As housing braces for a prolonged downturn, the single-family rental sector appears poised for a shopping spree.

Accounting for a third of the total U.S. rental inventory, single-family rentals now comprise nearly 16 million units worth over $4 trillion, according to data from Harvard’s Joint Center for Housing Studies. The sector — and especially its even faster-growing build-to-rent segment — would appear to be threatened by a combination of rising rates, inflation and sky-high construction costs crimping the rest of the real estate world.

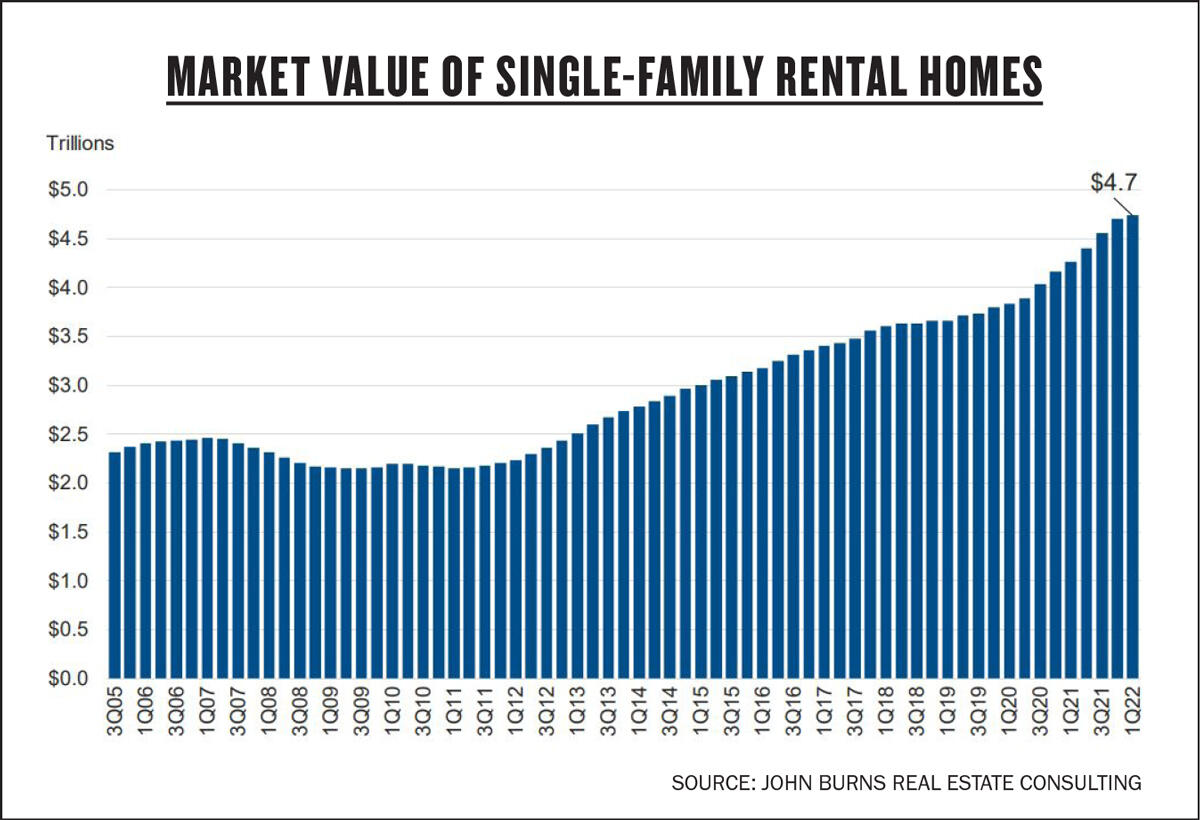

But with the growing realization that even wealthy Americans may be locked out of buying, and with rents increasing at record rates — 11.8 percent year-over-year in June, according to Yardi Matrix — the prospect of owning rental homes appears increasingly popular and profitable. Just follow the money. John Burns Real Estate Consulting found $45 billion was invested in the sector last year, making 2020’s $3 billion look like pocket change. The firm also estimates that the sector has doubled in value over the last decade.

“It is a golden hour for build-to-rent,” said Brad Hunter, founder of Hunter Housing Economics. “People who would have been in the market to buy a home are rethinking, shut out of ownership or simply indignant at the monthly cost of a mortgage. We’ve studied hundreds of build-to-rent developments around the country, and they’re leasing up as fast as the homes can be delivered.”

Even inflationary pressure can’t constrain the flow of funds and renters; while profits seem less eye-popping, it’s merely a quick set break in the midst of an all-day dance party. Recent financials reflect how, because of a lack of housing options, ever-rising rents are far from hitting a ceiling, or as American Homes 4 Rent CEO Bryan Smith said on a May 6 earnings call, the firm hasn’t encountered much price sensitivity in the marketplace.

There has been a speed bump due to increasing acquisition costs — nationwide, the median home sale price topped $400,000 this summer, and many operators have slowed down purchasing single homes until values moderate. A recent Attom Data report showed that in the last year, average gross yields before expenses for newly acquired single-family rentals decreased in over two-thirds of counties, but only by a percentage point. Most markets, especially the fast-growing South and Midwest, still show 8 percent yields.

Other figures tell the whole story: Lease growth for renewals rose 7.8 percent in the first quarter, and operating incomes soared by double digits. Canadian-American giant Tricon Residential saw 11.6 percent year-over-year growth in net operating income, while Invitation Homes notched an 11.7 percent gain. The stock prices of public single-family rental firms have declined roughly 5 percent this year, significantly outperforming the broader market.

As demand for rental housing rises, industry players will push to expand.

“You need to be doing scattered-site, build-to-rent and buying portfolios,” said Doug Brien, co-founder of Mynd, which develops property management software. “That’s really the way to make sense of this business.”

Trevor Koskovich, an investment sales broker at NorthMarq, sees a perfect storm for growth: Minimal housing construction in hot Sun Belt markets like Phoenix, Las Vegas and Nashville creates opportunity; increased operational efficiency means owners are collecting more on a per-square-foot basis; out-of-reach homeownership means wealthier tenants with less turnover; and capital is pouring in.

John Burns recently found that it costs, on average, an additional $800 a month to own rather than rent. Build-to-rent firms expect to deliver a record 14,000 new homes nationwide this year.

“With rents keeping pace with home values, even though the latter is leveling off, it’s still one of the best risk-adjusted investments you can make,” said Koskovich. “One thing people always need is housing, and they’ll forgo a lot of other expenses and luxuries to make sure they get to live in the kind of place they want to live in.”

As Josh Hartmann, CEO of national single-family rental developer NexMetro Communities, puts it: “The rents work for us, the cap rates work for us, the costs work for us, and the land cost works for us.”

It helps that demographic tailwinds have pushed renters from two of the biggest generations in history, baby boomers and millennials, into rental housing. Boomers want to age in place and forgo the pains of ownership but not the privacy of a detached home. Some builders, like Maxwell Group, are planning senior-focused build-to-rent communities.

But even more vital to the sector’s success are aging millennials, who are filling a key 30- to 44-year-old age group that is expected to grow to 70.2 million in 2030 from 65.7 million in 2021, outpacing the overall U.S. population. This single-family segment, including a wealthy cohort of would-be homeowners, has driven up occupancy and renewal rates; Invitation Homes saw occupancy hit just over 98 percent in early 2022, with renewal growth almost hitting double digits every month.

While the customer base grows, now may seem like an especially expensive time for expansion, with record housing prices and building costs already slowing down homebuilders. Bloomberg reported that KKR, American Homes 4 Rent and others have hit the brakes on acquisitions, with some investors cutting buying activity by half. But while there’s definitely appreciation in land costs — Hunter expects aggressive land purchasing to taper off as home prices settle down — the SFR world is uniquely positioned to grow even in recessionary times.

Some developers, like NexMetro, have focused on smaller units and squeezing more profit out of build-to-rent communities. They’re opting for compact, 1,000-square-foot homes, maximizing returns on 20-acre plots and charging higher rents per square foot.

Increasingly stuck with spec inventory many buyers can’t afford, homebuilders are simply offloading to growing institutional landlords. They’re running a dual track, said Koskovich, especially publicly traded builders under pressure to sell; they can counter rising interest rates by diversifying and simply selling homes to rental firms. Multifamily players like Alliance Residential and builders like Toll Brothers, Lennar and D.R. Horton either have deals with such firms or have vastly expanded their in-house rental-home segments.

Homes, as the owners of these rapidly appreciating assets know, are not just places to live, but investments. For single-family rental firms, these assets seem poised to continue to pay off. Unlike commercial property leases, home leases get re-signed and adjusted annually, allowing inflationary pressures to be more immediately reflected in rents. Another recent John Burns analysis suggests rents almost never drop for single-family homes. While home values see-sawed during the Great Recession and other downturns, rent growth never went negative.

Factor in operational efficiencies from technology and green design — Hunter has seen more single-family rental builders and long-term owners invest in energy efficiency and sustainability features — and a clearer picture emerges of better profit margins.

“Owners are saying, ‘I want to keep buying — I have a long-term thesis, and I can whittle away at the edges, but if I could apply technology, I can actually change my cap rate,’” Lucas Haldeman, co-founder and CEO of proptech firm SmartHome, told The Real Deal last year.

Invitation Homes, Tricon and others can also continue to afford expansion because the funding is there. The long-term value of these assets keeps increasing with rent growth, enough to make this period of higher mortgages an opportunity to expand portfolios.

In some sense, the sector might be an even better investment now.

Hartmann noted that due to a limited supply of rental homes, high demand and hungry investors, the sector is experiencing what’s called cap-rate compression; the income stream for the same investment is rising, making it an even bigger target for investors. So far this year, there have been 10 single-family rental securitization deals worth $7.8 billion, according to Kroll Bond Rating Agency data. MetLife Investment Management recently predicted that growing the institutional ownership of single-family rentals to 10 percent from its current 2 percent would require $200 billion in incremental debt financing.

Negative sentiment over institutional landlords has been growing, with a congressional subcommittee meeting in June bringing attention to what one representative called the “mass predatory purchasing” of private equity, while the same NIMBY sentiments and regulatory issues that harm other builders also apply to the build-for-rent sector. But even with slowing growth, investors seem confident that the value of rental assets during a housing crisis is assured.

“As the space continues to proliferate, it will become more efficient,” said Koskovich. “It’s like Amazon — you become the largest company in the world by becoming more efficient.”