Every real estate investor’s dream is to buy low and sell high. But actually executing that strategy is not as easy as it sounds.

This month, as many in the industry are expressing concern about a possible downshift in the market, The Real Deal set out to find out who’s timed this economic cycle best — so far.

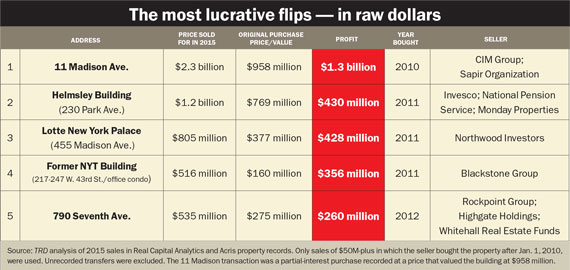

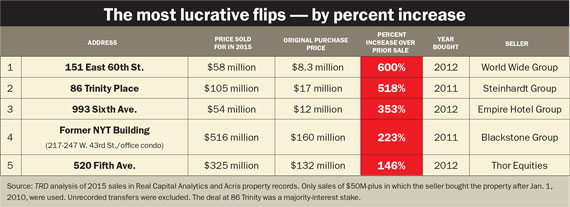

To do that, we analyzed 2015’s building sales above $50 million, but we only included buildings that the seller bought at some point since Jan. 1, 2010, when the market was still in the beginning of its recovery. Then we broke the deals down by both gross profit and percentage increase.

Based on raw dollars, 11 Madison, a 29-story Flatiron District office tower, was the most lucrative flip. The 29-story building was recapitalized in 2010, when the CIM Group bought a 49 percent stake in it, valuing it at about $958 million. When CIM and its partner the Sapir Organization sold it to SL Green Realty last year, it went for roughly $2.3 billion in the largest single-building sale in New York City history and the second-priciest single-asset deal of the year behind Stuyvesant Town-Peter Cooper Village. That was followed by the Helmsley Building at 230 Park Avenue, where an Invesco-led group sold for $1.2 billion, or about $430 million more than it paid in 2011, and the Lotte New York Palace Hotel at 455 Madison Avenue, where Northwood Investors sold for $805 million, $428 million more than it bought the site for in 2011.

Those flips were, not surprisingly, the ones that made headlines because the numbers were so large. But while the ranking of properties with the biggest percentage jumps in value may not have seen the same amount of money changing hands, the gains were astronomical. In addition, though the deals were smaller, they are within reach of a wider swath of industry players. Both big-time and small-time investors showed up on TRD’s ranking, reaping huge profits.

For example, the World Wide Group sold a 6,600-square-foot retail building at 151 East 60th Street for roughly $58 million in October 2015, after buying it for a mere $8.3 million in 2012. That amounted to a staggering 600 percent price increase. Kuafu Properties, the buyer, bought it as part of an assemblage and is planning to demolish it to make way for a condo tower.

Cushman & Wakefield’s Bob Knakal, who brokered Kuafu’s $300 million purchase of a mixed-use portfolio that included the East 60th Street site, said there were a “host of reasons” why Kuafu allocated certain dollar amounts to each building in the assemblage. While Knakal declined to specify those reasons, owning a property within a large assemblage obviously jacks up its value.

The second-most lucrative flip in the percent mark-up category came from hedge fund mogul Michael Steinhardt and his real estate adviser Allan Fried. The pair paid $17 million for the former headquarters of the American Stock Exchange at 86 Trinity Place back in 2011. They sold a majority stake in the building for 518 percent more than that to Clarion Partners in a $105 million transaction in November 2015. The partners, who scuttled their plans to convert a portion of the property into a hotel, still own part of the historic 182,000-square-foot Art Deco building. “If you bought in 2011, you had to have some guts,” Knakal said. “These people are being rewarded for their guts.”

Following that deal was the Empire Hotel Group’s sale of a one-story, 3,000-square-foot Garment District retail building at 993 Sixth Avenue for $54 million in October 2015. Empire, which paid $12 million for the building in 2012, gave up its plan to build a 122-key hotel on the site. Yet torpedoing the plan seems like it paid off: In a span of three years, the price climbed 353 percent.

The new owners, Isaac Chetrit and Ray Yadidi, want to incorporate the parcel into a larger assemblage spanning 375,000 buildable square feet, sources said. Chetrit and Yadidi also own 989-991 Sixth Avenue and are in contract to buy 235,000 square feet of nearby air rights. Their plans involve a commercial development, although the details have not been disclosed.

“It’s always good to assemble,” said JLL’s Yoron Cohen, who brokered Extell Development’s $247 million purchase of a stake in 1710 Broadway as part of an assemblage that included air rights from nearby properties. “It gives you the option to generate income, even short-term low income, and wait for the right time to develop. You need to have the ‘holding power’ to time it when it is economically viable.”

Other flips that landed on TRD’s ranking included the office portion of the former New York Times building (which sold for $356 million more than the purchase price) and 520 Fifth Avenue (which fetched $193 million more). The savvy sellers in those deals were, respectively, the Blackstone Group and Joseph Sitt’s Thor Equities. The $5.3 billion sale of Stuy Town was not included because the seller, CWCapital Asset Management, did not purchase the property. Instead it took control of the title to the massive apartment complex after it fell into foreclosure.

Knakal said he was not surprised to see investors making windfalls in a short stretch.

“The market had just started to correct in the early 2010s, and it built tremendous momentum,” he said.