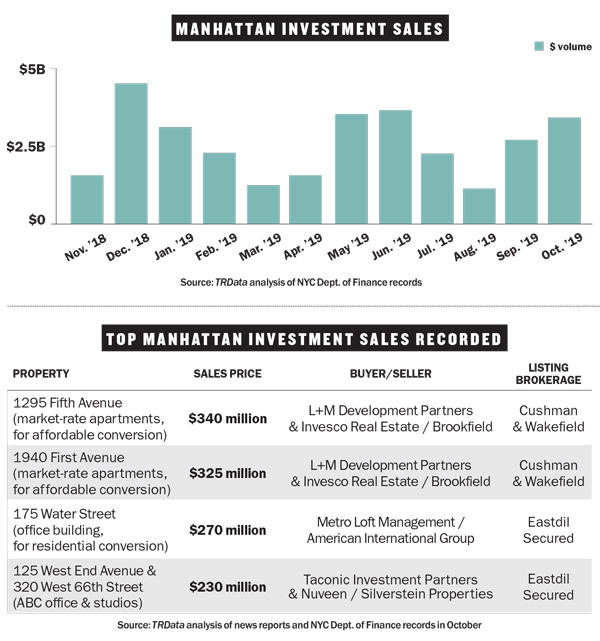

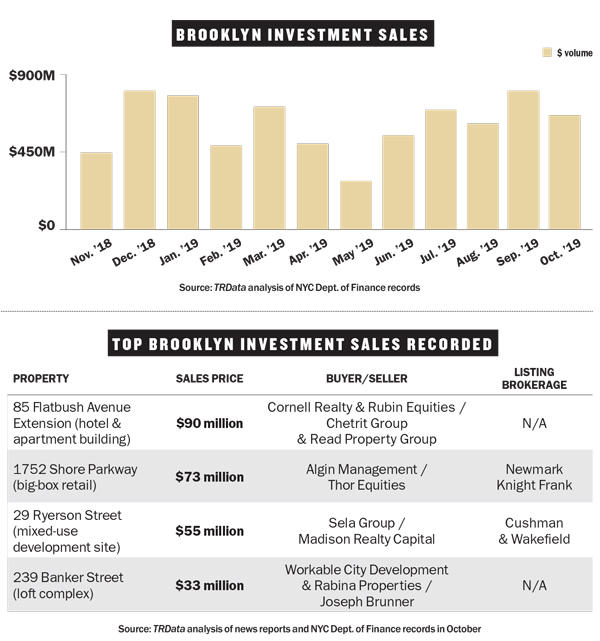

Investment sales in Manhattan and Brooklyn

Manhattan investment sales held strong in October with $2.83 billion in recorded deals, a 15 percent increase from the month before and 17 percent higher than the 12-month average. The borough’s two largest deals went to L+M Development Partners and Invesco Real Estate, which closed on four properties worth $820 million from Brookfield’s Putnam rental portfolio. Brooklyn’s investment sales, meanwhile, fell in October. The borough saw $567 million in deals recorded — 27 percent down from September and 3 percent below the 12-month average. The borough’s top deal went to Cornell Realty, which bought Downtown Brooklyn’s Tillary Hotel ( including a rental component on the upper floors) from the Chetrit Group for $90 million.

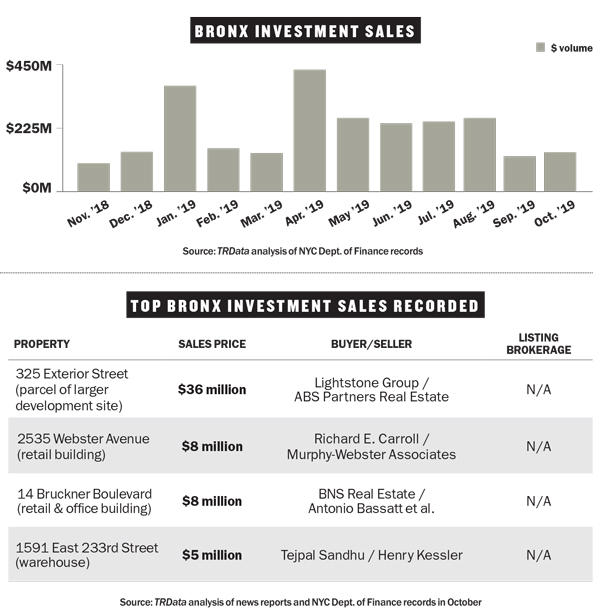

Investment sales in Queens and the Bronx

Queens investment sales continued to rebound in October with $472 million in recorded deals, 30 percent more than September’s total and 13 percent above the 12-month average. The borough’s top sale went to American Realty Advisors, which paid $260 million to Suncap Property Group for a massive FedEx warehouse in Maspeth after previous buyer Prologis failed to close. Investment sales in the Bronx remained slow in October with just $121 million in recorded deals —up 11 percent from the month prior, but still 42 percent below the 12-month average. Lightstone Group notched the borough’s top deal, further expanding an assemblage along the Harlem River by paying ABS Partners Real Estate $36 million for the parcel at 325 Exterior Street.