Manicured lawns, historic architecture and luxury amenities, not to mention sweeping views, are the hallmarks of what’s come to be known as the Gold Coast of Connecticut’s Fairfield County. And although sales on the high end have slowed, there are still buyers for these oh-so-New England estates — if the price is right.

In many cases, “right” means reduced. The dip in deals isn’t necessarily because the demand isn’t there, but more because the pricing was wrong to begin with. “Activity isn’t improving because demand is increasing — the demand was always there. It’s just that the pricing didn’t reflect today’s market,” said Jonathan Miller, CEO of the appraisal firm Miller Samuel.

Last year, there were just three sales above $10 million in Fairfield County. But sellers are starting to see the error of their ways — no doubt on the advice of their brokers — and doing a better job of matching asking prices to market realities. Since September, there have been four sales over $20 million in the area, giving brokers some hope for the future.

The housing market on Connecticut’s Gold Coast — home to billionaires from the Rockefellers to the Trumps — has struggled somewhat since the financial crisis. Coming out of the recession, new urbanism boomed and the suburbs suffered as “walkability” and “penthouse” became essentials for buyers. Things have only started to turn around fairly recently.

“About three years ago, we began to see an uptick in sales in Fairfield County, and a big part of that was migration from the city. The city reached an affordability threshold, and renters opted to become first-time owners in the suburban markets,” said Miller.

But that was mostly at entry-level and midtier price points in markets closest to the city on Metro-North. “The high-end market is slower. It’s not enjoying the sales boom that the balance of the county has enjoyed,” Miller said. “Part of that is because Wall Street isn’t paying like it was after the financial crisis, as compensation was steered toward salary and away from bonus for risk management. Generally, it peaked in 2007 and has been drifting lower ever since.”

Miller did note the increased traction at the higher end of the market at the end of this year, but it comes with a caveat, he said.

Sellers, who had been pricing their mansions without regard for what’s been happening in the market, have become less aspirational, he said. In other words, prices are being slashed.

Perhaps the best example of that trend is Wall Street billionaire Stanley Druckenmiller’s historic Sabine Farm in Greenwich. Originally priced at $31.5 million in March, Druckenmiller only found a buyer after that ask was reduced to $25 million in November. Still, that deal became the priciest in the county this year.

“We are typically seeing discounts of 20 to 30 percent,” Miller said.

Leslie McElwreath of Sotheby’s International Realty, who sold Druckenmiller’s Sabine Farm, agreed.

“People are getting realistic with their pricing. Buyers are recognizing value and seeing opportunities to pick up really special properties at prices that reflect the change in the market,” McElwreath said. “My owner recognized that there weren’t a lot of buyers at this price point and, more importantly, he really wanted a buyer who was going to keep the 19-acre property together in one parcel and continue the stewardship of this historic house.”

Still, not all sellers are ready to face the market’s music. Many owners of tony estates have simply let their listings expire.

There are currently 33 active listings over $10 million in Fairfield County, all of which are in Greenwich, according to Miller. Only 8 properties at that price point sold in 2017. At that rate of absorption, it would take around 40 months to liquidate the supply, according to Miller Samuel data. Normally, a six- to eight-month absorption rate is expected in a healthy market.

But brokers predict that the good fortune of the last two quarters of 2017 will continue well into the new year — or as long as the economy holds out.

“It’s noteworthy that people are feeling comfortable investing significant sums in Greenwich real estate again. I expect that to continue into at least the second quarter of next year,” McElwreath said.

She also thinks success on Wall Street will help strengthen the top of the market in Fairfield.

“The improvement in the stock market gives people a lot more buying ammunition than in years past, and people are looking to diversify,” she said.

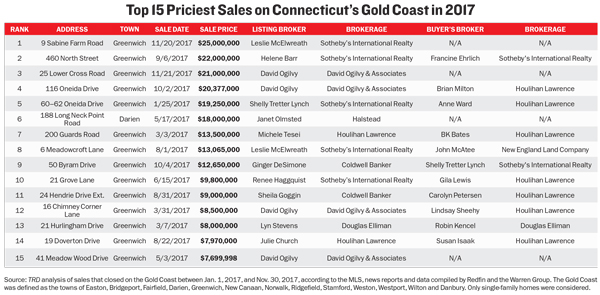

With the uptick in activity in mind, The Real Deal ranked the top 15 sales on Fairfield’s Gold Coast over the past year, taking a deep dive into the top 10 deals. It’s no surprise that all but one of the sales that made the ranking were in the uber-wealthy town of Greenwich. An $18 million sale in Darien at 188 Long Neck Point Road was the exception.

But it’s worth noting that while they didn’t make TRD’s list, significant sales also occurred in Westport, Norwalk, New Canaan and Rowayton this year.

In Westport, 5 Judy Point Lane went for $6.9 million in a sale brokered by Alan Hamilton of William Raveis Real Estate. In Norwalk, Eileen Murphy of Sotheby’s sold 10 Woodland Road for $5.7 million, while in New Canaan, 712 Oenoke Ridge got $5.5 million with representation from Carol Hollyday, also of Sotheby’s. Finally, 1 & 2 Rocky Point Road in Rowayton went for $5.1 million with Elizabeth Beinfield of Houlihan Lawrence.

Read on for the full details on the Connecticut Gold Coast’s priciest sales this year.

1. Sabine Farm at 9 Sabine Farm Road

Sale price: $25 million

Designed by New York architects Hunt & Hunt for publishing magnate H.J. Fisher in 1910, Sabine Farm remained in the family until about a decade ago. After a careful renovation, it’s been restored to its former glory.

It had last been purchased in 2004 for $23 million by hedge fund billionaire Stanley Druckenmiller. Almost all of its historic character remains; think center-cut English oak paneling, fireplaces with Caen stone mantels and antique friezes.

Amenities in the 12,000-square-foot, six-bedroom house include a gym, office, pool, spa, guesthouse and four-car garage. But the kicker is the land. The house sits on 19 acres in a section of Greenwich where lots now cannot exceed 2 acres.

“We were lucky to find buyers who wanted to raise their family here and protect the property, rather than subdivide it,“ McElwreath said.

460 North Street

2. North Court at 460 North Street

Sale price: $22 million

You might not expect a sprawling country estate built in 1906 to be packed to the gills with Warhols, but this is Greenwich, after all. This English manor-style manse has 15,500 square feet, seven bedrooms, eight bathrooms and, by TRD’s count from listing photographs, 11 Warhol lithographs and a Brillo Box — though there’s no word on whether the art came with the spread. In the 3,000-square-foot basement there is a lounge, theater, wine cellar and tasting room, yoga and massage room and sauna.

Celebrity interior designer Mark Cunningham did the interiors, and the property was featured in Architectural Digest. “Buyers prefer properties that are already done. Very few want to do any renovation themselves,”said listing broker Helene Barr of Sotheby’s. “They don’t want to put their stamp on the house, other than furnishings and art.”

The grounds of the property, which is known as North Court, include a stone wall around the perimeter, an Equinox-outfitted gym, a two-bedroom guest house, contemporary office suites, a seven-car garage, pool, teahouse, covered loggia, tennis court and formal boxwood gardens. Francine Ehrlich, also of Sotheby’s, represented the buyer.

3. Conyers Farm at 25 Lower Cross road

Sale price: $21 million

Conyers Farm is one of Greenwich’s premier estates. It’s also a perfect illustration of how much of an adjustment the market has seen in Fairfield County.

A little more than 15 years ago, Conyers Farm was on the market for $53 million. In 2004, the 80-acre estate sold to billionaire Thomas Peterffy for $45 million, a local record at the time. (Greenwich’s 50-acre Copper Beech Farm smashed that record in 2014 when it sold for $120 million.) In 2015, Peterffy put the 8,000-square-foot country estate back on the market for $65 million, but it garnered little interest. It sold once again this year, albeit at a $24 million discount from its last closing.

Steel and banking magnate Edmund Converse assembled some 80 farms for his country retreat at the turn of the 20th century. Conyers Farm sits on a massive slice of that old estate, and the mansion was carefully renovated by Peterffy. It boasts a two-story library, sauna, wine cellar, guest cottages, 22-stable barn and romantic “ruins” — aka the relics of an antique stone cow barn.

David Ogilvy of David Ogilvy & Associates handled the listing on both sides.

4. 116 Oneida Drive

Sale price: $20.4 million

Another David Ogilvy special, 116 Oneida weighs in at 9,781 square feet with nine bedrooms and nine-and-a-half bathrooms. It too sold at a neat discount to the $25 million it originally asked, and it sat on the market for 147 days, according to the Greenwich Time.

The listing for the waterfront stone Georgian-style house, built between 1923 and 1926, showed a three-story circular stairway, high ceilings, large windows, gym, indoor pool and sauna, open lawns and stone pillars bracketing the long driveway.

116 Oneida Drive

5. 60–62 Oneida Drive

Sale price: $19.3 million

This is another historic estate, but with an extra helping of land (hence the dual address). But unlike so many of its neighbors, it sold without renovation, according to listing broker Shelly Tretter Lynch of Sotheby’s. Anne Ward of Houlihan Lawrence represented the buyer.

“Many people thought the house would come down, but in fact the bones of the house and the architecture really represented a great opportunity for someone to go in and renovate,” Lynch said. “The people who bought it appreciated the architecture that was here and the prewar component. For people who are willing to take on a project, there is a lot of value in Greenwich. It’s sweet equity.”

The 9,173-square-foot, water-facing house has nine bedrooms, 10 bathrooms and a three-car garage on over 5.7 acres. It listed in the mid-$20 million range and, after a price reduction, sold in just six weeks, Lynch said.

6. 188 Long Neck Point Road

Sale price: $18 million

Located in Darien, this is the only property in the top-ranked sales on Connecticut’s Gold Coast that is not in Greenwich. But it’s easy to see why a stone manor house built on a peninsula on Long Island Sound might attract a well-heeled yachtsman or two.

In 2013, owner John Suhler — founder and chairman emeritus of the private-equity firm Veronis Suhler Stevenson — and his wife, Charlotte, listed the 17,000-square-foot mansion for $30 million. They paid just $8.9 million for what the Daily Mail described as the “Faux Chateau” back in 2000.

But with a less ambitious ask, the Suhlers were able to sell for a hefty profit. The 3.7-acre lot features a half-moon-shaped infinity pool, a deep-water dock and formal lawns. Inside there are nine bedrooms, 13 bathrooms and 22 floor-to-ceiling windows. Janet Olmsted of Halstead handled the deal.

7. 200 Guards Road

Sale price: $13.5 million

This English-style country estate is yet another piece of the original Conyers Farm. It has 30 acres directly on Converse Lake. The seven-bedroom stone house was built by Alan Wanzenberg, who the New York Times called “one of the most influential” designers of the 1980s. It features pretty much every amenity you can dream up, including Lutron lighting, an elevator, home theater, wine cellar, gym, billiards rooms, heated pool, spa, pool house, tennis court, half basketball court, three-hole golf course with sand traps, 2,100-square-foot guesthouse and gated entrance with a 24-hour security guard.

Michele Tesei on the seller’s side and BK Bates on the buyer’s side, both of Houlihan Lawrence, handled the sale.

8. 6 Meadowcroft Lane

Sale price: $13 million

This classic stone mansion was last asking $16.5 million, but once again, a price cut made all the difference. Leslie McElwreath of Sotheby’s represented the seller, and John McAtee of the New England Land Company brought the buyer.

Built in 1928, the 10,553-square-foot, six-bedroom, eight-bathroom house underwent a renovation that restored the property’s historic details while creating a more contemporary open floor plan. The residence features a front-to-back entry hall, high ceilings, an antique fireplace, formal dining room, paneled library and chef’s kitchen. The master suite boasts two dressing rooms, two offices, two bathrooms, two fireplaces and a private screened porch.

The eight-acre lot features three acres of park-like conservation land, a six-bedroom carriage house with two guest apartments, two en-suite staff rooms and enough room for six cars. Naturally, there is also a pool and tennis court. If it sounds Hamptons-esque, that’s because it is.

“Greenwich has always been a place for full-time residents, but we are seeing a lot more weekenders,” McElwreath said. “I am seeing people forgoing the Hamptons and instead buying their weekend homes in Greenwich. The traffic to the Hamptons this summer was worse than ever. Greenwich is just a 45-minute train ride away.”

9. 50 Byram Drive

Sale price: $12.7 million

This 6,621-square-foot mansion is not for landlubbers. Located in the Belle Haven section of Greenwich, 50 Byram has 175 feet of private waterfront with a private beach and views of Long Island Sound and the Captains Islands. The Louise Brooks-designed house has five bedrooms and five bathrooms spread over 6,621 square feet. The grounds have a three-car garage, pool, gardens and Jacuzzi. Ginger DeSimone of Coldwell Banker was the listing broker, and Shelly Tretter Lynch of Sotheby’s represented the buyer.

10. 21 Grove Lane

Sale price: $9.8 million

And last but not least IS the eight-bedroom, seven-bathroom abode of over 10,000 square feet on private Grove Lane. A stone’s throw from downtown Greenwich, the gated home has a 50-foot pool with a spa, nine fireplaces, wine cellar, three-car garage, elevator and gym. There’s also a three-bedroom guesthouse.

The shingled home, built in 1905, sits on more than three acres of lawns and landscaped grounds. Renee Haggquist of Sotheby’s and Gila Lewis of Houlihan Lawrence handled the sale on the seller’s side and buyer’s side, respectively.