When Michael Werner finally returned to his office at 1 New York Plaza last fall after months spent working from home, the stacks of paper piled atop the credenza caught his eye.

When Michael Werner finally returned to his office at 1 New York Plaza last fall after months spent working from home, the stacks of paper piled atop the credenza caught his eye.

“These were pending acquisitions of office properties or retail properties,” recalled Werner, a partner in Fried, Frank, Harris, Shriver & Jacobson’s real estate practice, referring to the documents that now function mainly as relics of a time before the pandemic turned the city’s commercial real estate market upside down.

Some deals in the making before the pandemic still went through, while others, especially those for retail or office buildings, went nowhere. Werner said he’s held onto the documents in case he ever needs them again, but has kept himself busy in the meantime by facilitating transactions for more resilient assets, such as industrial and life science properties.

More than 18 months into the pandemic, real estate lawyers in New York City and beyond have adapted to the new normal. Videoconferencing, virtual hearings, document sharing and electronic signatures have become ubiquitous. While the number of overall transactions for office, retail or hospitality properties has tumbled, firms have found work in other sectors or expanded their reach into new markets.

“This is a very unusual time,” said Robert Ivanhoe, vice chair of Greenberg Traurig. “What Covid did, and I’ve never seen anything like this before, is it changed the geographic focus, and it changed the sector focus of what [New York-based] investors wanted.”

Jonathan Mechanic, chair of Fried Frank’s real estate department, said he has been juggling multiple projects, from Vornado Realty Trust’s colossal Penn District project to 5 World Trade Center, an 80-story, 1,300-unit residential skyscraper jointly developed by Silverstein Properties and Brookfield Properties, which is expected to begin rising in the Financial District in 2023.

“It’s more an issue of finding people to do things than finding things for people to do,” Mechanic said. “I’ve been as busy as I’ve ever been.”

Condos seize the moment

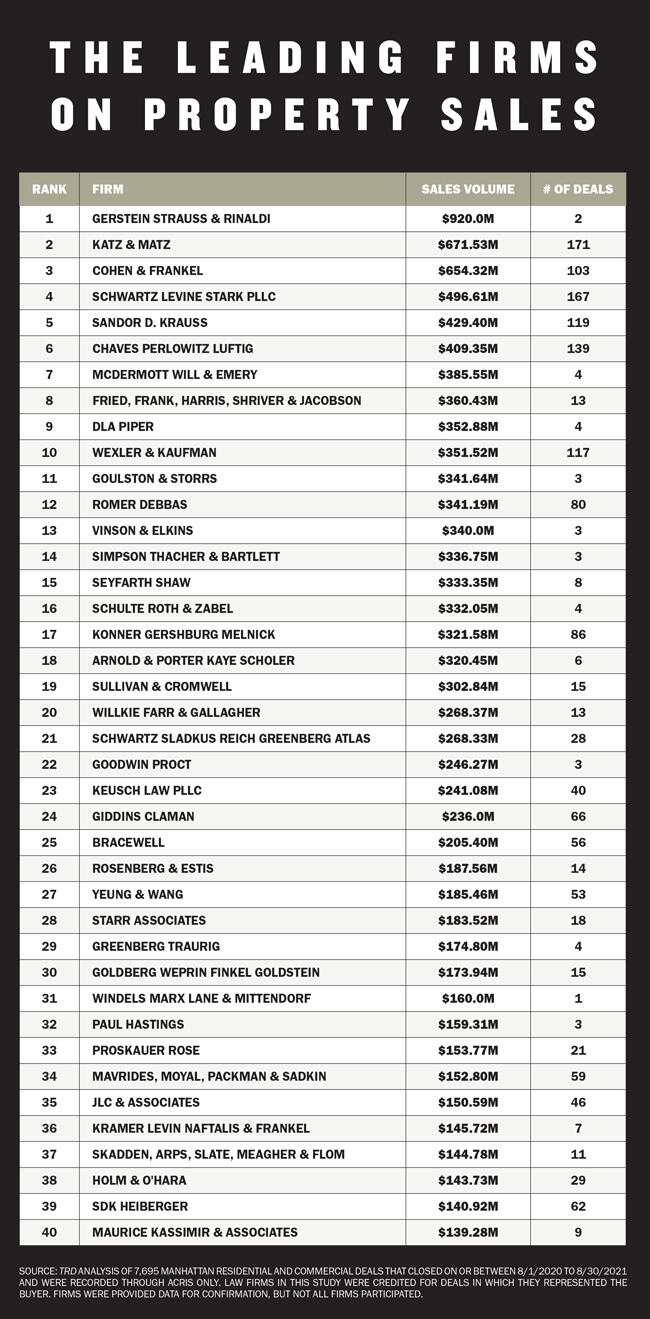

Office megadeals have propelled firms to the top of this list in previous years, but it was residential properties that drove the rankings this time around. To compile the list, The Real Deal analyzed Manhattan’s nearly 7,700 residential and commercial buyer-side sale transactions worth more than $1 million from August 2020 through August 2021. Together, the 40 firms closed $11.5 billion worth of transactions representing buyers.

Among the top six firms on the list, only Gerstein Strauss & Rinaldi had a nine-figure commercial transaction on its résumé. The firm represented Mark Karasick’s 601W Companies in its December acquisition of 410 Tenth Avenue, a 640,000-square-foot, Amazon-anchored office building, while Greenberg Traurig represented the seller, SL Green Realty. (The sale price of the Amazon-anchored building was reported as $950 million at the time of closing, but it was later recorded in the city register — which TRD’s ranking was based on — as $810 million.)

Among the top six firms on the list, only Gerstein Strauss & Rinaldi had a nine-figure commercial transaction on its résumé. The firm represented Mark Karasick’s 601W Companies in its December acquisition of 410 Tenth Avenue, a 640,000-square-foot, Amazon-anchored office building, while Greenberg Traurig represented the seller, SL Green Realty. (The sale price of the Amazon-anchored building was reported as $950 million at the time of closing, but it was later recorded in the city register — which TRD’s ranking was based on — as $810 million.)

The No. 2 through 6 spots are held by law firms that each closed more than 100 sales of luxury condominiums and townhouses, and the sheer volume of deals kept attorneys busy.

“This is a hurricane of business ever since the vaccines came out,” said Robert Frankel, a partner at Cohen & Frankel, which took the No. 3 spot in the ranking by closing 103 buyer-side transactions totaling $654.3 million. “We have had so much business this year.”

Frankel said that unlike the pre-Covid era, few foreign buyers were part of those residential transactions because travel restrictions kept them from the city. Instead, “very wealthy New Yorkers and wealthy Americans are buying luxury condos here because they’re getting very good discounts,” he said. “And they feel New York will come back.”

The most expensive buyer-side transaction handled by Cohen & Frankel involved the $40.7 million purchase of a 5,000-square-foot condo at Vornado’s 220 Central Park South in August of last year.

Coming in the No. 2 spot was Katz & Matz, with 171 transactions totaling $671.5 million. The firm’s biggest buyer-side deal was the $27.3 million sale of a West Village townhouse. Neither Katz & Matz nor Gerstein Strauss & Rinaldi responded to requests for comment.

Evolving demands

As sales in the retail, hospitality and office sectors have remained dismally rare, Big Apple firms shifted to deals in growing sectors such as industrial and life sciences.

Samples of assignments that Fried Frank’s Werner took on include the $600 million recapitalization of Taconic Partners and Nuveen Real Estate’s life sciences hub at 125 West End Avenue, and Innovo Property Group’s $119 million sale of a distribution center at 511 Barry Street in the Bronx to Illinois-based CenterPoint.

Fried Frank also represented the seller — a joint venture between Goldman Sachs Asset Management and Blumenfeld Development Group — in CenterPoint’s $116.5 million acquisition of an industrial property at 1080 Leggett Avenue in the Bronx, according to public records.

Those deals kept Fried Frank lawyers busy, but they were not counted toward this year’s TRD ranking because none of them were buyer-side transactions. As a result, the firm, which topped the buyer-side list last year, dropped to the No. 8 spot this year.

Meanwhile, Manhattan’s office leasing — which went mostly dormant in the earlier months of the pandemic — has finally started picking up, and attorneys are adjusting to a newly emerged tenant market.

“Deals are taking longer to complete probably because there’s less pressure on tenants to get them done quickly, because although the market is active, there’s less fear that you’ll lose out on a transaction,” said Raymond Sanseverino, chair of Loeb & Loeb’s real estate practice.

Having lived through the pandemic, commercial tenants now want protection against the next crisis incorporated into their leases, because existing force majeure clauses did not adequately address the circumstances seen in the last 18 months. Sanseverino said he has seen one lease, for example, that allows a rent abatement period for tenant buildout to be extended in case of a government-mandated shutdown.

“Tenants have the ability to negotiate for more things now because there are fewer deals and fewer tenants,” he said.

Trophy buildings, such as SL Green’s skyscraper One Vanderbilt, which Loeb & Loeb represents, can still command high prices in this market, but owners of lesser-quality products are feeling downward pressure in pricing. Under these conditions, landlords are more willing to sign shorter-term leases, betting that the market will improve down the road, Sanseverino said.

The challenges facing residential landlords have been even more daunting, as some financially strapped tenants, protected by eviction moratoriums, stopped paying rent. As a result, many landlords have been unable to make their mortgage payments, and their attorneys have been kept busy advising them on how to navigate these uncharted waters, said Denise Pursley, who leads Nixon Peabody’s national real estate practice.

“The eviction moratorium has helped prevent more homelessness during the pandemic and is very much needed. But on the other side, we have clients who are unable to collect rent,” she said.

“There’s a tension there, and we are all really working together to alleviate that tension in a way that is not going to cause a flood of evictions once the moratorium is lifted.”

Nixon Peabody has partnered with pro bono organizations, such as Lawyers Clearinghouse, to assist tenants who could be vulnerable to eviction once the ban expires, Pursley said, but it is also working with landlords and their lenders to secure mortgage forbearance agreements.

In the meantime, landlords are unable to sell their properties that have now diminished in value. They are forced to hold out for better market conditions.

Seeking stability

Even before the pandemic, yield-seeking investors were competing for opportunities to provide equity or financing for top-quality real estate projects. The competition intensified in recent months as investors sought certainty in an uncertain world.

Andrew Dady, a partner at Gibson Dunn, said that with more investors and lenders wanting to participate in quality deals, capital stacks became more complicated, requiring skilled lawyers who can assist with “the structuring and protections that are necessary to do those complex transactions.”

A $1.25 billion construction loan for L&L Holding Company and Columbia Property Trust’s Terminal Warehouse redevelopment project, which closed in July, was one of those deals. Dady advised Blackstone, KKR and Goldman Sachs, which led the financing package that also included Oaktree Capital Management and Paramount Group at the mezzanine level.

The trend was also apparent when SL Green closed in June on a $3 billion refinancing of One Vanderbilt, one of the largest single-property CMBS loans ever issued. The mortgage consisted of nine senior A notes, each coming from a different bank. Wells Fargo led the refinancing with $1.5 billion, while Goldman Sachs contributed $600 million.

“For quality Class A office space, particularly those owned by institutional, experienced property owners in the right markets, there are a lot of deals going on with respect to office right now,” said Holly Chamberlain, a partner with Cadwalader, who, along with her colleague Chris Dickson, led a team advising Wells Fargo and Goldman Sachs on the $3 billion deal.

Chamberlain also advised on an $860 million refinancing package for Paramount Group’s 1301 Sixth Avenue, a 1.7 million-square-foot trophy office building.

The pandemic prompted some investors who previously focused on New York to look elsewhere, and their attorneys followed.

Stephen Rabinowitz, co-chair of Greenberg Traurig’s global real estate practice, who advised SL Green on its sale of 410 Tenth Avenue, has been involved in mixed-use projects in Charlotte and Raleigh, North Carolina; multifamily developments in San Francisco and Marin County, California; and single-family rental projects in Arizona, Texas and Colorado.

“If you compare right now to the same time in 2019, we are substantially busier than we were then,” he said. “It’s been a really extraordinary year for our clients, and extraordinary for us.”

Signs of recovery

As New York slowly emerges from the pandemimc, a few deals that had been derailed since March 2020 recently crossed the finish line.

When the pandemic hit, Tal Golomb, a partner with Fried Frank, was advising Calvary Baptist Church on the sale of its property at 123-141 West 57th Street. Buyer Alchemy Properties, in partnership with real estate investment firm ABR Partners, was about to close the deal, valued at about $330 million, including the sale of the property and the cost to build a 26-story boutique office building with the church’s new facility at the base. But facing sudden uncertainty in the health crisis, the lender pulled out, and the deal collapsed.

“The great news was that everyone was highly committed to seeing the transaction through,” Golomb said. The deal finally closed in June, with ABR’s equity partner, Cain International, bringing in its affiliate Security Benefit Life as a new lender.

Greenberg Traurig’s Ivanhoe said he also completed a stalled transaction: SL Green’s sale of its 41 percent stake in the 261-unit apartment building at 400 East 57th Street to A&E Real Estate in a deal valuing the property at $133.5 million. The contract was signed in April. Ivanhoe, who also advised Stonehenge Partners on its acquisition of 920 Park Avenue that same month, said these transactions signal the city’s gradual recovery.

One of the retail properties whose information sat in the stacks of paper waiting in Werner’s office has recently gone into contract. Werner said he’s “seeing an uptick in office investment again,” as well.

To restore some semblance of normalcy, Fried Frank’s Mechanic said he is eager to resume the firm’s famed Christmas party at Cipriani 42nd Street, which was canceled last year. The firm’s alternative celebration, which involved sending its clients jigsaw puzzles with a drawing of the party, was well received, Mechanic said, but he would much prefer to see his friends in person.

“We’re going to monitor and make sure that it’s safe and appropriate,” he said. “But if it could be done, we would like to do it.”

Read more