In early 2003, Bruce Ratner walked into City Hall with a proposal to build the largest public-private real estate development New York had seen in more than two decades.

The plan — based on a design by Frank Gehry — was to erect a sports-and-entertainment arena along with 4,500 apartments and 2.1 million square feet of commercial space on (and around) an underused rail yard along Atlantic Avenue in Brooklyn.

During Ratner’s presentation, a senior policy adviser in the Bloomberg administration reportedly leaned over to deputy mayor Dan Doctoroff and whispered, “the guy has balls.”

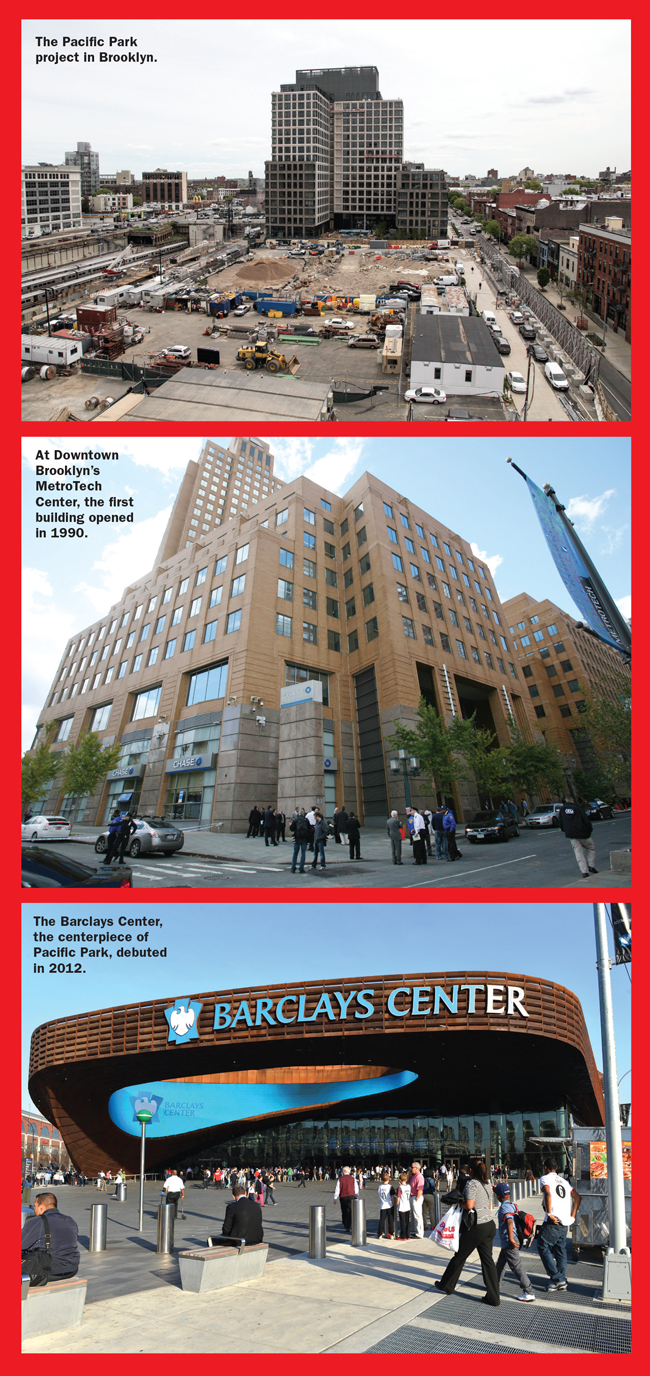

Fifteen years later, Ratner’s vision has become only a partial reality, with an arena that’s home to the Brooklyn Nets and New York Islanders and four of 16 residential towers up, with several more planned.

But Ratner is now retired, and his company — once one of the most powerful real estate developers in New York — is a shell of its former self.

Previously mentioned in the same breath as major builders such as Related Companies, Silverstein Properties and Tishman Speyer, the firm doesn’t have any other major projects in the works in New York City.

Last year, Forest City Ratner Companies, now a subsidiary of the Cleveland-based REIT Forest City Realty Trust, quietly dropped Ratner’s name, rebranding itself as Forest City New York.

And in January, the company sold the majority of its remaining stake in Pacific Park, its largest development project in New York, to the Chinese developer Greenland Group.

On that very same January day, news broke that Forest City New York’s CEO, MaryAnne Gilmartin — a Ratner protégé who was leading the development charge after he gave up the CEO role — was leaving the firm after more than two decades and taking a group of high-level executives with her.

Meanwhile, late last month, the parent company announced that it would not sell itself — ending weeks of speculation that it was on the block. That was despite attracting 50 potential buyers.

The company’s board did, however, further dilute the Ratner family’s control of the company, accelerating a trend that was put in motion several years ago — and suggesting that the company will continue its retreat from the risky world of development.

The firm also recently laid off roughly 20 staffers in its Brooklyn office, its third round of layoffs since 2016.

So how did one of New York’s most powerful developers end up here? The company, sources say, was hindered by two key problems: major missteps at Pacific Park and a corporate restructuring that marginalized its development business.

It certainly didn’t help that the firm was operating in one of the riskiest sectors in one of the most competitive cities on the globe.

“Development is so fickle, and every big development company is only one disaster away from oblivious,” said Paul Adornato, a retired BMO Capital Markets analyst who followed Forest City for years.

Ratner v. Cleveland

New York’s real estate industry is full of development firms that have made costly miscalculations but rose from the ashes — think Tishman Speyer and Macklowe Properties.

The fact that Ratner’s firm never moved on from Pacific Park to its next big development has to do with the company’s unique structure, sources say.

Ratner didn’t start his career in real estate. He came from a wealthy Cleveland family. His father ran a cement and gravel company, and his uncles started a real estate development firm.

After graduating from Harvard University and Columbia Law School, Ratner began working in government, eventually rising to Commissioner of the Department of Consumer Affairs in the Koch administration.

But in the 1980s, Ratner left policy and went into the family business, convincing his relatives back home to fund his New York development projects.

For years, Ratner ran his own operation, partnering with Forest City — a public company controlled by his relatives in Cleveland — on his development deals. But in 2006, he sold his 30 percent stake in the joint New York portfolio to Forest City for $46.3 million and shares, making the firm a subsidiary of Forest City Enterprises.

A source close to the 73-year-old Ratner — who stepped down as Forest City Ratner’s CEO in 2013 and left Forest City Realty Trust’s board in late 2016 — said the move was in part about estate planning. Ratner was nearing retirement and his two daughters had no interest in taking over.

Initially, Forest City Ratner continued to operate as if the sale had never happened, former employees say.

But that, they said, began to change in 2011, when David LaRue was appointed Forest City CEO — the first non-Ratner to head the company.

“He was sort of given the job to rein in New York and slowly chipped away at that,” said a former Forest City employee, speaking on condition of anonymity. “The biggest issue was that New York was using most of the equity set aside for development, so it was creating tension in the business.”

Gradually, two businesses merged into one. Paychecks began coming from Cleveland, and the parent company began to exert greater control over budgets — in some cases denying funds for development expenses.

“Every step of the way, they were hamstrung by people in Cleveland,” said one source close to the company. “You could just sense the frustration with people in Brooklyn.”

Forest City spokesperson Jeff Linton denied that characterization, adding that in any business, “capital is finite and capital allocation across our entire footprint needs to be balanced.”

“That means that opportunities need to be prioritized across the business, and not all projects can move forward simultaneously,” Linton said.

For some time, a couple of Forest City’s shareholders — led by investment firm Third Avenue Management — were pushing for broader changes at the company.

Those changes came in 2016.

That was the year the company — which had holdings in a slew of sectors, including office, residential, retail and life sciences — became a REIT. That was a game changer for its future as a developer.

“They’re really a development company that uses leverage and takes risks — the public market doesn’t like that,” said another source close to the company.

Around the same time, Forest City began looking for an investor to take over, or at least fund, the firm’s New York development business, sources say.

The company’s management team also began unloading parts of the company.

In 2017, it sold its federally assisted housing and retail portfolios. That came on the heels of the October 2016 sale of the firm’s modular division, after the company built the city’s tallest modular tower at 461 Dean Street in Brooklyn.

That same month, the REIT announced a $307.6 million accounting loss on Pacific Park — a move that effectively wrote the project’s value down to a big fat zero. That prompted the firm to halt construction of new apartment towers until further notice. That notice has still not come.

That “hugely disappointing” loss was one of the factors that prompted a stock selloff, which the company responded to by scrapping the structure that gave the Ratner family voting control over the company, explained Adornato.

Sources say the only reason Gilmartin — who co-founded her own development firm, L&L MAG, with L&L Holding principals David Levinson and Robert Lapidus — didn’t leave earlier is that she was looking for the right opportunity. Gilmartin declined to be interviewed for this story, but at the time of her departure, she billed herself as a “hopeless developer.”

“It takes a lifetime to establish credibility and the reputation and the partnerships that we have in New York,” she said. “To not take advantage of that going forward in a responsible and responsive way to the market just doesn’t make any sense at all.”

Ratner v. Goldstein

Former employees blame corporate changes at Forest City’s parent for the company’s shift away from development, but they also point to miscalculations by Ratner, who declined to be interviewed.

Ratner, they said, underestimated the local resistance to his legacy project, which Doctoroff noted in his 2017 book, “Greater Than Ever: New York’s Big Comeback.”

“[He] had a savvy understanding of the political system,” wrote Doctoroff, noting that Ratner knew how to win over unions and get support from politicians (by doling out campaign donations).

“Yet for all his sophistication,” Doctoroff added, “Ratner utterly underestimated one set of potential opponents: a new core of well-off, white families who had purchased brownstones and now did not want to see their neighborhood crowded by others.”

“Yet for all his sophistication,” Doctoroff added, “Ratner utterly underestimated one set of potential opponents: a new core of well-off, white families who had purchased brownstones and now did not want to see their neighborhood crowded by others.”

But when Ratner embarked on Pacific Park, he was far from a newbie on the Brooklyn development scene.

After building the One Pierrepont Plaza office tower in the late 1980s, Ratner then went one to construct the massive MetroTech Center, a $1 billion, nine-building office complex in Downtown Brooklyn. The project — a public-private investment done in conjunction with Polytechnic University — opened its first building in 1990.

“Bruce Ratner is probably single-handedly the most important person to the transformation of Brooklyn,” said Tucker Reed, co-founder of real estate firm Totem and former president of the Downtown Brooklyn Partnership.

“There was no office market in Brooklyn for a whole generation until” Ratner built MetroTech, Reed added.

In 1996, Ratner completed the 396,000-square-foot retail complex known as Atlantic Center (a second mall, Atlantic Terminal, was added in 2004, along with a 14-story office building) at the corner of Flatbush and Atlantic avenues — a daring move at the time.

Then in 2001, with the wind at its back, the company headed across the river into Manhattan to develop a new 52-story headquarters for the New York Times on land seized by the Empire State Development Corporation through eminent domain.

The Renzo Piano-designed building, which sits on Eighth Avenue between 40th and 41st streets — was completed in 2007.

“Their business model was to find projects that were extremely complicated and that no one else would take on,” said RXR Realty’s Seth Pinsky, who headed the New York City Economic Development Corporation during the Bloomberg years and worked on the Pacific Park project (then known as Atlantic Yards).

“Often, this involved working with the public sector,” Pinsky said.

At Pacific Park, Ratner followed the same general playbook. But the company made ambitious promises to the city and state, pledging to invest hundreds of millions in infrastructure and to keep 30 percent of the units affordable. Those factors reduced the margin of error, although the company also landed more than $700 million in tax breaks.

Anyone who was following New York real estate at the time no doubt remembers Daniel Goldstein, the founder of the opposition group Develop Don’t Destroy Brooklyn and a local condo owner. The group sued to block the project, claiming that the use of eminent domain was unconstitutional, and staged near-constant protests, which dominated the press coverage.

“You can’t overstate the impact that the opposition to the project had,” Pinsky said. “The delay meant Forest City was spending enormous sums of money while fighting the opposition until finally, when they were able to put shovels into the ground and go vertical, the market was no longer there.”

The former Forest City Ratner employee echoed that point.

“Community opposition is one thing. I don’t know that anyone can plan for someone like Daniel Goldstein,” said the source. “This was at the dawn of blogs and social media. Daniel Goldstein was masterful in using social media to amplify what was a very small, very localized opposition to the project.”

When Goldstein’s final appeal was dismissed in March 2010, the real estate market was in the toilet post-recession, and the global financial markets had seized up.

Nonetheless, the Barclays Center opened in 2012. Then, two years later, Greenland bought a 70 percent stake in the project, excluding the arena, for $200 million. As the first apartment buildings began to rise, Pacific Park seemed to have turned a corner.

But problems soon began to mount: The modular construction was leaking; the company sued its modular construction partner, Skanska, and the Brooklyn residential market was flooded with an oversupply of high-end inventory.

Forest City v. the future

In late January, news broke that Brookfield Asset Management was in talks to buy Forest City for around $6.4 billion. But last month’s announcement put the kibosh on any sale — at least for now.

Although Forest City entered into an exclusivity agreement with a “large financial investor,” it ultimately rejected the firm’s offer.

And while the firm reduced the Ratners’ control over the company — chopping its number of board appointees to two from four — it gave more control to two hedge fund investors, Starboard Value and Scopia Capital Management.

For now, longtime Forest City executive Robert Sanna is heading up Forest City’s New York office, which still controls a sizable office portfolio, including many of the aforementioned buildings and the 907-unit residential rental 8 Spruce Street, among many others.

“New York is an important core market with a substantial base of very high-quality assets,” Forest City’s Linton said in a statement, adding that the city accounts for a third of the company’s net operating income. “We expect to continue to have a presence focused on leasing, asset management, operations and a core development capability.”

And the company still has some development projects, including a planned mixed-use complex in Jersey City, plus ongoing work on the giant Cornell Tech campus on Roosevelt Island. But future New York megadevelopments are unlikely.

Meanwhile, Greenland, a company with little experience developing in the U.S., is now racing against a city deadline to complete Pacific Park’s affordable housing units by 2025.

Ratner probably did not envision the project going this way.

“When you look at the record of this company — and this is very serious — we finish virtually everything,” he told the New York Times in 2012. “We don’t give up.”

RXR’s Pinsky predicted that the project will likely make someone a lot of money. But it’s unlikely that Bruce Ratner will be that person.

“I absolutely am confident that the project will get built out and that it will likely be a financial success for somebody,” Pinsky said. “I think the concept is too good, the location is too right and the demand is too high for the project not to be a huge win at some point in the future.”