Jerome Avenue, the roughly 7-mile thoroughfare running from the south end to the north end of the Bronx, has long been home to a lengthy stretch of auto shops and other low-scale commercial buildings.

But if a recently passed rezoning takes off, it could soon become better known for a slew of residential high-rise projects.

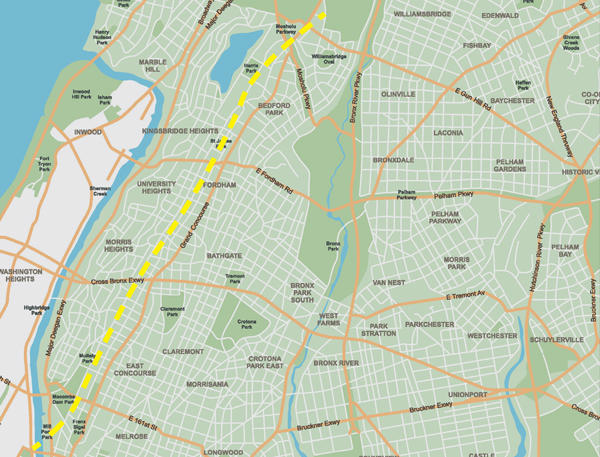

The City Council unanimously passed the Jerome Avenue rezoning in late March, paving the way for a major overhaul to those neighborhoods after years of debate. The rezoning will cover about 92 blocks across 2 miles, from 165th Street to 184th Street, and is expected to generate roughly 4,600 new units of housing, according to the city.

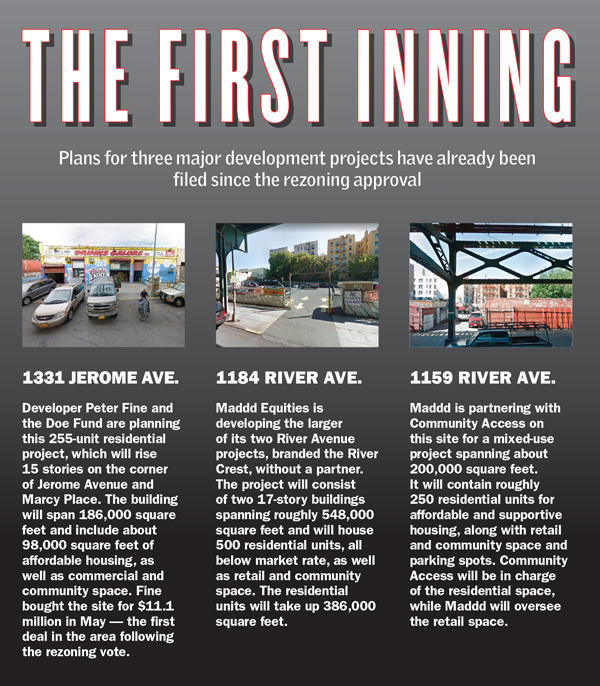

Three major real estate projects are already being planned for the area: two from Long Island-based Maddd Equities on River Avenue, totaling 750,000 square feet, and one from Manhattan developer Peter Fine near the corner of Jerome and Marcy Place, totaling 186,000 square feet.

And though one of the goals of the rezoning is to bring more affordable housing to the area, it has still sparked fears about gentrification and displacement due to the immediate response from private developers. Some also worry that sellers may have an inflated sense of what their land is worth — hampering the amount of deals that actually get done.

“The market is so hot that all the owners want to do deals that have no contingencies,” said Steven Westreich, president of the Manhattan investment sales brokerage Westbridge Realty Group. “They have a million brokers that are running after them and throwing crazy numbers at them.”

The first wave

Fine, a co-founder of Atlantic Development Group, purchased the 25,000-square-foot lot at 1331 Jerome Avenue for $11.1 million in May, marking the first property in the area to be snapped up after the rezoning vote.

The developer is partnering with the anti-poverty nonprofit the Doe Fund to build a 15-story project there with 255 apartments that will be entirely below market rate. The plans call for roughly 98,000 square feet of housing, 69,000 square feet of community space and 19,000 square feet of commercial space. The total cost of the project is still unknown.

Fine told The Real Deal in a brief statement that he was “thrilled” to develop “255 units of desperately needed affordable housing on Jerome Avenue.”

David Simone, a principal at Concourse Realty Partners who helped broker Fine’s purchase of the site, said the area had always been fairly popular with retail landlords, but the rezoning makes it far more attractive to residential developers. “It’s not going to be a one- or two-year transformation,” he said, “but I think over the long term, you’ll see a lot of development in this area.”

Maddd, meanwhile, is planning its two projects within a few blocks of Yankee Stadium. That area has seen relatively few large residential developments despite its proximity to one of the borough’s most famed commercial hubs.

The project at 1184 River Avenue, known as the River Crest, will total about 548,000 square feet across two 17-story buildings and include 500 apartments across 386,000 square feet, all below market rate. It will also include retail and community space and 354 parking spots.

The development at 1159 River Avenue, less than a quarter of a mile down the road, will be smaller and span about 200,000 square feet, including space for retail and parking. That building — which Maddd is partnering on with the New York City nonprofit Community Access — will contain 250 apartments, split between affordable and supportive housing. The two projects are projected to cost about $330 million in total, according to the developers.

The rezoning will cover about 92 blocks across 2 miles.

Community Access CEO Steve Coe said the partners hope to mitigate gentrification concerns by designating a third to half of the units for families earning roughly 30 percent of the area’s median income. “The 1184 River Avenue project gives us some flexibility to do that,” Coe said.

“The rezoning has allowed for larger projects, and larger projects allow for a mix of incomes,” he added. “Hopefully, benevolent developers will be sensitive to that and try to do the same thing.”

Playing catch-up

The first three big projects on the heels of the rezoning vote are primarily affordable, but industry sources say more market-rate developments are likely to follow.

Daniel Parker, a managing director at the commercial brokerage Hodges Ward Elliott, said the area is ripe for more money-driven projects. “Bronx investors are very interested in any existing or development opportunities [along Jerome Avenue],” he said. “Those are areas that have a lot of demand for market-rate housing, but virtually no new supply has been built in the last two or three decades.”

Eli Weiss of Joy Construction, who is consulting for Maddd Equities on the two projects, said his client wanted to develop in the area because it has good transportation options and is close to several large employment hubs, including the stadium.

Weiss said he hopes the rezoning process helps longstanding residents but added that it’s too soon to know what the real impact will be. “Everyone is intending for this to be a benefit to the community,” Weiss explained. “How it works out, history judges that.”

Council member Vanessa Gibson, who represents a significant chunk of the area, said she’s hoping to see the Jerome Avenue rezoning lead to more affordable housing projects and told TRD that the process is moving too slowly. “I would like it to move a little quicker — especially on the publicly owned sites,” Gibson said, “because there are commitments that have been made to achieve affordable senior housing on one of my sites, and that’s important for me.”

Westreich of Westbridge Realty said he’s seen acquisition and development activity pick up following the rezoning, but not as much as he thought they might. That’s largely due to confusion about what type of housing is allowed, environmental issues at several of the properties and overconfidence among property owners about what prices they can expect to get, he argued.

Westreich said $65 per buildable square foot is a reasonable expectation for owners in the area, but overeager brokers are trying to convince them they can get up to $80 per foot.

“Long-term, everything will catch up with itself,” he said. “The prices will catch up with the environmental issues, and the prices will become commensurate with what they’re actually worth. But there’s so much noise in the Bronx right now.”

Council member and Land Use Committee chair Rafael Salamanca echoed that point. “At the end of the day, [landlords] want to make a profit,” he said. “I think they’re going to come to the table with a realistic ask, and I see things moving along in the district.”

“The affordable borough”

While the city included multiple community benefits — including $189 million for workforce development, parks and two new schools — the planned rezoning has also ruffled feathers among longtime residents.

Many are worried that the initiative will drive out what’s left of the area’s famed auto shops and increase rents beyond what current tenants can afford. Fitzroy Christian, a community activist who has lived by Jerome Avenue and Featherbed Lane since 1976, argued that the affordable housing standards the city is using for new developments are out of reach for most people who live in those neighborhoods.

“To speak about producing affordable housing for people who make $46,500 and above is totally ridiculous,” he said. “And with the pressures that come with upzoning, landlords are going to be working overtime to get all of these low-paying tenants out and open their apartments to those who can afford to pay the much higher rent.”

Mark Stagg — an active developer in the Bronx, with eight projects underway in the borough — said he supports the rezoning and thinks it will make Jerome Avenue far better for residential development. Stagg added that he’s looking at a handful of sites where he would ideally build a 150-unit market-rate project.

And while the rezoning is likely to make Jerome Avenue’s famed auto shops a thing of the past, housing prices in the Bronx would still remain cheaper than they are in the rest of the city, he argued.

“With the current price levels in Manhattan, Brooklyn and Queens, I see this being the affordable borough,” Stagg said.