INVESTMENT SALES IN MANHATTAN AND BROOKLYN

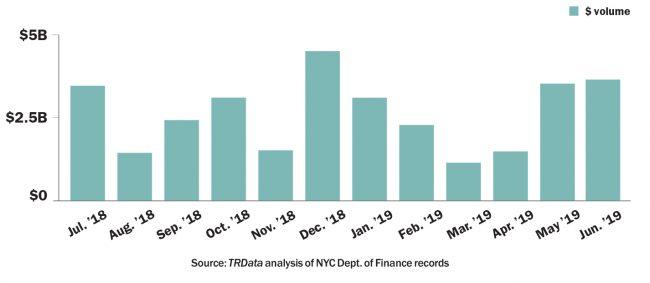

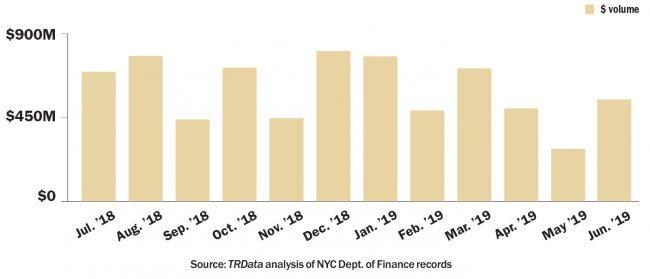

Manhattan investment sales stayed almost flat in June with $3.49 billion in deals recorded,35 percent above the 12-month average. The strong showing was largely thanks to one giant deal, which saw the Related Companies and Allianz buy up WarnerMedia’s 1.5 millionsquare-foot office condominium at 30 Hudson Yards for $2.2 billion. Brooklyn’s investment sales market bounced back somewhat in June with $492 million in deals recorded, 75 percent up from the month prior but still 17 percent below the 12-month average. The borough’s top deal went to the Holterbosch family, a German-American beer dynasty, which picked up a market-rate rental building at 100 South 4th Street from Meadow Partners for $61 million.

MANHATTAN INVESTMENT SALES

TOP MANHATTAN INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 30 Hudson Yardsn(WarnerMedia officencondo) | $2.2 billion | Related Companies & Allianz /nWarnerMedia | Cushman &nWakefield |

| 355 West 16th Streetn(hotel) | $175 million | Worth Capital Holdings 52 LLC /n346 West 17th Street LLC | N/A |

| 511-541 West 25thnStreet (office complex,n95 percent stake) | $148 million | Artemis Real Estate Partners /nPGIM Real Estate | Cushman &nWakefield |

| 142 West 36th Streetn(office building) | $82 million | Alduwaliya Asset Management /nWaterman Interestsn& USAA Real Estate | Cushman &nWakefield |

Source: TRData analysis of news reports and NYC Dept. of Finance records in June

BROOKLYN INVESTMENT SALES

TOP BROOKLYN INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 100 South 4th Streetn(rental building,nmarket rate) | $61 million | Holterbosch family /nMeadow Partners | Hodges WardnElliott |

| 1000 Dean Streetn(commercial building) | $56 million | LIVWRK / Jonathan Butler,nBFC Partners & Goldman SachsnUrban Investment Group | TerraCRG |

| 1007 Atlantic Avenuen(mixed-use building) | $26 million | Classon Management LLC /nSterling Town Equities | N/A |

| 240 Broadwayn(mixed-use building) | $20 million | 240 Broadway Property LLC /nAbraham Russak | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in June

INVESTMENT SALES IN QUEENS AND THE BRONX

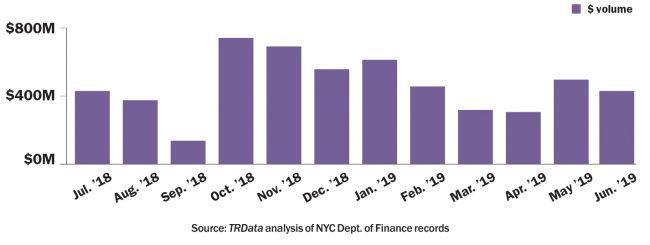

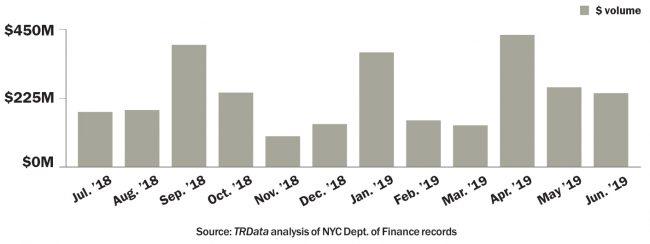

Queens’ investment sales market slowed down in June with $409 million in deals recorded,17 percent down from the previous month and 11 percent below the 12-month average. The borough’s top deals were for a pair of rent-stabilized buildings in Flushing, which Zara Realty acquired for $80 million. The Bronx’s investment sales market continued to regress from April’s peak, with $229 million in deals recorded in June, down 11 percent from the month prior and slightly under the 12-month average. The Holterbosch family made a borough-topping buy here as well, picking up an Amazon last-mile warehouse at 1300 Viele Avenue for $70 million — almost three times what sellers MRP Realty and AEW Capital Management paid for it in 2017.

QUEENS INVESTMENT SALES

TOP QUEENS INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 140-30/140-50nAsh Avenuen(rent-stabilized building) | $43 million | Zara Realty /nIlias Theodoropoulos | MeridiannCapital |

| 140-60 Beech Avenuen(rent-stabilized building) | $38 million | Zara Realty /nIlias Theodoropoulos | MeridiannCapital |

| 6107-6125 WoodsidenAvenue (rent-stabilizednbuildings) | $36 million | Fisher Associates / Eric Markel | Marcus &nMillichap |

| 11-40 45th Roadn(commercial building) | $26 million | George Xu / Radha Soami Society | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in June

BRONX INVESTMENT SALES

TOP BRONX INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 1300 Viele Avenuen(Amazon warehouse) | $70 million | Holterbosch family /nMRP Realtyn& AEW Capital Management | Cushman &nWakefield |

| 320 West FordhamnRoad (developmentnsite) | $32 million | Dynamic Star / Lasala family et al. | JLL |

| 135-145 West KingsbridgenRoadn(rent-stabilized building) | $16 million | Ignacio Castillo / The Morgan Group | RosewoodnRealty Group |

| 3443 Jerome Avenuen(1-story retail building) | $9 million | Ruben Luna /nLeonard Gero & Stephen Freidus | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in June