New York City continues to expand, but another year of growth was punctuated by a series of challenges for construction firms.

The city’s top contractors last year continued to deal with pervasive supply chain issues and faltering hopes for the end of the work-from-home era — a reality that has significantly reduced demand for new office construction and tenant build-outs.

New development also dealt with the most turbulent financial market since 2008 and historically high interest rates in the second half of the year that made even the least risky construction projects difficult to finance.

Elsewhere, the expiration of the 421a tax abatement pumped the brakes on previously robust demand for rental projects, slowing growth even as Major Eric Adams outlined a “moonshot” goal of adding 500,000 new homes to the city in the next decade.

As a result, opportunities to fill in portfolio gaps emerged in unlikely places.

Over the past year, contractors propped up their portfolios with hospital expansions, in part fueled by a surge in elective surgeries that were canceled or postponed during the pandemic. Other work outside the typical flow of projects included the $9.5 billion overhaul of John F. Kennedy Airport, which calls for 3.6 million square feet of new construction, and New York City Football Club’s new $780 million stadium near Citi Field in Queens.

In more traditional sectors, some major office projects persisted through the downturn, including Disney’s new 1.2 million-square-foot headquarters at 137 Varick Street in Hudson Square, and JPMorgan’s forthcoming 2.5 million-square-foot, hydroelectric-powered office tower at 270 Park Avenue in Midtown.

Residential work continued in Manhattan, too, but was particularly noticeable in Northern Brooklyn, Long Island City and the South Bronx.

Across the board, executives running the city’s largest construction firms had to make careful bets.

“I used the term cautiously optimistic last year,” said Steve Sommer, who leads New York construction at Lendlease. “This year, I’m more cautious than I am optimistic.”

Contract kings

Developers filed permits for 1,853 new buildings across the city last year, which combined call for more than 57 million square feet of construction, according to the Real Estate Board of New York.

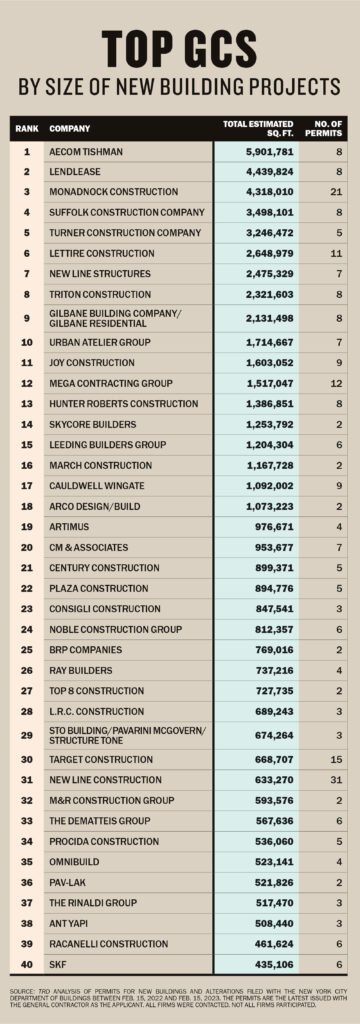

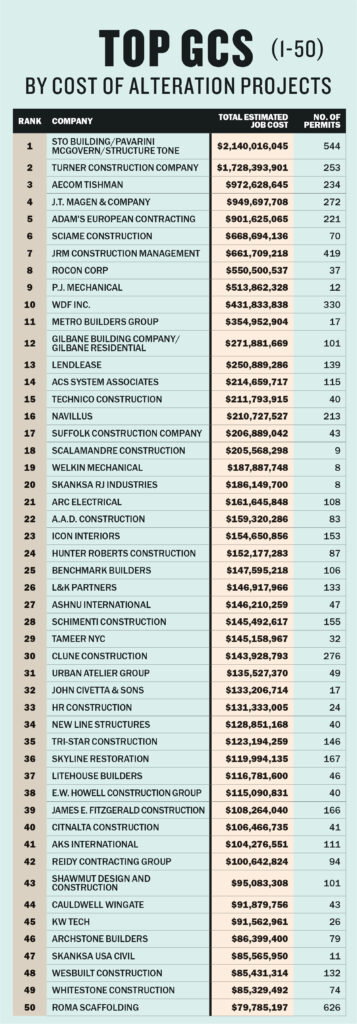

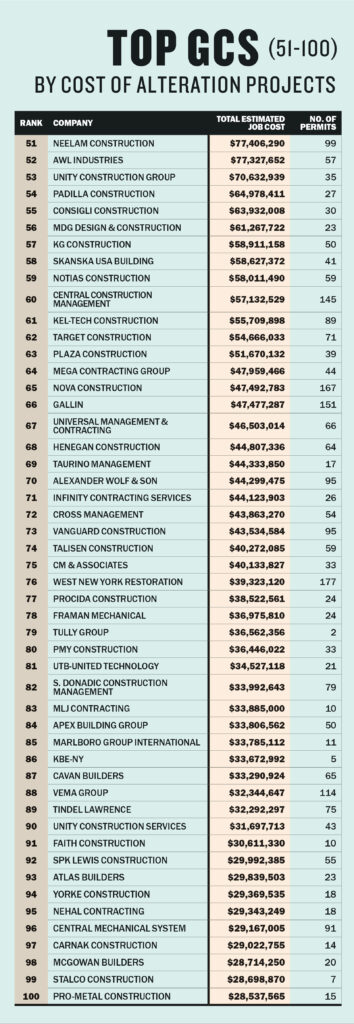

To find out which construction firms captured the largest portions of that work, The Real Deal analyzed every building permit issued across the five boroughs between February 15, 2022 and February 15, 2023, then added up the total square footage across all filings where a given firm was listed as the general contractor. The top firms for building alterations were also ranked, measured by the total estimated cost of their projects.

AECOM Tishman came out on top for new buildings, rising from fourth place in 2021. The 125-year-old company is listed on filings for eight projects combining for 5.9 million square feet, including the JFK airport revamp and JPMorgan’s new Park Avenue tower.

After falling outside the top 10 in 2021, Lendlease surged back to second place last year, also filing for eight projects combining for 4.4 million square feet. Monadnock Construction placed third, falling from the number one spot in the previous year’s ranking, with 21 new building permits that combined for 4.3 million square feet — just shy of Lendlease’s total.

When it came to alterations, STO Building/Pavarini McGovern came out on top for the second year in a row, with more than $2 billion in soft costs pulled from permit applications. Similarly, Turner Construction held onto its second place ranking for a second-straight year, with $1.7 billion worth of alteration projects. AECOM Tishman, JT Magen & Company and Adam’s European Contracting rounded out the top five.

From global to local

Despite lingering supply chain issues, lead times on some key materials began to stabilize. For others, things got far worse.

“Steel has stabilized, concrete has stabilized, drywall and metals have somewhat stabilized,” said Bert Rahm, Turner Construction’s New York vice president. “But we’re seeing that a lot of specialized gear still has tremendous lead times.”

Electrical items like generators used to take four months to arrive — now they can take more than a year. Lead times on some mechanical items, like switch gears and air handling units, have also increased.

The crunch has ramped up pressure on designers and architects to work faster and commit to certain materials and suppliers earlier in the process than they normally would.

“Every single supplier is telling me ‘money is not going to fix this,’” Lendlease’s Sommer said. “You have clients that would readily spend more money to accelerate a fabrication, because they want to get their projects completed.”

In some ways, that’s prompted a reimagining of the supply chain. To alleviate pressure in certain sectors and get jobs done on time, some contractors are going with pricier materials from local suppliers rather than conventional outsourcing. Though it costs more, another benefit of working with local suppliers is that the materials travel shorter distances, which reduces a project’s carbon footprint.

Concrete suppliers in Brooklyn have been “magic” for that reason, Sommer said.

Fading hope for offices

When it comes to the future of the office market, most contractors recognize that the pipeline over the next few years will depend heavily on anchor tenants, such as Disney in Hudson Square or JPMorgan in Midtown. Spec offices, once ubiquitous, are now riskier than ever.

“People are starting to contemplate whether or not it makes sense to build a building right now,” said Ralph Esposito, Suffolk’s Northeast and Mid-Atlantic president.

Demand for alteration work on office buildings, however, remains strong. As workers stayed home, employers seized an opportunity to reinvent their workspaces in a bid to entice them back. That means reskinned buildings with updated infrastructure that offer rich amenities, ranging from gyms, pool halls and golf simulators to outdoor spaces and on-site medical facilities.

“It’s nice to see that the architecture and the intent of buildings is really changing depending on how the end user is going to need the space,” said Turner’s Rahm. “I tell my kids, I wish I was 24 years old going to work right now.”

Looking ahead

Across the board, executives agree that March’s banking turmoil hurt the industry significantly, further complicating developers’ ability to score construction financing.

“Rather than waiting for the banking crisis to kind of solve itself, we’ve made a lot of phone calls to clients to say, ‘What can we do to make some of these projects go?’” said Esposito.

Still, most firms expect business to be slow for the rest of the year.

“In the last three to four weeks it’s declined faster than anticipated,” said Sommer.

In spite of these new challenges, executives across the board are finding corners of the market to be optimistic about.

“It’s always been clear that if the private sector lags, the public sector generally picks it up, or the reverse,” said Jay Badame, president and COO of construction at AECOM Tishman. “So we’re in a situation where today private sectors are pencils down.”

Those public-sector projects add to work emerging in other areas, including the rush to build the city’s first full-scale casino and excitement around office-to-residential conversions.

“Is it as robust as it was in 2019? No,” said Rahm. “But is it doom and gloom? No, absolutely not.”