Top of the Standard, height of the real estate boom. The cavernous space is overflowing with the industry’s who’s who, rubbing shoulders, double-dipping smoked salmon canapés, fending off lesser mortals trying to muscle into their photos. It’s the kind of Manhattan party you could only throw when deals are coming fast and money is cheap. Grabbing a drink at the bar (the line’s five deep), we spot two young strivers, shiny-suited, shiny-eyed, gazing around in wonder.

“I feel like I’m inside The Real Deal,” one says to the other.

There you have it in a nutshell. When a publication rises above the daily churn of stories and monthly magazines to become something else altogether — the paper of record, the zeitgeist, the thing that the industry wakes up to and often goes to bed with — then you’ve got something special. Over the past two decades, TRD has done that like no other.

Our reporters and editors have had a ringside seat to the biggest real estate stories in America: from skyline-shaping deals to generational feuds to political theater that transformed industry economics. With pens, laptops, microphones and cameras, they’ve gotten in-depth on the things that matter to readers, investigating fraud and chicanery, analyzing the most important market trends, churning out scoops on the biggest deals, interviewing players in the eye of the storm and bringing the blood sport of real estate to life. The platforms constantly evolve, the stories and cast of characters change, but the DNA has stayed consistent throughout the life of TRD: Real estate is the most consequential and colorful industry in America, and we’re the only publication that treats it that way.

What follows is a snapshot of stories TRD has brought readers to in its characteristic way: with a gimlet eye and a sense of fascination.

New York’s “It” buildings

In Manhattan, some buildings are more than assets — they’re characters with personalities and enthralling backstories. They represent a moment in time in the market. TRD has chronicled them extensively. Take Gary Barnett’s One 57, the first building to break the industry’s equivalent of the sound barrier when tech billionaire Michael Dell snagged a penthouse for $100.4 million. Or the Zeckendorf brothers’ 15 Central Park West, which represented a changing of the luxury guard from co-ops to condos. Or 220 Central Park South, where Steve Roth battled for 15 years to build what eventually became the most profitable condo in the city’s history (besting 15 CPW).

Of course, you can’t have a play without tragic figures, and TRD has written about them, too — like 125 Greenwich Street, the skinny supertall whose capital stack woes left a giant void in the Lower Manhattan skyline, and One Seaport, which epitomizes everything that can go wrong in a skyscraper development.

Vengeance is mine

Even by New York real estate standards, Charlie Kushner’s crime was extraordinary: The developer — handsome, successful, politically connected — was convicted of a litany of felonies including witness tampering. Enraged that his brother-in-law, Bill Schulder, had testified against him, Kushner hired a prostitute to seduce Schulder, videotaped the liaison and sent the tape to his sister.

TRD landed the first in-depth interview with Kushner after his release from prison. Asked if he had made up with his sister and brother-in-law, Kushner said, “I believe that God and my parents in heaven forgive me for what I did, which was wrong. I don’t believe God and my parents will ever forgive my brother and sister for instigating a criminal investigation and being cheerleaders for the government and putting their brother in jail.”

Kushner’s eldest son, Jared, would also become a staple of these pages, both for his high-profile but spectacularly ill-timed deals, like the acquisition of 666 Fifth Avenue, and for his marriage to the eventual First Daughter, Ivanka Trump. Those family ties would become a flashpoint for the Kushners, who had to fend off allegations of conflicts of interest while President Donald Trump was in office. In 2018, at the height of the 666 Fifth drama, Kushner once again sat down for an interview with TRD. “Are you guys going to be assholes today, or are you going to give us a fair shake?” he asked. “You’ve been assholes in the past.”

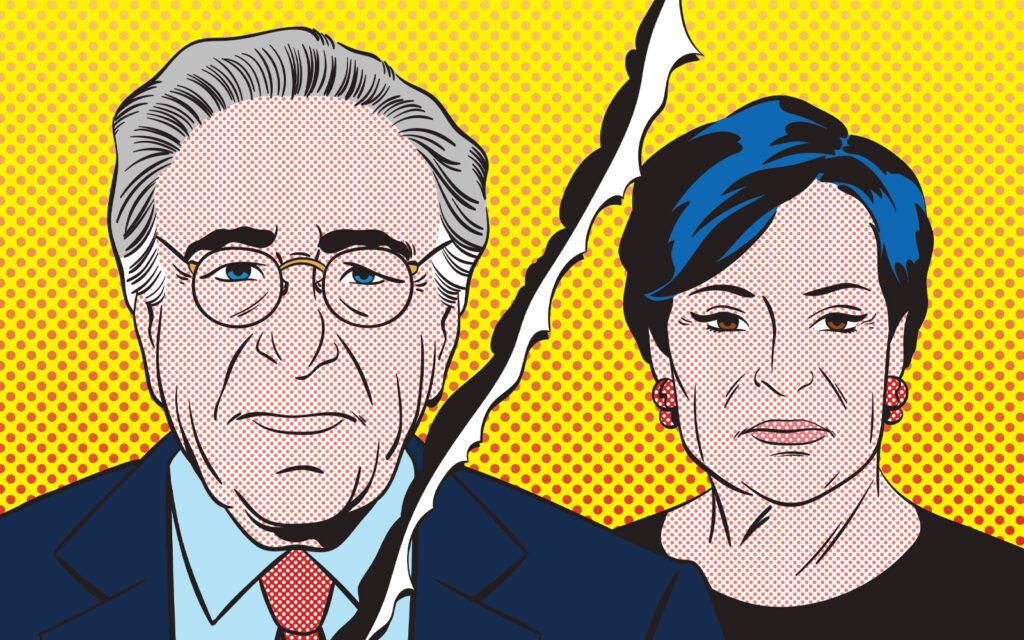

Long-in-the-tooth Lotharios and French mistresses

It’s a story that could only happen in New York real estate. Harry Macklowe, developer, bon vivant and gambler with the skyline, was revealed to be stashing his French mistress in his luxury condo conversion at 737 Park Avenue — for two years. The chain of events set off the industry’s biggest divorce, and threw up fascinating artifacts from Macklowe’s 60-year career.

The divorce proceedings, where TRD had a reporter embedded, threw up some made-for-the-movies industry nuggets. At one point, Macklowe claimed that his personal net worth was negative $400 million, largely as a result of deferred capital gains from the $2.8 billion sale of his most prized asset, the GM Building.

How Stuy Town was won

Nothing symbolizes middle-class housing for solid, hardworking folk like Stuyvesant Town, the sprawling complex with 11,000-plus units on Manhattan’s East Side. In 2006, it also became the symbol of the excesses of the market, when Tishman Speyer paid a whopping $5.4 billion for it with aggressive plans to turn over its rent-stabilized units. That deal melted down, but in 2015 Blackstone took its own pass at the property. TRD covered the hell out of the story, from revealing Blackstone’s pension-fund partner to exposing a $144 million freebie the city provided to make the deal happen to the definitive account of the dealmaking that landed Blackstone its ultimate prize — a prize, that is, until the city’s rent laws pulled a 180.

Inside the world of the real estate Hasidim

A nondescript three-story brown-brick property in South Williamsburg is a portal to a secretive world: It’s home to more than 1,000 LLCs tied to the Hasidic Brooklyn landlords who run rental empires all over the borough. The most popular TRD story of all time was a deep dive into their empire: their origin stories, how they operate, what they own and how they’ve remained in the shadows.

Following the Compass

From the little startup that could to the “greatest fundraising machine in the history of America,” as one rival put it, the rise of Compass has now been a dominant narrative in the residential brokerage world for years. TRD was there every step of the way, from the first clear-eyed look at the company’s much-ballyhooed tech platform to essential reporting on its recruitment strategies and an investigation into the clawbacks in its contracts, hard-hitting stories on its staggering losses — $1.1 billion in just two years — and the wartime decisions Compass and other firms had to make when the market turned.

The rise of Miami

Momentum is a powerful thing. “Fuck it, I’m moving to Miami” became a common refrain during the pandemic, when Florida’s laissez-faire Covid policies and lack of state income tax attracted monied masses from the Northeast and California.

Since then, Miami — and above all, its real estate market — has experienced an incredible renaissance as the home to more eight- and nine-figure residential sales than anywhere else in America. Now the question becomes: Can the historically boom-and-bust town evolve into something more lasting?