President Barack Obama earned just shy of $95,000 in royalties last year from the sales of his two autobiographies, “Dreams from My Father” and “The Audacity of Hope.”

President Barack Obama earned just shy of $95,000 in royalties last year from the sales of his two autobiographies, “Dreams from My Father” and “The Audacity of Hope.”

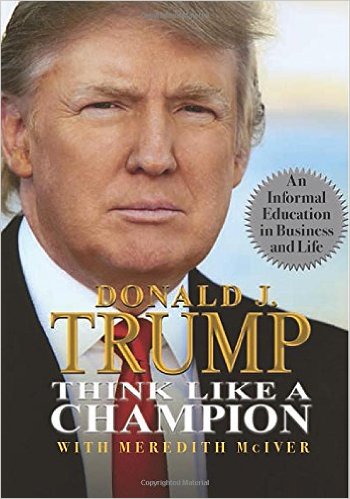

GOP presidential front-runner Donald Trump, likewise, earned as much as $165,000 in royalties from the sales of three titles: “Think Like a Champion,” “Time to Get Tough” and “The Art of the Deal.”

Still, that’s peanuts compared to the millions of dollars the firebrand candidate rakes in by licensing his name to golf courses, hotels, beverages, clothing and other products. He also owns vineyards, has a production company and rents out his private aircraft.

And those operations make up just a slice of the business empire Trump would likely have to distance himself from if he became president. In financial disclosures filed with the Federal Elections Commission last year, Trump listed some 561 LLCs, corporations, partnerships and other business entities he owns (see related sidebar).

“It’s really hard to anticipate the things that would come up, but it seems almost inevitable that [conflicts of interest] would arise,” said Kenneth Gross, the head of the political law practice in the Washington, D.C., office of Skadden, Arps, Slate, Meagher & Flom.

Trump, whose campaign did not respond to requests for comment, has said that if elected he plans to hand over the reins at the Trump Organization to his children. Yet given his wide-ranging business interests and all of his assets, there are myriad areas where conflicts with the government could come into play.

Public policy and political law experts say while there have been a slew of wealthy presidents and presidential candidates — from Ross Perot to both George Bushes to Mitt Romney — not since John F. Kennedy has the country elected a president with wealth on the scale of Trump’s. Thanks to a family trust established by his father, JFK had a worth estimated at $1 billion in today’s dollars. Trump’s net worth varies depending on the source. Last year, Bloomberg News pegged it at $2.9 billion, while Forbes now has it at $4.5 billion. Trump, meanwhile, claims he’s worth more than $10 billion.

“We’re in uncharted waters,” said Gross, who has represented wealthy clients including former New York City Mayor Michael Bloomberg, along with Treasury officials, ambassadors and senior White House officials, in their transitions to the public sector.

Erecting a firewall

There are surprisingly few limitations on what a president can do when it comes to their outside business affairs.

Nothing in Federal law prohibits the president or vice president from having another company while in office.

And though presidents are required to make financial disclosures, the POTUS is free to reap financial gains from brick-and-mortar businesses or investments.

“The president and the vice president are subject to no restrictions on actions that benefit their financial interests,” said Richard Painter, a professor at the University of Minnesota Law School, explaining that such measures would be unconstitutional.

But most presidential candidates proactively erect a wall between themselves and their businesses to avoid conflicts.

That often includes stepping down from boards and putting stocks into bland investments like Treasury bills or mutual funds or placing business assets into blind trusts.

George W. Bush

“Most candidates begin to do this as well. It’s surprising he hasn’t done this already,” said Lisa Gilbert, the director of the Washington-based watchdog group Public Citizens Congress Watch. She added that, considering Trump’s wide-ranging business interests, she’d like to see him put up the “strongest firewall imaginable.”

President George W. Bush had his assets (reportedly including his 1,600-acre Crawford, Texas, ranch but not his interest in the Texas Rangers baseball team) in a blind trust going back to when he was governor of Texas. And Obama started one when he was elected to the Senate, but put his investments into mutual funds when it was revealed the trust owned stocks in companies with business before the Federal government. One of the companies, AVI BioPharma, was developing a drug to treat avian flu at a time when Obama was aggressively pushing to increase funding to combat the disease.

Meanwhile, Romney, who made a fortune estimated to be around $250 million as the founder of private-equity giant Bain Capital, put his wealth into a blind trust as governor of Massachusetts but drew some criticism for appointing his longtime personal attorney to run the trust, calling into question just how “blind” it actually was.

No sudden ‘amnesia’

Even when the executor tapped to run a trust is not a personal acquaintance, it’s difficult to take existing investments and entirely shield them.

“They sound good and they have political benefit,” said Skadden’s Gross, “but the problem with them is, No. 1, you can’t blind what you put into a trust. You don’t suddenly get a case of amnesia. The second problem is that you lose control of your finances.”

Complicating matters with Trump is the fact that his financial interests are so wide-reaching that they could create unprecedented regulatory challenges.

The Trump Organization, for example, has a 60-year lease with the federal government at a former Washington D.C. post office, where it developed and now operates the Trump International Hotel. If the hotel failed to make its lease payments or violated its lease in another way, would a federal agency be tasked with going after it and crossing the commander in chief?

Michael Bloomberg

Sources say Bloomberg’s experience as mayor offers a solid model to follow in some areas. The then-mayor waived fees his company, Bloomberg L.P., was charging the city for the use of the firm’s namesake terminals.

But all of the Trump Organization’s business decisions would likely be under extra scrutiny because he’d be passing the company torch to members of his own family.

Generally speaking, ethics watchdogs and regulators have focused on elected officials’ stock portfolios rather than on real estate, said Robert Rizzi, co-head of the tax practice at the Washington-based law firm Steptoe & Johnson.

“Generally, real estate is not as sensitive,” he said. “But here it’s just the opposite. It’s the thing he owns the most of or has the biggest interest in.”

The Pritzker paradigm

While there are few examples to look back on of real estate magnates who made it to the Oval Office, there is a recent example of one entering the president’s inner circle.

In 2013, Obama nominated billionaire Hyatt hotel heiress Penny Pritzker as U.S. Commerce Secretary. In order to avoid conflicts, Pritzker — who founded the Chicago-based PSP Capital Partners, Pritzker Realty Group and Artemis Real Estate Partners — divested herself of some 200 business entities, stepped down from the Hyatt board of directors and converted her voting shares in the company to more passive common stock.

Penny Pritzker

“If I were an ethics lawyer for a presidential candidate with substantial holdings in real estate, what she did would be a good example of what I would suggest a president should do,” said the University of Minnesota’s Painter.

Pritzker did stop short of completely divesting herself of Hyatt interests because, as she explained in financial disclosures, recusing herself on issues that could create a potential conflict would not significantly limit her abilities to do her job as commerce secretary.

Steptoe’s Rizzi, who advised Pritzker on the matter, said public officials who sell their holdings in order to avoid conflicts do enjoy one financial benefit: They can defer paying capital gains taxes.

“If you’re required to divest in order to avoid a conflict of interest, you can roll over the gains,” Rizzi said, explaining that the move requires certification from the Office of Government Ethics. “You can sell a property and not pay tax on the gain as long as you roll it into qualified mutual funds, essentially Treasuries.”

The Emoluments Clause

If Trump does actually make it to the White House, one thing he’d need to examine is a little-known Constitutional provision called the Emoluments Clause.

The clause — which dates back to 1787 and was meant to bar U.S. government officials and retired military personnel from accepting royal titles in foreign countries — has in recent years been interpreted far more broadly to ban accepting any kind of gift from a foreign entity. And the definition of “gift” has also broadened in scope.

“The application of the Emoluments Clause has been interpreted so broadly that any source from a foreign sovereign could conceivably apply,” Rizzi said. “The question is, ‘What’s the penalty and how do you enforce that?’”

For Trump, the provision could get him in hot water if, say, a foreign government offered a tax break to one of his overseas sites in a way that was perceived to be a gift or an act of favoritism.

The GOP frontrunner owns golf courses in Ireland and Scotland (in addition to Florida, New Jersey and elsewhere), and while it’s not clear if the overseas holdings receive any tax breaks, many of his courses benefit from them stateside.

Trump International Golf Links & Hotel Ireland

In addition, if one of his enterprises tapped a sovereign wealth fund as an investor — a common source of revenue these days — it could lead to an ethics issue.

“That would be a problem when a foreign government has the ability to make a U.S. president richer or poorer,” Painter said.

Still, even if Trump proactively cut off other forms of income, he would be entitled to his $400,000 salary as president and his book royalties — which would likely skyrocket.

“It is probably the case that the president’s books sell better because he is the president, and he therefore enjoys increased royalties,” Rizzi said. “As president, Trump’s name almost certainly would be worth more, at least in some markets.”