The Apex condoRobb Pair, president of the brokerage and development firm Harlem Lofts, had an uncomfortably close-up view of that neighborhood’s tumbling sales market in recent years. He estimates that the three-family townhouse that he owns at 119th Street and Lenox Avenue, where he lives with his family, has lost about a million dollars in value since its peak in last decade’s boom.

Among Harlem’s woes has been a glut of new condominium units, many of which were located in troubled buildings that just missed the boom years or suffered during the downturn. The number of new condo and co-op units in Upper Manhattan — Harlem and neighborhoods to the north — has risen steadily since 2008, with an accompanying slide in average sale prices.

Buildings marketed by Pair’s company are no exception. Still, he maintained in a recent interview that he is optimistic, and that he is not alone among people who deal in new construction and conversions uptown.

“It sounds like broker talk, but if you compare it to two years ago, we’re jumping-up-and-down happy,” Pair said.

That excitement, brokers said, stems from an uptick in sales that followed sharp reductions in prices citywide. There are plenty of units still available, they say, but sales are being made — albeit at lower prices than three years ago.

Ariel Property Advisors, an investment sales firm, found in its 2010 year-end condominium report that prices of units in Upper Manhattan (which it defines as Harlem through Inwood) dropped an average of 6.6 percent from 2009, after an 8.8 percent decline that year. Shimon Shkury, the company’s president, said it’s a positive sign for Harlem that prices fell at similar rates to those elsewhere in Manhattan, indicating that the neighborhood is no longer viewed by consumers as marginal.

“I think that’s a healthy decline, it’s a reasonable decline,” Shkury said. “It means that the area, in my opinion, is relatively established and in good shape.”

Shkury also said he was encouraged by brisk sales in buildings along Frederick Douglass Boulevard and, to a lesser extent, in East Harlem. He noted that development sites are still changing hands, though buyers tend to be those with longer-term plans: people looking to build in 18 months, international investors, or institutions like schools and nonprofit organizations that are planning to build for their own use.

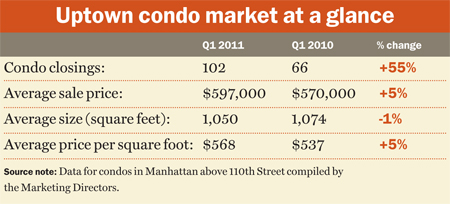

Adrienne Albert, chief executive officer of the Marketing Directors, said that in any downturn, emerging neighborhoods like Harlem should be expected to face more problems than prime neighborhoods. Still, she added, “Harlem is seeing that supply being absorbed rather quickly in the last four months, maybe five months.” According to the firm’s data, closings above 110th Street were up 55 percent over the first quarter of 2010, while the average price per square foot rose 5 percent.

Data from real estate website StreetEasy, focusing on condo and co-op sales in new and newly converted buildings, seems to bolster that point. In Manhattan as a whole, the site counted 406 closings in the first quarter of 2011 — the fewest in a first quarter in years. But in Upper Manhattan as a whole — which StreetEasy defines as Central Harlem through Washington Heights — closings were up by 46 percent over 2009.

What’s more, this year’s closings in Central Harlem were pricier than last year: The average sale price rose 33 percent from the first quarter of 2010.

The neighborhood has been able to respond to the improved sales market in the city precisely because there is so much available inventory, Albert said.

Drawing buyers, though, has required adjustments. At the Apex, a 44-unit condo project represented by the Marketing Directors at 124th Street and Frederick Douglass Boulevard, building sponsor RCG Longview announced last month that it had trimmed its budget in order to offer reduced common charges. The building, which came on the market in September, is now 30 percent sold.

Drawing buyers, though, has required adjustments. At the Apex, a 44-unit condo project represented by the Marketing Directors at 124th Street and Frederick Douglass Boulevard, building sponsor RCG Longview announced last month that it had trimmed its budget in order to offer reduced common charges. The building, which came on the market in September, is now 30 percent sold.

Some price corrections have been more dramatic. Pair, at Harlem Lofts, pointed to two buildings his firm is marketing: 764 Saint Nicholas Avenue in Hamilton Heights and 108 West 131st Street in Central Harlem. Both originally entered the market at $775 per square foot, he said.

Now the asking prices for their units are around $480 and $450 per square foot, respectively.

“They’ll never fetch the original prices,” Pair said. “We’re just going to take the losses and move on.”

The lower prices, he said, are partly a result of the area’s ample supply of new units. He added, though, that there is a bright side, once prices have found the right level.

“Frederick Douglass had an oversupply, but as a result of this, now it’s got a boom happening,” Pair said. “Obviously something happened, where they’re selling at better rates and people are moving in there.”

One factor is gentrification: The area has gained higher-end amenities in the last year, including a branch of Levain Bakery, the beer garden Bier International, and the boutique hotel Aloft Harlem, located in the same building as the Apex condos.

Harlem’s apparent turnaround came too late for some buildings and developers. Units in the WA Condominiums, a six-story building at 131st Street and Adam Clayton Powell Boulevard, were listed at $1,200 per square foot when they came on the market in 2008. The lender foreclosed in November 2009 after the owners did not get a temporary certificate of occupancy, and no units are currently listed for sale.

In many buildings where prices have been lowered, Pair said, someone is making money — if not the original developers and lenders.

“What happened is behind-the-scenes, the paper was sold, and the new owners were able to buy the paper at whatever, 50 cents on the dollar, and put them back on the market,” he said. “Someone took the hit, and now the guys that bought the paper are making out like bandits.”

As a resident, Pair said, he believes that the downturn has been good for Harlem, scaring off some investment buyers and making units available for people who want to live in them.

“I live in the neighborhood and I’m raising my family here, so I care about the neighborhood,” he said. “If I just cared about the money, I might not be so happy.”