Real estate is high drama playing out on the skyline. But rarely does it rise to the level of Greek tragedy that it has at the Flatiron Building.

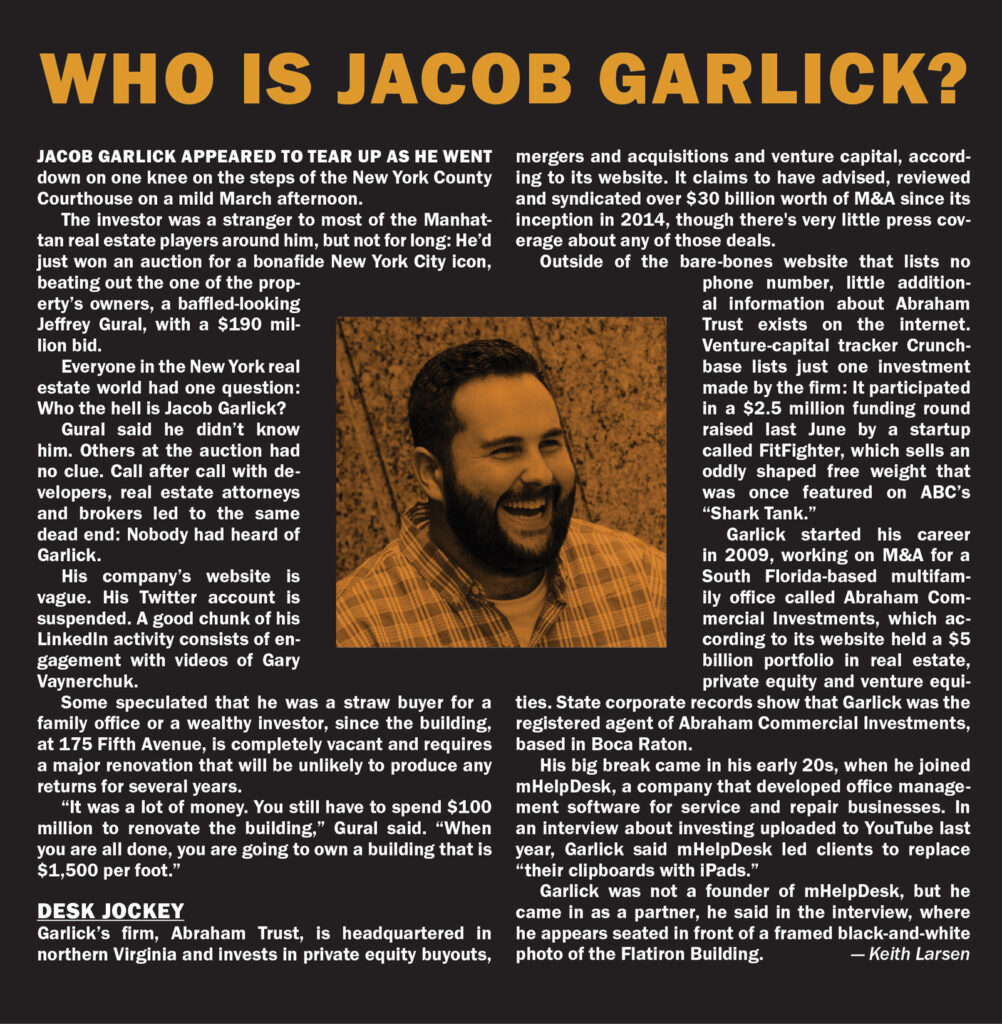

After coming out of nowhere to win a live auction for the iconic property in March, then failing to produce a deposit to secure his $190 million bid, a complete outsider, Jacob Garlick, spent the weeks that followed scrambling to show that he had the money.

Even as its owners prepare to restart the auction process that he dramatically derailed, the 31-year-old with zero track record in big-ticket real estate has maintained that he’s still in the running to buy the property.

Nobody seems to believe him.

GFP Real Estate’s Jeffrey Gural, who has long held a stake in the office building and was the runner-up in the March 22 auction, said there was only one scenario in which Garlick’s bid should even be considered: if he wired the entire $190 million into an escrow account.

“Why would you take anything he is saying seriously?” Gural said.

According to Gural, immediately after Garlick won the auction on the steps of the New York County Courthouse — which, unusually, did not require participants to post an upfront deposit or proof of funds — Garlick turned to him and asked if he wanted to partner in the deal. Later, Gural said, Garlick even asked him if he would put up the $19 million deposit in exchange for a 10 percent stake in the vacant building.

“It was such a ridiculous proposal,” said Gural. “It concerned me. It was a red flag that he didn’t have the money.”

In Gural’s telling, Garlick’s group kept promising that the money was coming. It was to be wired from one bank, then from another. The deadline arrived, but the money never did.

Now the building will be auctioned off again on May 23, on the same courthouse steps in Lower Manhattan where Garlick’s 15 minutes of fame began.

Cracks in the facade

Garlick’s wild ride only came about because of a partnership spat between the building’s owners.

Sorgente Group, GFP Real Estate and ABS Real Estate Partners, who together controlled a 75 percent stake, could not see eye to eye with the remaining 25 percent owner, Nathan Silverstein, about the landmarked property’s future.

The majority owners sued, claiming they simply could not go on co-owning the property with Silverstein, who they said had proposed physically splitting up the building. Gural, in court filings, called that idea “preposterous.”

It’s highly unorthodox to do an auction without requiring a deposit.

“It boggles the mind to suggest that we could nevertheless agree on a plan to physically divide this building into five smaller, independent properties, none of which would be marketable — and then agree on a plan as to how that work would be financed,” Gural said.

The building’s tenancy-in-common ownership structure, which gave each of the stakeholders veto power over decisions at the property, led to a stalemate.

By that point, the building’s longtime anchor tenant, Macmillan Publishers, which occupied all 21 floors, had announced plans to move out.

In 2019, co-working startup Knotel was in talks to lease the entire property, but a deal never materialized. Silverstein blamed Newmark, which GFP Real Estate had split off from only two years earlier, for failing to market the building after Macmillan left and said Gural was negotiating to lease it to Knotel at an “exceptionally low cost.” He also claimed in court filings that Newmark CEO Barry Gosin held a large stake in Knotel. The co-working firm filed for bankruptcy in 2021 and was acquired by Newmark.

The majority owners eventually sought a partition sale, which would put the building up for auction but provide them an advantage by allowing them to buy it back using their existing ownership interests as part of a bid.

“I was hoping that we would be able to buy [Silverstein’s] interest at a lot lower price,” Gural said.

Garlick, who seemed to want the property no matter what, price be damned, spoiled those plans.

Insiders speculated that Garlick was connected in some way to Silverstein. Garlick, the theory went, was there to drive up Gural’s bid, giving Silverstein a bigger payday as a minority owner.

Silverstein confirmed to The Real Deal that he is a “distant relative” of Garlick, but said he’s only ever met him once.

Others involved in the auction said that Garlick’s continued effort to seal the deal after flopping on the deposit was news to them. Matthew Mannion, the auctioneer, and Peter Axelrod, the court-appointed referee, both said last month that they were not aware that he was a realistic contender to acquire the building.

Gural added that Garlick could be liable for the deposit regardless.

“I hope he has $19 million,” he said.

“Highly unorthodox”

The fracas Garlick set off might never have been possible without a key lapse in the proceedings: Bidders were not required to put down any deposit before participating in the auction, according to court filings.

“It’s highly unorthodox to do an auction without requiring a deposit,” said Greg Corbin, a bankruptcy specialist at brokerage Rosewood Realty Group. “Over the past 15 years of conducting distressed asset auctions, only once have we allowed people to bid without providing funds up front.”

“I’ve never seen that before,” said real estate attorney Adam Leitman Bailey, who noted that he generally asks for proof of funds before an auction.

Those present at the auction said Garlick, wearing a charcoal suit with a patterned tie and pocket square, stood just a few feet from the auctioneer, like a prizefighter steeling himself for a title bout. He rarely broke eye contact, calmly raising his paddle to outbid Gural until the price hit $190 million.

Garlick told NY1 on the scene that owning the historic building had been his “lifelong dream since I’m 14 years old.”

“I’ve worked every day of my life to be in this position,” he said.

That night, he had a celebratory party at the Ritz Carlton in NoMad with the same entourage that had accompanied him to the auction, according to witnesses.

Reality came knocking two days later, when Garlick failed to cough up the $19 million deposit. As runner-up, Gural had the option to buy the building at his final bid of $189.5 million, but declined to make the deal at that price.

The building, which Gural estimates needs a $100 million renovation, is now set to be auctioned again unless a deal can be made with Silverstein to buy out his stake.

“I’m not Nathan’s favorite person,” said Gural. But “the reality is, we have an empty building.”