The global commercial real estate industry may be consolidating, but in a twist, New York City’s “Big Four” commercial brokerages — CBRE, Cushman & Wakefield, Newmark Grubb Knight Frank and JLL — may end up with more jumbo competitors.

The current wave of mergers and acquisitions may add one, or even two, more gargantuan commercial brokerages to the New York landscape, real estate professionals predict.

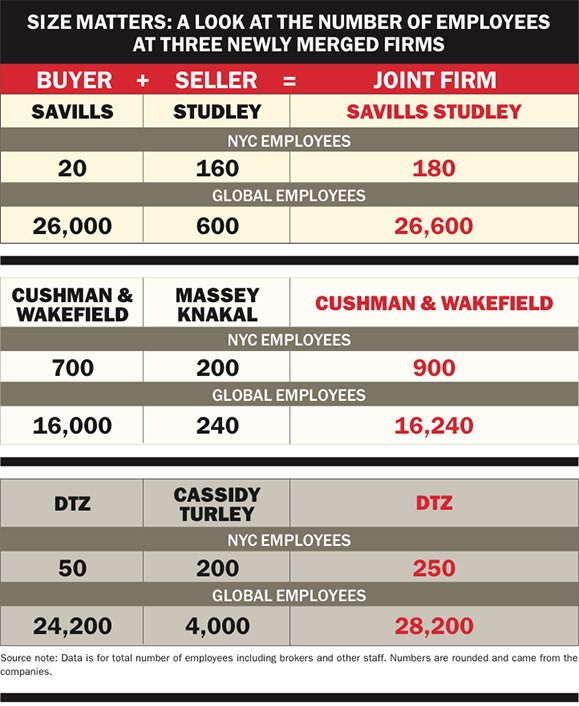

The most recent high-profile acquisition, the surprise purchase of Massey Knakal Realty Services by Cushman in December was just one of several major mergers in the last eight months. The others, of course, are: The marriage of U.S. firm Cassidy Turley with the global DTZ, and the purchase of the Manhattan-based Studley by the London-based Savills.

These new unions illustrate just how much pressure there is on global companies to get even bigger.

The reason for the pressure is, not surprisingly, revenue. In order to boost their top lines, many global companies are looking to expand into new markets or beef up operations in cities they are already in. Rather than doing that organically, it’s often easier to snap up another firm.

“You are either a consolidator or a consolidatee,” said Robert Shibuya, president of the national tenant-representative firm Mohr Partners, and former head of the global property and engineering firm UGL Services/DTZ, which has since split into two companies.

While mergers are altering New York’s commercial brokerage world, the same is not true on the residential side. That’s despite some big shakeups, including Related Companies investing in CORE last fall, William Raveis entering the market, and Coldwell Banker dropping its affiliation with Bellmarc.

But the changes on the commercial side are having a more substantial impact, giving the global firms a new relationship with landlords, developers, investors and other influential real estate players in the city.

The mergers will also create more competition at the highest echelon of the New York commercial brokerage industry, sources predicted.

“It may take a while, but they will spend the time [and] they will spend the resources,” said Alan Cohen, executive managing director and partner at the brokerage ABS Partners Real Estate.

The agenda

The trend toward larger commercial firms has been going on for decades, but each of the acquiring firms involved in these latest deals had a very specific agenda.

The DTZ-Cassidy Turley transaction (bankrolled by private equity firm TPG Capital and others) and the Savills-Studley deal actually hinged on similar rationales, insiders said: Both firms were strong players in Europe and Asia, but had only tiny U.S. operations.

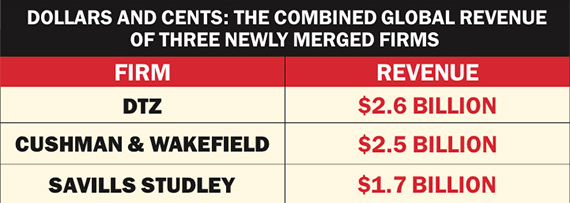

In 2013, the combined global revenues of DTZ and Cassidy Turley came to $2.6 billion, just below those of the second-largest international commercial firm, JLL, which had revenues of $3.7 billion in 2013. (DTZ has also tapped Brett White, the former CEO of CBRE, to take over as executive chairman after a non-compete with his former employer expires next month.)

For its part, Savills’s purchase of Studley — the company is now known as Savills Studley in the U.S. — is slightly different, because Studley was in the shrinking niche business of representing tenants.

Meanwhile, in a first, the Massey Knakal-Cushman deal will give the global firm scores of brokers targeting smaller investment sales deals — ranging from under $1 million to about $50 million. Most of the large New York firms currently have teams of investment sales brokers vying for deals priced at $50 million and up.

While those three big deals are all different in nature, they all spell one thing for the local landscape: a shake-up. And the change-ups are only expected to continue.

The Cushman acquisition may very well prompt other global firms to consider getting into the low-end property sales game, said Paul Massey, the co-founder of Massey Knakal and now president of New York investment sales at Cushman.

The Savills and DTZ deals could ignite more competition for New York leasing assignments and/or corporate services on both the landlord and tenant sides, in turn driving down related fees and commissions, industry professionals said.

“There will be [increased] pricing competition because of these mergers,” said ABS Partner’s Cohen.

‘Public’ peer pressure

In addition to the near-compulsion to get bigger, there’s also more drive among global firms to go public. By selling into the public markets, they get access to cheaper capital, which allows them to expand further and make more money for investors.

While Savills is already a public company and Cushman is owned by the publicly traded Italian firm Exor, many observers are expecting TPG and its partners to take DTZ public in a few years. In addition, some expect Exor to reprise its 2014 IPO of Fiat Chrysler, another company it owns, by spinning off Cushman.

“Publicly traded organizations have a lower cost of capital and thus can pay more for both acquisitions and recruits,” said Peter Hennessy, the president of the tri-state region for DTZ.

The drive to fill gaps in revenue is what’s often driving the shopping list.

Mohr Partners’ Shibuya described each acquisition as either a “bolt-on” (in which a firm buys a company that provides them with a new line of business) or an “infill” (in which the firm purchases another firm to grow an existing service).

“Think about geography, think about service lines and about clients,” he said, explaining how executives determine which companies to buy and which areas to expand into.

William Elder, executive vice president at the landlord RXR Realty, said that when a brokerage is managing the real estate needs of global clients (whether it be for office leasing, building purchases or other investments), it needs to have a worldwide network to tap into.

“When you represent the big, multi-national corporations, you need the footprint to be international,” he said.

While leasing and sales can provide more than half of the revenue for most commercial brokerages in a strong market, that revenue stream is volatile. As a result, Wall Street likes public companies to have a steady stream of money coming in from advisory and corporate services because it helps to bolster stock prices.

“The corporate services business is huge for these companies, as it’s contractual and predictable income,” Elder said.

No guaranteed success

This, of course, is not the first wave of consolidation of the commercial industry in New York.

In 2008, the Toronto-based company FirstService acquired a stake in the local GVA Williams Real Estate. Now known locally as a branch of the global Colliers International, the company has a significant local share, but remains within a pack of second-tier players.

More recently, in 2012, Newmark’s parent company, BGC Partners, acquired Grubb & Ellis, which was in bankruptcy at the time. That move has, however, had little local impact.

In addition, real estate mogul Andrew Farkas bought NAI Global, a global network of commercial companies, in 2012. NAI has made little headway in New York so far, but it struck a deal late last year with EVO Real Estate Group, which is now its New York commercial brokerage brand. And sources are not counting the firm out, given Farkas’ track record. In 1996, Farkas’ Insignia Financial Group bought the Edward S. Gordon Company, the predecessor to CBRE in New York, the biggest commercial firm in the city.

Yet despite the massive amounts of money involved in these company acquisitions, there is no guarantee that joining forces will make an impact in New York.

“[The] Savills Studley merger still won’t make them a full-service firm,” said Joseph Harbert, president of the Eastern Region for Colliers, calling the deal a combination of “tenant rep and some investment sales.”

“It won’t make them competitive with full-service firms,” he added.

As for DTZ, Harbert said it has a weak presence in New York and others markets. “The DTZ folks have a lot of work to do before they compete effectively in New York and elsewhere,” he said.

In fact, the largest power shifts in Manhattan in recent years were not the result of major corporate acquisitions. Instead they stemmed from good, old-fashion poaching.

In 2011, JLL lured a large leasing team from Cushman that included powerbrokers Paul Glickman and Mitchell Konsker. Two years before that, the company wooed a top leasing team from Newmark headed by Scott Panzer. Both of those moves redirected tens of million of dollars in annual revenue, and massively upped JLL’s leasing game in New York. JLL also hired an investment sales team from Cushman in 2010 led by Richard Baxter, Jonathan Caplan, Scott Latham and Yoron Cohen.

Sources said that while the new DTZ has some industry veterans with deep contacts, such as Hennessy, the firm still lacks a major rainmaker.

“It is going to be very hard to make real inroads against JLL, CB,” one source said. “It is a great opportunity [for DTZ], but the hard part is going to be getting real talent over there.”

Hennessy said he “can’t disagree that the hard part is recruitiwng the right talent.”

But he said the company’s new resources and capital partners would allow it to do that. “DTZ has a new compelling story that we believe will resonate with the right talent,” Hennessy said.