After a flurry of deals in 2015 for some of the rare remaining vacant parcels in the Hamptons, experts say that land prices are still going up, especially for oceanfront building lots south of the highway. “We’re at a point where there are very few vacant buildable lots,” said James Keogh, a realtor at Douglas Elliman.

Real estate players also say the buyer profile has changed. In 2015, developers rushed to snap up parcels to build elaborate vacation homes on speculation. But realtors say that many of these developers have acquired sufficient inventory for the time being, so buyers who are planning to build their own homes are playing an ever-greater role.

Against this backdrop, the average sales price per acre of land in the Hamptons was $1.05 million in the first quarter of 2016, up 3.3 percent from a year earlier. Yet the number of sales declined somewhat — from 31 to 27 — during the same time period, according to the Manhattan real estate appraisal firm Miller Samuel.

Despite the slight year-over-year decline in the number of deals, some very large sums are being paid.

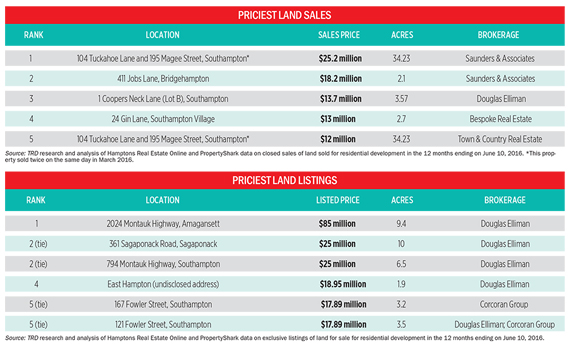

The highest-priced deal on The Real Deal‘s list of land sold for residential development was at 104 Tuckahoe Lane and 195 Magee Street in Southampton. In a twist, this nearly 35-acre parcel was sold twice on a single day in March 2016 to undisclosed buyers, making this piece of land both the largest and fifth-largest deal on our list. Initially, it sold in a deal brokered by Town & Country Real Estate for $12 million. Then, after permits that had been applied for previously came through to develop a 28-home subdivision on the parcel, the property was flipped for more than $25 million in a transaction handled by Saunders & Associates. The brokers were mum on the details of how the two transactions unfolded.

Diane Saatchi

In many cases, the best bet for buyers in search of buildable land is often a tear-down. The second-most expensive deal on our list was the $18.2 million purchase of 2.1 acres at 411 Jobs Lane in Bridgehampton, in another deal brokered by Saunders & Associates. After the original home on the property was torn down prior to the closing, another house later went up on the parcel.

Coming in at third place was 1 Coopers Neck Lane in Southampton. Michaela Keszler, a licensed broker with Douglas Elliman in Southampton, was the listing agent. An 8-acre parcel was subdivided, and the vacant 3.57-acre lot sold for $13.7 million. The new owner plans to build a personal residence. The larger lot, which has a swimming pool, tennis court and cottage, is still on the market.

The fourth deal on TRD’s list was 24 Gin Lane in Southampton, a 2.7-acre parcel, formerly part of the Wooldon Manor Estate, which sold for $13 million in December 2015. Bespoke Real Estate handled the deal.

Meanwhile, among active land listings, many are at sky-high asking prices. The costliest listing, 2024 Montauk Highway in Amagansett — a 9.4-acre oceanfront parcel consisting of four lots — is listed at $85 million. Peggy Stankevich, an agent with Douglas Elliman in Bridgehampton, has the exclusive on the property, which is owned by her father, George Stankevich, a real estate and investment banking attorney who lives in East Hampton. Stankevich says her father bought the property as an investment decades ago. “He was originally planning to build on it,” she says. “Now it’s past that point.”

Nothing has ever been built on the property, though it has permits that would allow either residential or commercial development, she said. “I’ve gotten quite a few calls on it recently,” said Stankevich, who said she has heard from both developers and individuals.

Teardowns

Experts say that many of the best building lots are gone. “There’s very little vacant land, and a lot of it is in not-great locations,” said Diane Saatchi, a licensed real estate broker with Saunders & Associates who has worked in the Hamptons for 29 years.

In some cases, as was the case with 411 Jobs Lane, sellers will tear down the home before the deal closes so that it trades as raw land. “Folks do that to sidestep the 1-percent mansion tax,” Saatchi said, explaining that buyers who take down structures valued at more than $1 million after the sales are closed are liable for the tax. But if the buyer or seller assumes the cost and bother of tearing down the house before the deal closes, the property trades hands as vacant land.

The average acreage of Hamptons parcels that sold hit 2.95 in the first quarter of 2016, up from 2.06 in the same quarter of 2015, according to Miller Samuel. Christopher Burnside, a broker in the Bridgehampton office of Brown Harris Stevens, said many of his buyers are gravitating toward larger lots so they can build big houses without using up all of the land. “They’re not spec builders,” Burnside said. “They’re families with kids that are building custom homes for themselves.”

Buyers are also going farther afield. Ray Lord, a licensed real estate salesperson for Douglas Elliman, said that some of his clients have been exploring land opportunities in Azurest, Ninevah Beach and Sag Harbor Hills, historically black communities in Sag Harbor. Home prices in these communities have risen sharply in recent years. Lord estimates there were at least 30 such sales in the first half of 2016. One of his clients has picked up a dozen or so parcels and plans to redevelop all of them, he said.

Lord pointed out another distinction in the Hamptons residential marketplace. Unlike in Manhattan, where many luxury residential properties are purchased by foreign buyers, he said the Hamptons tend to be a local affair — with many of the buyers coming from New York City. “We’re in the second-home market,” Lord said. “We don’t find many foreign buyers at all.”