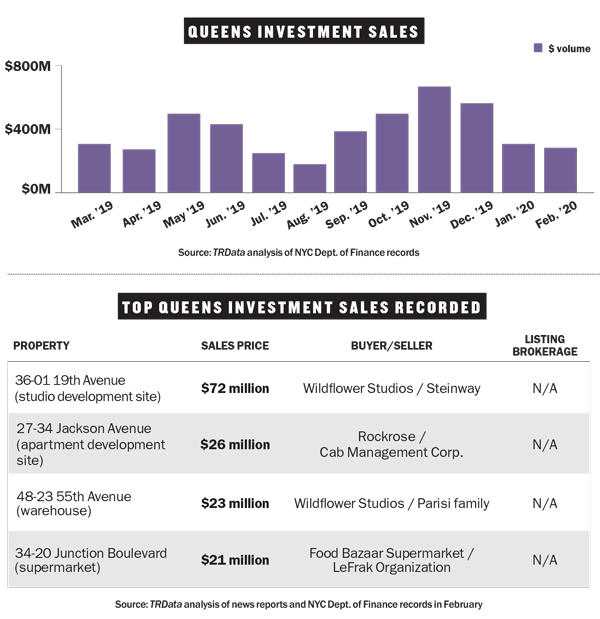

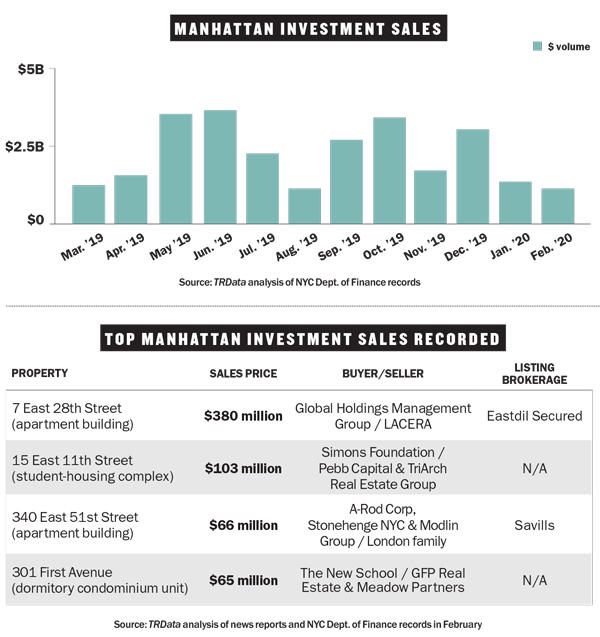

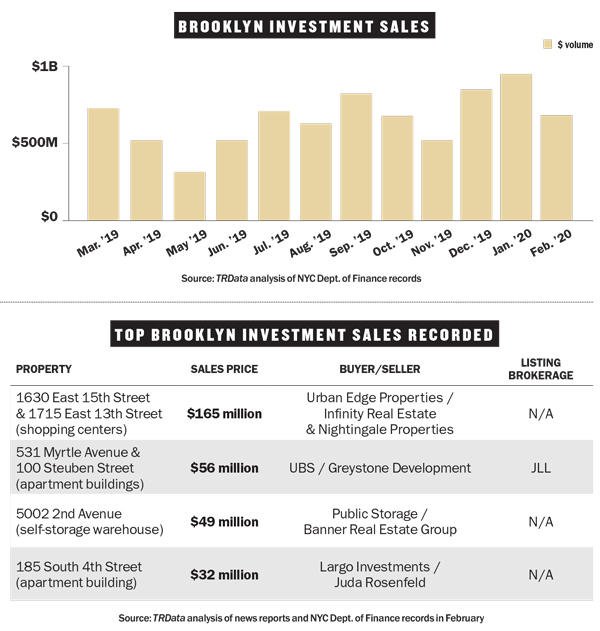

Investment sales in Manhattan and Brooklyn

Manhattan investment sales hit a 12-month low in February with just $942 million in deals recorded, down 21 percent from January and 54 percent below the 12-month average. The borough’s largest deal went to Eyal Ofer’s Global Holdings Management Group, which acquired the 50-story rental tower at 7 East 28th Street from the Los Angeles County Employees’ Retirement Association for $380 million. Brooklyn investment sales slowed down with $616 million in deals recorded in February, 35 percent down from the month prior and close to the 12-month average. The borough’s biggest deal saw Urban Edge Properties pick up two southern Brooklyn shopping centers from Infinity Real Estate and Nightingale Properties for $165 million.

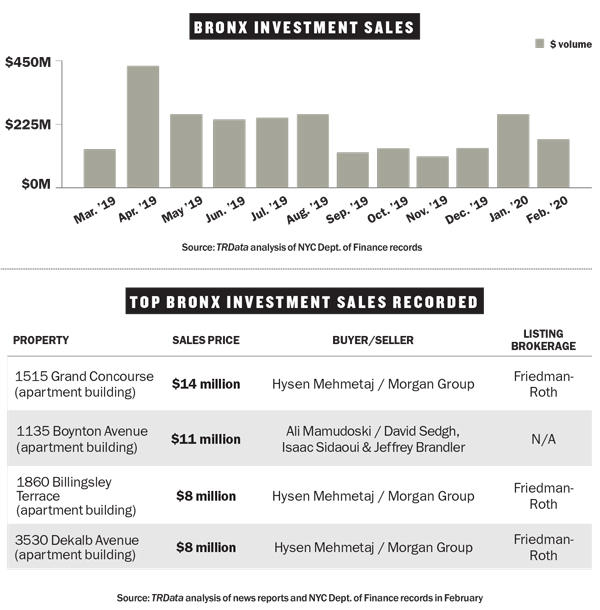

Investment sales in Queens and the Bronx

Queens investment sales held steady with $278 million in deals recorded in February, 3 percent down from the prior month and 24 percent below the 12-month average. The borough’s largest deal went to Robert de Niro’s Wildflower Studios, which bought an Astoria development site for about $71.6 million from piano maker Steinway. Bronx investment sales regressed from a January spike, with $160 million in deals recorded in February, a 38 percent decline and 20 percent below the 12-month average. The borough’s top deal went to landlord Hysen Mehmetaj, who acquired a trio of six-story elevator apartment buildings from Scott Morgan’s Morgan Group for $30 million.