INVESTMENT SALES IN MANHATTAN AND BROOKLYN

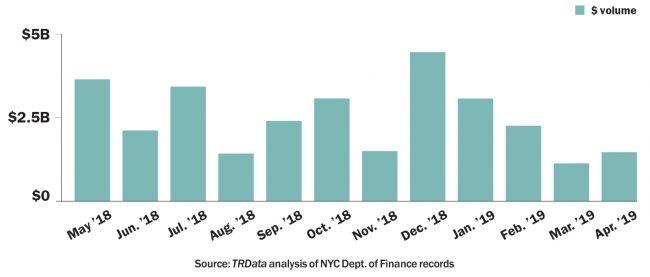

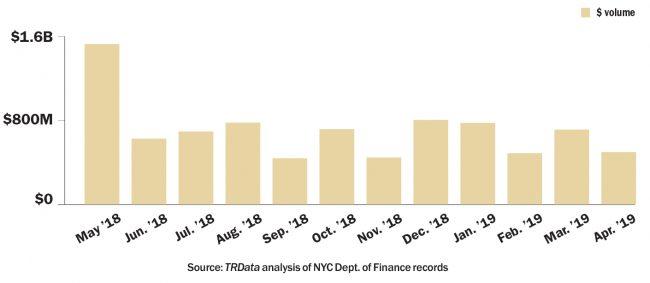

Manhattan investment sales ended a three-month slide in April with $1.42 billion in deals recorded, a 30 percent increase from March but still 41 percent below the 12-month average. The month’s top sale went to Greystar, the country’s largest apartment manager, which picked up Equity Residential’s 800 Sixth Avenue rental tower for $240 million. Brooklyn’s investment sales market slowed down in April, with recorded deals totaling $496 million — 30 percent below both March’s dollar volume and the 12-month average. The borough’s top deal was the acquisition by Alloy Development and Davis Companies of a former addiction treatment clinic from nonprofit Phoenix House for $52 million. The buyers plan to convert the property into condos.

MANHATTAN INVESTMENT SALES

TOP MANHATTAN INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 800 Sixth Avenuen(rental building) | $240 million | Greystar /nEquity Residential | Cushmann& Wakefield |

| 165 East 66th Streetn(rental resi portion) | $200 million | CIM Group /nCrescent Heights | KassinnSabbagh Realty |

| 395 Lexington Avenuen& two other lotsn(Chrysler Building) | $151 million | RFR Holding & Signa Holding /nMubadala & Tishman Speyer | CBRE |

| 106 Spring Streetn(retail condo) | $79 million | SL Green Realty /n60 Guilders & Carlyle Group | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in April

BROOKLYN INVESTMENT SALES

TOP BROOKLYN INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 42 & 50 Jay Streetn(clinic, for condonconversion) | $52 million | Alloy Development & DavisnCompanies / Phoenix House | N/A |

| 151 Kent Avenuen(loft building) | $41 million | DLJ Real Estate /nN. Seidenfeld and Z. Mehl family | JLL |

| 554 4th Avenuen(condo building) | $30 million | Spruce Capital /nBrookland Capital | N/A |

| 1702 East 9th Streetn(retail) & 1717 Eastn8th Street (rental) | $20 million | Concord Capital New York LLC /nZ&K Realty Developers | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in April

INVESTMENT SALES IN QUEENS AND THE BRONX

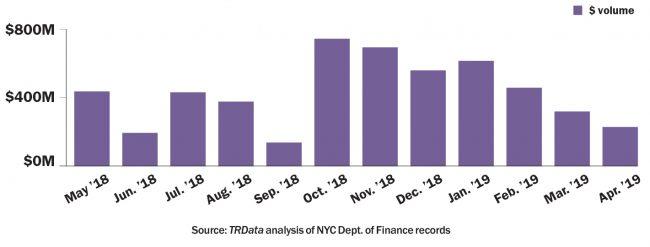

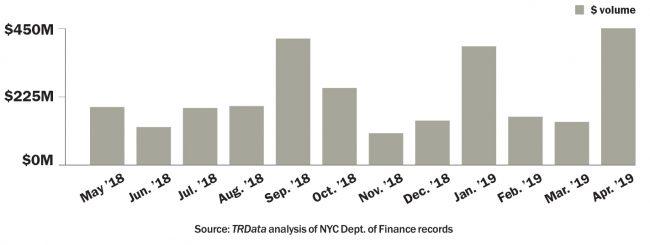

Queens’ investment sales market was relatively flat in April with $301 million in deals recorded, 4 percent lower than March’s tally and 30 percent below the 12-month average. The borough’s top deal was inked by the Collective, the British co-living firm that bought the Paper Factory Hotel at 37-06 36th Street for $58 million. The Bronx investment sales market, meanwhile, saw its most active month in years with $423 million in deals recorded, almost double the 12-month average and more than triple March’s total. The borough’s largest deal was also its largest singleasset multifamily transaction since 2012: Abraham Fruchthandler’s FBE Limited bought a pair of buildings on Story Avenue from Related Companies’ asset-management arm for $88 million.

QUEENS INVESTMENT SALES

TOP QUEENS INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 37-06 36th Street (hotel,nfor co-living conversion) | $58 million | The Collective /nGal Sela | N/A |

| 30 properties alongnBeach 5th and 6thnStreets (townhomes) | $33 million | Treetop Development /nJDS Development Group | WestwoodnRealtynAssociates |

| 17-20 WhitestonenExpressway (office) | $24 million | Pavers Pension Fund Holding Corp. /nOctagon Realty LLC | N/A |

| 71-15, 71-21 & 71-27n65th Streetn(rent-stabilized) | $16 million | Rockabill Development & SelfhelpnCommunity Services /nUrban American Management | Ariel PropertynAdvisors |

Source: TRData analysis of news reports and NYC Dept. of Finance records in April

BRONX INVESTMENT SALES

TOP BRONX INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 2001 & 2045 Story Avenuen(100% market-ratenrental) | $88 million | FBE Limited /nRelated Fund Management | HodgesnWard Elliott |

| 414 Gerard Avenue & 3nother lots (developmentnsite, mixed-use) | $39 million | Domain Companies /nTreetop Development | NewmarknKnight Frank |

| 3240 Henry HudsonnParkway (rent-stabilized) | $36 million | Nelson Management /nMorris Weintraub Associates | Marcusn& Millichap |

| 708-710 & 740 Eastn243rd Street | $29 million | Neighborhood RestorenHousing Development Fund Corp. /nPrime Realty Services LLC | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in April