When sales launched at the Baltic in Park Slope back in 2016, the condo building had the market to itself. But then things started softening, and more nearby developments started launching sales.

By the end of 2018, there were about 1,000 condo and rental units on the market in just that one neighborhood.

To sell the remaining apartments with that new competition, the project, developed by Michael Stern’s JDS Development, had to change its strategy, said Robin Schneiderman, the director of business development at Terra Development Marketing, which oversees Halstead Property Development Marketing and Brown Harris Stevens Development Marketing, the latter of which is selling the project.

The revamped plan offered new broker incentives, including increasing commissions for buyers’ brokers to 4 percent from 3 percent, for contracts signed by Feb. 15. The brokerage also struck a partnership with Restoration Hardware, which designed a model penthouse at the project. As of press time, buyers who close on units by that same date at the building will receive a $20,000 interior design allowance.

“We are adding strategic incentives to purchasers and the brokerage community to develop a sense of urgency,” said Schneiderman, who noted that about 70 percent of the 43 units are already sold. “Unfortunately, that’s what is lacking in the condo market today.”

That lack of urgency stems largely from the inventory piling up.

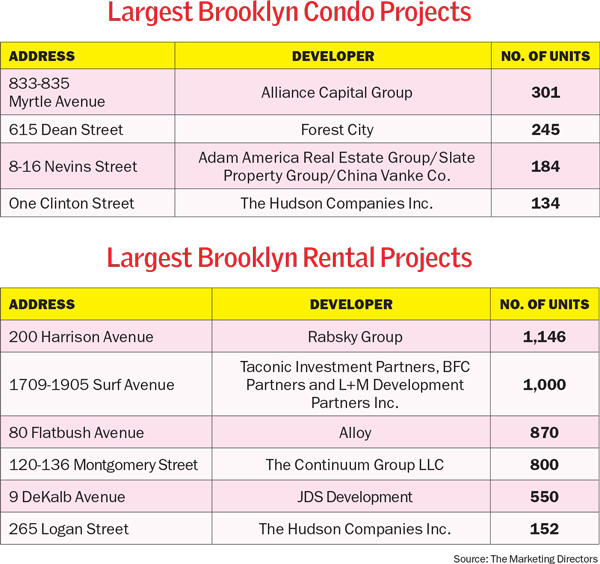

As developers have rushed into Brooklyn at an accelerated rate in the last five years — putting shovels in the ground in neighborhoods ranging the maturity spectrum — they have created a big batch of condos and rentals. And over the next three years another large wave of residential projects is slated to come online, including Two Trees’ Domino Sugar project; Greenland USA’s 810-unit rental 18 Sixth Avenue, which is part of the Pacific Park megadevelopment; RedSky Capital’s 470-unit 18 India Street in Greenpoint; and 9 DeKalb, a supertall tower with 400-plus apartments that JDS is also developing. Those projects join large developments that are already selling, like Extell Development’s 458-unit Brooklyn Point project and Tishman Speyer’s 481-unit 11 Hoyt.

While the projects coming online are targeting a broad range of prices, the amount of inventory in some pockets of the borough is creating concerns.

Some say that unloading these units is going to take longer than developers were banking on and will require more financial compromises than they expected.

Jordan Sachs, CEO of Bold New York, said a previous sellout timeline of 18 months to two years may be pushed to three years now.

“Developers have had to reshape their thoughts and understand that things are a little different,” said Sachs. “For larger buildings, some are feeling the pain because absorption is maybe a year off from what they planned.”

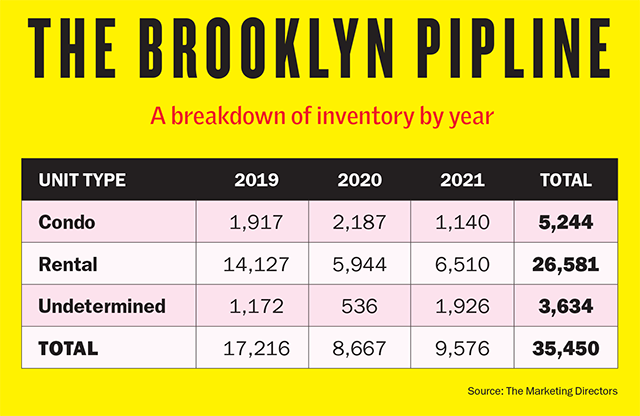

In 2019 alone, the borough is expected to get hit with 1,917 condo units and a massive 14,127 rentals, according to data compiled by the Marketing Directors. In total, the borough is slated to add roughly 35,400 units by 2021.

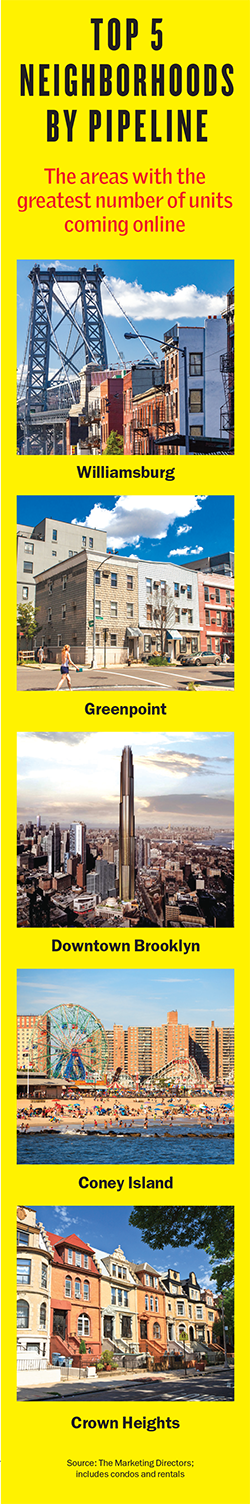

Williamsburg, Greenpoint and Downtown Brooklyn are among those getting the biggest influx of product.

“Developers feel there’s a lot of inventory in most neighborhoods, and sophisticated developers want to see absorption,” said David Pfeffer, chair of the construction group at the law firm Tarter Krinsky & Drogin, which works with both commercial and residential clients in Brooklyn. “There’s definitely going to be a pause in the market.”

Testing market depth

In the last few years, Brooklyn has obviously seen its residential developments hit new scales in terms of both size and price.

Extell’s Brooklyn Point will soon be the tallest tower in the borough at 720 feet, but it will quickly be surpassed by 9 DeKalb.

The Extell project, at 138 Willoughby Street in Downtown Brooklyn, sold more than $100 million in inventory during the first seven months of sales, the firm said.

But according to Ari Goldstein, senior vice president at Extell, the developer is “very careful with our pricing.”

Condos at the project — which has a total sellout of $901 million — start at a modest $850,000 and rise to $3.9 million for the penthouse. “On the very high end, I think there’s always some appetite, but I don’t know how big or deep that market will be” in Brooklyn, Goldstein said.

And Extell is not leaving anything to chance. In late November, firm chief Gary Barnett said the company was offering to pay between three and five years’ worth of common charges portfolio-wide for buyers who bought units by the end of 2018. Between that and a 25-year tax abatement at Brooklyn Point, that could mean buyers would have almost no carrying costs for several years. “They felt they wanted to find an incentive that helped the brokers but also motivated the buyers,” one source told The Real Deal in late November. “They recognize it is a buyer’s market.”

Anecdotal evidence suggests that projects in the borough are seeing a lot of potential buyers come through. But they seem to be in no hurry, given how many options they have.

In 2018’s third quarter, new development condos in Brooklyn saw a 46 percent year-over-year drop in sales and a 1 percent dip in median prices.

“We’re in a market that’s cooled off,” said Pfeffer. “Developers feel there’s a lot of inventory in most neighborhoods.”

Some developers have already exited the market. Forest City New York, for example, sold all but 5 percent of its stake in the 22-acre Pacific Park project to its joint-venture partner Greenland back in February 2018.

Spitzer Enterprises’ 857-unit rental complex at 420 Kent Avenue in Williamburg

Then eight months later, Greenland sold three of the project’s developable parcels to TF Cornerstone and the Brodsky Organization. While Greenland was reportedly prompted to sell by multiple factors, including less financial support from its parent company in China, the Wall Street Journal also reported that initial revenue from condo sales was “falling short of early projections.”

And early last month, celebrity broker Ryan Serhant — who stars on “Million Dollar Listing New York” — email-blasted fellow brokers announcing a one-day 20 percent-off sale at the 278-unit 550 Vanderbilt, the centerpiece condo tower at Pacific Park, according to the Bridge website.

In general, the timeline and pace of sales have created a new landscape, said Amy Pearl, vice president of development at Silverback Development, whose projects include the 22-unit condo 67 Livingston Street in Brooklyn Heights.

“People have the ability to transact, but they’re really cautious,” she said. “This isn’t three years ago, when people were buying off floor plans. The timeline has shifted to when the project is available, staged and ready to go.”

“People have the ability to transact, but they’re really cautious,” she said. “This isn’t three years ago, when people were buying off floor plans. The timeline has shifted to when the project is available, staged and ready to go.”

Location luck

Not all neighborhoods are created equal.

Williamsburg and Bushwick, for example, are not only bracing for an influx of inventory, they are also about to get hit with the shutdown of the L train.

In October, Williamsburg had the second-highest level of condo inventory — at 346 units — in the borough, after Bedford-Stuyvesant. According to StreetEasy, it also had 3,244 rentals. And in the next three years, Williamsburg is slated to see the biggest influx of rental units in the borough, according to the Marketing Directors’ data.

The Rabsky Group, for example, has its 1,146-unit 200 Harrison Avenue in the works. And Eliot Spitzer launched leasing about six months ago on his massive 857-unit rental complex at 420 Kent. In addition, Two Trees is developing more than 2,800 units at its Domino site.

But the company said its 522-unit rental project at 325 Kent Avenue, the first building at the Domino site, leased ahead of expectations. It’s fully occupied less than a year after opening.

Brian Upbin, head of asset management for Two Trees, dismissed concerns about the L train shutdown, noting that tenants were aware of it “but still flocked to the building, given its premier amenities.”

However, in Bushwick, interest from developers has already started to drop off, according to Marcus & Millichap’s Shaun Riney, who works on the firm’s New York multifamily team.

“It has suffered with the L train, and there’s a big worry, if the train is not back on in 18 months, that neighborhood could really slide,” he said. “Those tenants were never really rooted to that neighborhood to begin with.”

Extell Development’s 458-unit Brooklyn Point in Downtown Brooklyn

Greenpoint — which, according to StreetEasy, had 736 rentals as of October and 127 condos, including Stellar Management’s 197-unit OTTO Greenpoint — may be in better shape, though. That’s because it could benefit from its proximity to Long Island City, where Amazon is now gearing up to build a massive campus.

The Amazon news is “great for [the] landscape in that area,” said Erik Serras, president of Ideal Properties Group, which is working on several residential projects in the borough, including the six-unit boutique condo at 491 Monroe Street in Stuyvesant Heights. “It just sort of cements the stability of the neighborhood.”

But sources say the benefits won’t happen overnight — and, of course, are not guaranteed. And Long Island City itself now poses another level of competition.

Though the rental market in Greenpoint is performing well, Citi Habitats’ David Maundrell, executive vice president of new developments for Brooklyn and Queens, said that crossover of renters and buyers between Brooklyn and Long Island City has been minimal to date.

While the pipeline may be daunting for developers, product — particularly well-priced product — is still moving. It’s just not moving as fast as it once was.

New development units in the borough were sitting on the market for 210 days in the third quarter, according to the latest Elliman report. While that was down about 5 percent year over year, it was up about 23 percent on the quarter. And new development did not see the same kind of improvement on that metric as the overall Brooklyn market did.

Buyers Carmen Zee and her husband offer a case in point.

The couple own a one-bedroom in the Financial District and also rent a two-bedroom there. They’re considering relocating to Downtown Brooklyn and looking for a two-bedroom priced around $1.6 million. “We’re mainly looking in Brooklyn because we’re being priced out of new development in Manhattan,” Zee told TRD. But they’ve been shopping around on and off for about a year and half and don’t seem to be in any hurry.

As developers lower prices to unload units, penciling out projects has become increasingly harder. That’s especially true for rentals, as land prices and construction costs have remained stubbornly high.

In 2017, the average price per buildable square foot in Downtown Brooklyn was $390 for residential projects. The surrounding area — which includes Park Slope and Clinton Hill — averaged $387, according to TerraCRG. According to Marcus & Millichap’s Riney, any rental project being developed at $350 per buildable square foot would need a strong retail component to pencil out.

Developers can sometimes make it work if they find more creative ways to structure deals, said Dennis Sughrue, a partner at Pryor Cashman.

Developers can sometimes make it work if they find more creative ways to structure deals, said Dennis Sughrue, a partner at Pryor Cashman.

They can, for example, find ways to let the original landowner partake in the upside of the project or include a retail or residential unit in the transaction. The approach, in essence, is: “How do you bring an original owner in as more of a sort of partner?”

Still, it’s not always doable. And the market softening has proven painful for some firms that shelled out for pricey sites, said Sughrue, who has worked with developers in Brooklyn.

“You do have developers who bought land at high costs and are now looking at maybe adjusting projections,” he said. “It’s an unpleasant exercise.”

Dual markets

In some cases, the Brooklyn market is smashing records.

The penthouse at the Quay Tower — which is being developed in the footprint of Brooklyn Bridge Park by RAL Development and David Wine’s Oliver’s Realty Group — reportedly went into contract for around $20 million.

And actor Matt Damon seems to have closed last month on a penthouse at the Standish, also in Brooklyn Heights, for nearly $16.7 million.

While those projects clearly speak to the pricing potential that Brooklyn can now achieve on the high end, they don’t have much bearing on the broader inventory issues for the borough’s new development market.

According to Elliman, median new development sales prices were about $905,000 in the third quarter.

But some developers are still aiming high. Asking prices in select neighborhoods were still up — at least for the month of October.

The median listing price in Downtown Brooklyn for the month was $1.1 million, up 15 percent from a year earlier, according to data compiled by StreetEasy. In Greenpoint, the median ask increased 19 percent to $1.7 million, and in Williamsburg it rose 6 percent to $1.4 million.

Still, developers are thinking twice about starting projects.

In 2015, there was about $2.1 billion in development site deals in the borough, said Dan Marks, a partner at TerraCRG. That dipped to about $1 billion in 2017. While the 2018 numbers were still being tallied at press time, Marks said the firm expected the year to end lower than that.

“A lot of developers are either in a lot of these projects and don’t have appetite for more — or are nervous to see how this round of inventory will be absorbed,” he said.

David Ennis, founder of the Daten Group — whose Brooklyn portfolio includes 575 Fourth Avenue, a condo project in Park Slope and 840 Fulton Street, a rental in Clinton Hill — said the firm is more interested in rentals but is not looking to rush into any new projects.

“We look at markets that have emerged or are maturing,” Ennis said. “We’re not pioneers.”

At one of Bold’s Greenpoint developments, the marketing team is trying to think outside of the box. It recently advertised the project on coffee cup sleeves at neighborhood cafes. That may sound basic, but it’s a departure from the traditional approach, Bold’s Sachs said.

The efforts, he said, also include changing up the model units being used in the building and tailoring them more to target specific demographics. Generally, developers are also offering more referral perks to brokers who bring in buyers, Sachs said.

Nonetheless, real estate consultant Nancy Packes said there’s little motivation for developers to further slash prices and miss out on profits — nor is there clear motivation for buyers to close deals.

“We are in a holding pattern,” Packes said. “We’re not seeing the shifts that would give them the confidence to make more aggressive bets.”