compass poached Stan Richman, mother-and-son team Linda and Brent Chang, and Sabrina Wu. From The Agency, it poached Kofi Nartey and Hana Cha, the managing director of The Agency’s new development division. Eastside broker duo Kurt Wisner and Courtney Smith also joined from Beverly Hills-based Nourmand & Associates earlier in 2016.

Among competitors, rumors are rife that Compass is forking out six-figure signing bonuses to recruit top talent.

“You have several companies trying to slice up the pie, but the pie is not getting any bigger,” said Hyland, one of his firm’s founding partners. “It’s become a food fight.”

For its part, Compass has denied offering brokers outrageous bonuses or compensation packages. CEO Robert Reffkin claims that only 1 percent of top agent recruits are offered bonuses, and only a “very small minority” of new hires have been offered equity in the company.

“I know they have wanted some people very badly, and some have been offered more money than others,” Mills said. “I feel that I’ve been very open to hearing everything, but in the end I just think that it all comes down to hard work and Coldwell Banker has been very supportive and it comes down to loyalty.”

Keenan also said executives recognize that it’s important Elliman not hand out top-dollar offers to every broker that walks in the door, or the company risks significantly compromising its potential profit margin.

As a result, some firms have focused their attention on attracting brokers who perhaps aren’t closing $100 million deals, and don’t have the name recognition that goes with that, but are doing a large volume of transactions in a lower price range. Those agents can really drive the value of the firm and are easier to recruit, they said.

“You have to be careful, and you have to be disciplined,” Keenan said.

Stacking up

Despite the best efforts of newbie firms, national powerhouses Sotheby’s and Coldwell Banker still control most of the region’s volume of deals, and boutique firm Hilton & Hyland controls the lion’s share of the über-luxury market in areas such as Beverly Hills from its single office.

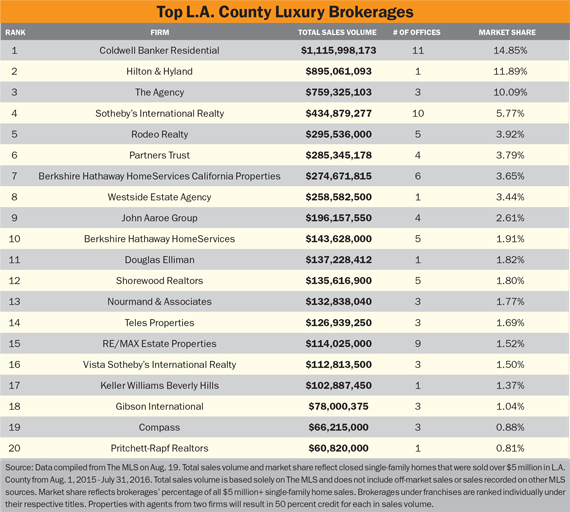

TRD’s inaugural ranking of L.A. firms shows that, for sales valued at $5 million and above, Coldwell Banker had the largest market share of any firm in the region, selling $1.12 billion across 11 offices. And, despite only having one office, Hilton & Hyland was not far behind, with $895.1 million in sales.

Hilton & Hyland alumni Mauricio Umansky and Billy Rose have seemingly had tremendous success in a short time with their five-year-old startup, posting $759.3 million in sales across just three offices. In fourth place was Sotheby’s International Realty, with $434.9 million in sales over $5 million.

Meanwhile, Compass, which has been open for less than a year, posted $66.2 million in sales, while Elliman logged in $137.2 million in sales priced over $5 million.

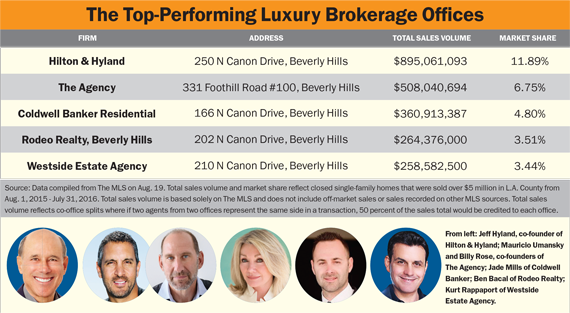

The five top-performing offices in L.A. County by sales over $5 million were all in Beverly Hills, starting with Hilton & Hyland. The Agency and Coldwell Banker offices came in at second and third, respectively.

Still, some said it might be too early to tell whether or not the region’s newcomers will succeed.

“It’s not how they do the first six or 12 months that tells the story of whether they’re going to be successful or not,” Aaroe said. “It’s a look back at the end of the second or third year. I’ve seen new players come into this market before and not be able to achieve liftoff by then.”