Surging construction costs compounded by new tariffs and high land prices are the talk of the town among developers these days, but a huge spike in the number of multifamily units permitted shows that builders are still very bullish on Northern Jersey.

A total of 9,372 new rental and condo units were permitted in buildings of 50 units or more between April 2017 and March 2018 in Bergen, Hudson, Essex, Morris and Passaic counties, according to an analysis by The Real Deal. That’s more than a 79 percent increase over the prior 12-month period, when only 5,229 units were permitted in projects of that size.

“It’s been a productive year for development, and I think that the supply and demand factors have matched up well,” said Michael Barry, co-owner and principal of Ironstate Development, which had the highest number of approved units on TRD’s ranking with 1,128.

But several hurdles still exist on the road to getting those permits, not to mention actually moving forward with construction, which remains a question on some projects.

“Developers today face challenges including significantly increased construction costs, which are beginning to be impacted by tariffs, along with an increase in supply due to various affordable housing settlements throughout the state,” said Ron Ladell, senior vice president at AvalonBay Communities.

AvalonBay took the second slot on the ranking of top developers, with 838 units. Ladell said the key to the company’s success is knowing where to put down roots. “We’ve been able to successfully identify ideal areas in which to develop, construct, own and manage multifamily communities,” he said.

Hot pockets

The brisk pace of development can clearly be seen in Jersey City, where 3,022 units in high-rises of 50 or more units were permitted. Harrison, to its west, was a distant — but not insignificant — second, with 735 units. In fact, the entire corridor serviced by the PATH train (Hoboken, Jersey City, Harrison and Newark) along with nearby Bayonne, Weehawken and West New York all emerged as top hubs for new residential construction.

“Transit-oriented developments have been a hot topic for some time, but they had not been especially quick in coming,” said Phillip Gesue, chief development officer at Strategic Capital, the investment and development arm of China Construction America. The firm took the 12th slot on TRD’s ranking, with 359 permitted units.

While momentum was slow to build in places like Harrison and Jersey City, that is clearly changing, Gesue said. “In just a few years, Harrison has gone from brownfield to a small city with a ton of new development just off the PATH,” Gesue said. “The same is true for Journal Square in Jersey City.”

The recent activity in multifamily has not been entirely relegated to Hudson County. Bergen County is relatively bustling as well, with developers in Hackensack and Edgewater getting permits for 442 and 252 units, respectively, in buildings of 50 or more units. And, moving further into suburban territory, Morris County also has some heat, with permits issued for 350 new units in Boonton, and Madison showing some signs of a spark, too.

Growing pains

Proximity to mass transportation is but one major factor influencing residential development these days; financing, governance and renter/buyer demographics all play significant parts as well. And then there are the approvals.

“It’s tough to get approvals, because each of the state’s 565 municipalities has its own unique guidelines for new construction,” said Jonathan C. Kushner, president of Kushner Real Estate Group (KRE). With 549 units permitted in the period measured, the firm ranked third. KRE was founded by Eugene Schenkman and Murray Kushner, the brother of Charles Kushner of Kushner Companies. The companies are not related.

While there was action on the condo side — two of the top projects were condos — it’s the rental market that’s shining. “Millennials are renting longer and are more price-conscious than other generations were at their age, so you don’t see a lot of people looking to buy,” said Mike DeMarco, CEO of Mack-Cali, which had 360 permitted units to tie for 10th place on the list.

While there was action on the condo side — two of the top projects were condos — it’s the rental market that’s shining. “Millennials are renting longer and are more price-conscious than other generations were at their age, so you don’t see a lot of people looking to buy,” said Mike DeMarco, CEO of Mack-Cali, which had 360 permitted units to tie for 10th place on the list.

And it’s not simply that millennials aren’t looking to purchase a home in the short term; some may not aspire to homeownership at all. “There’s a changing attitude about renting, wherein people are increasingly seeing it as their primary source of housing,” added Gesue. “It’s not somewhere they’re going to park themselves until they save enough to buy; it actually is their life.”

That has led to a trend toward higher-end amenities. Gesue compared the change to going from “the Volkswagen level to today’s BMW.”

Big league builds

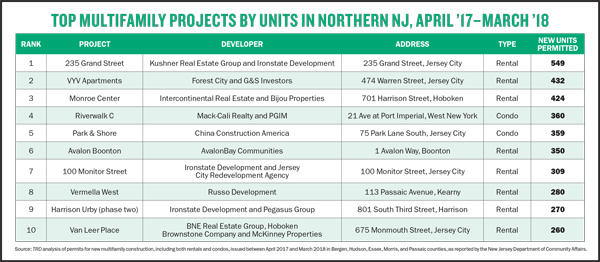

The biggest individual permitted project of the last year is located, unsurprisingly, in Jersey City, at 235 Grand Street, according to TRD’s analysis.

A joint venture between KRE and Ironstate, the 45-story tower, which aims to be completed by late 2019, will consist of 549 rental units and 6,380 square feet of ground-floor retail along with a revitalized neighborhood park. KRE also recently launched 485 Marin, an 18-story, 397-unit rental in the Hamilton Park area, with studios starting around $2,300 and three-bedrooms running into the $5,000 range.

Jersey City is also home to the runner-up for largest project of the top 10: VYV Apartments, a 432-unit collaboration between Forest City Realty Trust and G&S Investors at 474 Warren Street. Those units put both companies at the No. 5 spot on the ranking. Phase one — which received a $40 million Economic Redevelopment and Growth subsidy and is an 80/20 split between market-rate apartments and affordable units — opened last year, with a second building scheduled for 2020.

Hudson Exchange, the larger residential development encompassing the VYV projects, is one of the partnership’s biggest projects, said Abe Naparstek, senior vice president of residential development for Forest City. “The site overall has entitlements for up to 12 buildings — potentially close to 6,000 apartments and ample ground-floor retail,” he said. “And we’re also going to build a 1-acre park in the center of the project, so it’s a pretty large-scale opportunity.”

Hopping the PATH to Harrison, the biggest project to emerge in the last year was the 270-unit second phase of the Urby, a joint venture of Ironstate and Pegasus Group. Phase one of the project has fully leased its 409 units, and phase two is set to open by the end of the year, with studios starting at $1,800 and three-bedrooms topping out at $3,300.

And while Newark didn’t have one specific project that made the ranking, there were 697 units permitted for construction across various developments. Its future looks bright, with the 12-acre Riverfront Square potentially breaking ground next year, which will add up to 2,000 rentals totaling about 1.4 million square feet to the market.

“We wanted to … activate the streets of Newark and produce a live/work/play environment, similar to what we see in Brooklyn, Hoboken and Jersey City,” said Ben Korman, chief executive officer and founder of Lotus Equity Group, the developer behind Riverfront Square.

Bijou Properties and Intercontinental Real Estate tied for the 7th spot on TRD’s top developers list, each with 424 units. Those are part of a joint mixed-use project under construction at 700 Jackson Street in Hoboken. In addition to the residential units, there’s a 6,835-square-foot gym, a 2-acre park and 25,000 square feet of ground-floor retail, all set to open in mid-2019.

That notwithstanding, Hoboken hasn’t seen the velocity of development other areas have. “There’s not much new product coming to Hoboken; development is quite limited,” said James Caulfield, a partner with Fields Development. “There are a few larger three- and four-bedrooms” in smaller developments, he said. “But there aren’t really any new apartment buildings coming in.”

Veering from the PATH

A brief jaunt up the Hudson is Port Imperial, a $2 billion riverfront development area that encompasses parts of three towns in Hudson County: Weehawken, West New York and Guttenberg. Port Imperial will include 20 upscale residential, retail and hotel properties upon completion. One of those projects is RiverHouse 11, a 10-story, 295-unit luxury rental development by Roseland Residential Trust, a division of Mack-Cali.

The area is often a last stop before going the full suburban route, said Gabe Pasquale, senior vice president of marketing and sales with Landsea Homes, the developer of the Avora at Port Imperial, which opened to residents in early June with 183 condominiums.

“I think that buyers see Weehawken as more of a peaceful, quiet, tranquil and sophisticated market,” Pasquale said.

Rounding out the top developments in Hudson County is Vermella West, a 280-unit project in Kearny by Russo Development (No. 9 on TRD’s list, with 392 units). The four-building project broke ground last September on Passaic Avenue, where it will occupy 7 acres and feature a 9,000-square-foot clubhouse, a gym and a walkway along the Passaic River.

Making a quick transfer from the PATH onto NJ Transit to Morris County, one finds Avalon Boonton from developer AvalonBay. The 350-unit property will occupy a 14-acre site atop a hill from which, “on a clear day, you could probably see 30-40 miles east from the top two floors,” according to Ladell of AvalonBay.

And a short drive away in Madison is a 135-unit mixed condo and rental project with new retail and a streetscape developed by KRE with Mark Built Homes, further illustrating that new multifamily is not just for city folk.

“It’s a beautiful downtown location next to the train station, with a Midtown Direct train,” said Kushner. “Madison is probably one of the most desirable towns in the tri-state, with incredible school systems, but it hadn’t seen many new projects built since the 1950s.”

Looking to the immediate future, developers were tempered in their prognostications. “I’m concerned about increased construction costs combined with tempered rent growth,” said Ladell. “There’s that increased supply in both urban and suburban locations. The demand still exists, but it will require developers to be very smart and judicious in identifying development opportunities and managing their costs appropriately.”

Financing is another concern, he said: “Liquidity continues to be there, but it’s beginning to be constrained in a rising interest rate environment.”

On a broader scale — and despite daily drama coming out of Washington, D.C. — federal intervention has been mostly good for developers. Big business is doing very well in this economy, according to Mack-Cali’s DeMarco. Trump’s “economic priming of the pump has actually worked,” he said.

“This corporate tax cut is increasing employment, wages are going up a bit, the stock market remains firm … If he could stop talking about trade and tariffs, that would calm things down tremendously,” DeMarco said. “But banking, pharma, food and retail — all big businesses in N.J. and the metro area — are doing very well.”