Land-hungry developers from around the globe are buying up sites in Miami-Dade County for tens of millions of dollars per acre, spurring record sales.

Among the sky-high prices: nearly $75 million paid for 2.4 acres in Brickell, $64 million for 7.4 acres in Miami’s Arts & Entertainment District, and $75 million for 4.5 acres in downtown Miami.

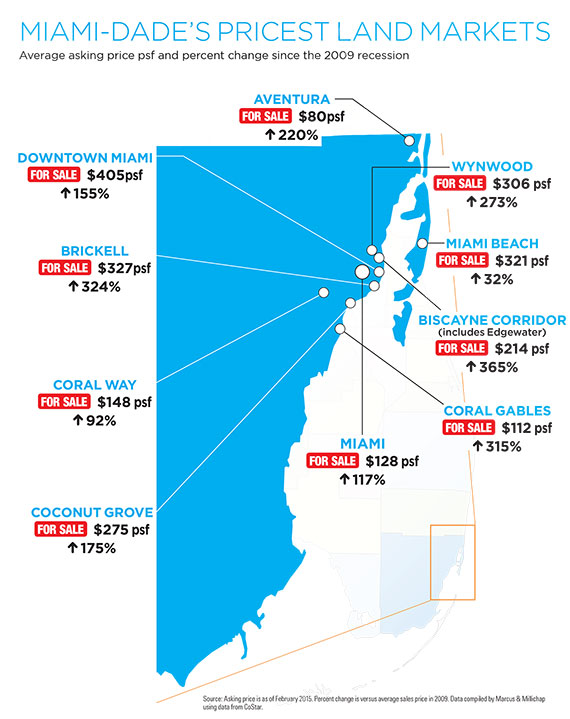

International buyers are dominating the local land grab scene. Take the $75 million sale in December of a construction site in the Brickell submarket, an area where asking prices are now 324 percent more than what the land sold for in 2009. The sale of 1430 South Miami Avenue, for $718 per square foot, was notable not just for its price, but also because its buyers are Chinese — an affiliate of China City Construction and New York–based American Da Tang Group.

Head north to Flagler Street in downtown Miami, and you’ll likely run into a piece of land that Moishe Mana, an Israeli investor, has purchased.

“What Moishe Mana has done is probably the most notable,” Marcus & Millichap Land Group Director Ryan Shaw said, referring to Mana’s $75 million assemblage of 4.5 acres in downtown Miami.

“If you want anything of size, you’re going to have to assemble properties, and I don’t think that’s cost-effective at this point in the cycle,” Shaw said.

He added that if asking prices in Greater Downtown Miami haven’t peaked, they will soon. “If anyone buys anything now, they’re parking their money,” he said.

The sale of 3333 Biscayne Boulevard, a 36,883-square-foot lot, and the adjacent 6,250-square-foot plot at 332 Northeast 34th Street in Edgewater helped propel neighborhood prices to $300 per square foot. Both properties sold for a total of $12.5 million in September.

“The contributory value of the existing improvements is minimal compared to the value of the redevelopment potential of the land,” according to the Miami Downtown Development Authority’s “Greater Downtown Miami Annual Residential Market Study Update,” released in March.

Along the Biscayne Corridor, including Edgewater, prices have increased a whopping 365 percent — to $214 per square foot — versus the average 2009 sale price, according to data from CoStar.

In Wynwood, prices have increased 273 percent to an average of $306 per square foot. Nearby, in the Arts & Entertainment District, a vacant 7.4-acre lot sold for $64 million in January, or $199 per square foot. The site, at the corner of Northeast Second Avenue and 17th Street, is adjacent to a historic City of Miami cemetery. Shaw said it marked a notable price point in an area that has been undervalued.

According to the Miami Downtown Development Authority, land prices in Wynwood haven’t reached downtown Miami’s prices because of restrictive zoning for high-rise development.

Regardless, “there have been several 2014 acquisitions within the Wynwood submarket that are tied to expectations of a future change in zoning with a future plan to redevelop to a more intense use,” the report said.

Despite the huge uptick in prices, some submarkets are still struggling. In South Dade, prices have decreased even further since the crash, from an average sale price of $22 per square foot to a current asking price of $17 per square foot.