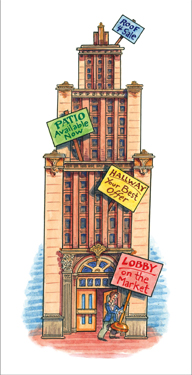

Here is a quick test for the entrepreneurially inclined: Open the front door of your apartment, peer down the hallway, and then take a slow, observant walk up to the roof. What exactly do you see? For most, the answer will be dusty linoleum, mass-produced Swedish light fixtures or, for the unfortunate few, a rickety staircase. A select few, however, will see revenue — possibly tens of thousands of dollars — that could help fill the coffers of their co-ops or condominiums.

When a building on Spring Street and Sixth Avenue was torn down a few years ago and turned into a parking lot, a neighboring co-op with its exterior wall newly exposed to the street saw an opportunity. The shareholders of the co-op got together and decided to sell their newfound space to advertisers. The result: $40,000 a year in additional revenue.

Typically, a building gets incremental revenue from an owner combining two adjacent apartments who needs to incorporate the common hallway space for a single entryway. In those situations, the board will appraise the space and sell it to the renovating shareholder (along with additional shares in the building, if it’s a co-op). Nowadays, however, New York residents are coming up with even more inventive ways to squeeze some coin out of any dead space — a cellar, an unused utility closet, a staircase or even a rooftop antenna.

“We call it ‘searching for hidden assets,'” said James Samson, a partner at the real estate firm Samson, Fink & Dubow, and an expert on tapping the value of condo and co-op dead space.

For the boards of New York City buildings, finding unexploited value can be as simple as taking a look around. And while it may not be an entirely new trend, squeezing money out of stones appears to be gaining popularity, due in large part to a more unpredictable real estate market, according to a number of experts in the field.

“I think the boards are looking into it more,” said Alvin Schein, a partner at Seiden & Schein. “Most boards are under financial stress; taxes and expenses are going up. What can they do to bring in income? One of the things that boards do look at is: ‘Do we have any dead space to sell?'”

For the board members of a building at the corner of Mercer and Waverly streets in the Village, the answer was ‘yes.’ As capital improvement costs mounted at the 62-unit co-op last year, the board began looking around for a way to buffer those costs.

“We analyzed it, and we hired a good architect, and we went through the process and said, ‘What if we put [in] roof decks that we can then sell?'” said Dennis Greenstein, a tenant in the building as well as a real estate partner at Seyfarth Shaw. The result was the creation of 13 private roof decks of varying sizes, priced at approximately $300 per square foot, six of which have sold already.

The sale of those six has already offset the design and construction costs, Greenstein said. The sale of the remaining seven, meanwhile, is expected to be pure profit, netting the co-op tens of thousands of dollars, if not more.

According to Mary Ann Rothman, the executive director of the Council of New York Cooperatives & Condominiums, there is no official registrar of how many co-ops and condominiums are in the process of monetizing their dead space or how much additional revenue the process brings in. However, some legal consultants have experienced an uptick in the demand for their services.

“More and more of it is going on now,” said Aaron Shmulewitz of Belkin Burden Wenig & Goldman. According to Shmulewitz, rather than taking a risk on selling their current apartment and seeking to upgrade, more and more owners are opting to stay put and add value. “So if they can acquire an adjacent hallway area or patio space, it has a synergistic effect on the value of their apartment,” he said.

Michael Berenson, president of Akam Living Services, said that properties that he manages on the Upper West Side have sold maids’ quarters to shareholders who then convert them into storage spaces, offices or even once a personal gym. While Berenson declined to disclose the building addresses, he noted that he could think of three different buildings that had converted these spaces in the past two years. “There have been a lot of apartments on the market — much more inventory than in many years past — so shareholders are looking for ways to make their apartment stand out.”

The process of converting common space into revenue differs for co-ops and condos. Co-op boards have exponentially more power, and can allocate shares when converting a onetime common space to private space, whereas the process for condominiums is slightly more complicated.

Even so, condos and co-ops are borrowing ideas from each other. Co-ops, which can vote on any given transaction, are starting to employ a condo-like “right of first refusal,” according to James Goldstick, vice president and director of sales for Mark Greenberg Real Estate. Goldstick noted that two co-ops his firm manages — one in Kew Gardens Hills and one on the Upper West Side — have the right of first refusal in their corporate documents, and have used the power to buy units in their buildings. The hope is to wait out the market trough and then resell the building-owned units when the market rebounds, thus making a profit for the co-ops.

With buildings hemmed in by fixed space and limited square footage, the question remains: Where will this hunt for additional capital lead the building community? According to Samson, the likely next frontier is the sale of naming rights to corporations.

Somewhere in the world, Donald Trump is laughing.