If the Flatiron District’s One Madison condo tower typifies the nadir and the zenith of real estate’s recent history, then Ian Bruce Eichner is perhaps the most fitting developer to eclipse the storied building’s successes — or to get swallowed up in its shadow trying.

With a property grab one broker described bluntly as “ballsy,” Eichner is back building in Manhattan after spending much of the early aughts in Las Vegas developing and, reminiscent of his high-profile rise and crash 25 years ago, surrendering the city’s most expensive casino ever, the Cosmopolitan.

“I was exiled to the desert,” he said.

Now, more than 15 years after last turning over a shovel of dirt in New York, Eichner is back at work, with a pair of ambitious buildings, at a time when experts wonder aloud how much longer the market can climb before a correction.

At 45 East 22nd Street he is planning a 65-story, 777-foot-tall condo tower a stone’s throw from One Madison, the chic spire overlooking Madison Square Park that stood empty as a symbol of excess during the downturn, before breaking a Downtown sales record as the market recovered.

The second project is a massive rental that will eventually include 670 units in Harlem. When the tower tops out at 32 stories, it will be the tallest building in the neighborhood.

A rendering of 45 East 22nd Street

Neither project is without controversy, much like the CEO of the Continuum Company himself.

In fact, his very name is one mentioned in real estate circles as a portentous omen: Some say an Eichner building rising out of the ground is a harbinger of a market about to turn south.

Yet despite his high-profile losses, the developer continues to secure financing. And while he acknowledged there’s no lack of competition for buyers among Manhattan’s pricey new glass towers, he’s confident his Flatiron project will set itself apart.

“I’ve got a tall building. I’ve got views. I’ve got five floors of amenities. I’ve got parking,” he told The Real Deal during a visit to the sales center for 45 East 22nd Street, adding that the project is in one of the city’s hottest neighborhoods. “I’m feeling OK.”

Eichner, 69, is a charismatic and personable figure who, for all of his downfalls, said his decisions are based on cold, hard logic, grounded in the numbers underlying his projects. And those numbers, he maintains, pencil out.

Big wins and bad bets

About his name, Ian Bruce Eichner: It’s “actually pronounced ‘Eye-an,’” he explained, although by age 8, Eichner decided that using two names was too formal. He is known as “Bruce.” The young Eichner grew up in Sunnyside, Queens, and after graduating from Stuyvesant High School went on to law school.

His father was an academic, an associate dean at what was then called the New School for Social Research. Eichner said his father had him reading “The Canterbury Tales” in Middle English as a youngster, and would have probably preferred his eldest son chose a career path as a tweedy professor teaching English at a small college in New England.

But that was not the future for Eichner, who recalled his father lamenting to his mother, “I believe that our eldest child is entrepreneurial. Indeed, he may be a capitalist.”

After law school, Eichner worked as a prosecutor, but finding life in the public sector financially unrewarding, he got into real estate in the 1970s with the purchase of a rental property in Park Slope.

By the 1980s, he was developing in Manhattan, building a trio of condo towers on the Upper East Side before tackling the 72-story office/condo tower CitySpire near Carnegie Hall.

CitySpire splashed Eichner’s name across the tabloids as it notoriously topped out 11 feet taller than the zoning allowed. There was talk of Eichner actually dismantling part of the building, but in the end, he struck a deal that left the tower intact, in return for setting aside space for nonprofit performance groups.

As the 1980s came to a close, the developer embarked on yet another first for his career: an ambitious 44-story office tower at 1540 Broadway in Times Square, with a complex retail atrium at its base.

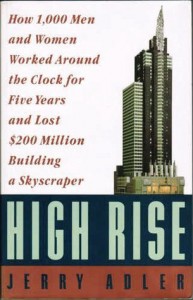

The development process was documented in the book, “High Rise: How 1,000 Men and Women Worked Around the Clock for Five Years and Lost $200 Million Building a Skyscraper.”

The development process was documented in the book, “High Rise: How 1,000 Men and Women Worked Around the Clock for Five Years and Lost $200 Million Building a Skyscraper.”

By 1993, Eichner would surrender CitySpire to his creditors and sell the empty 1540 Broadway to the Bertelsmann publishing company. The decision to have his excess catalogued in ink was his alone — he said his staff voted 40 to 1 against the book — but he says it was still one of the most interesting experiences of his life.

“Now, if I knew the damn thing was going to blow up and if you gave me a preview that the project was going to go belly up, would I have done that? Maybe not.”

Eichner continued to develop in the city, transforming a bankrupt hotel near Central Park into a timeshare hotel dubbed the Manhattan Club, and, in Brooklyn Heights, building the first new high-rise in decades. By the turn of the century, he was in Miami’s South Beach, at work on a pair of record-breaking condo towers, and from there it was on to the Las Vegas strip, where in 2008, as the economy went into free fall, lender Deutsche Bank foreclosed on the casino.

Risky strategy pays off

Eichner is, according to those who have watched him closely, a shrewd strategist with an eye for complex deals, and those qualities were on display when he made a complicated assemblage on the 22nd Street site.

Upon returning to New York around 2010, he made an unsuccessful bid to put up $40 million to take control of One Madison, which at that point had been taken over by creditors after the original developer, Ira Shapiro, defaulted on his loan.

While Eichner didn’t come away with the tower, he did glean the knowledge that there were still unused air rights on the block.

“I knew that there were some air rights that were available on 22nd and 23rd streets,” he said. “What I didn’t know was that there was a site that was potentially acquirable.”

According to sources with knowledge of the deal, The Related Companies, which along with Ziel Feldman’s HFZ Capital Group had taken over control of One Madison, inherited an air rights contract on the block that Shapiro initially intended to use to build another tower.

Related, however, was not interested in a second building, and terminated the contract.

With a potential location on 22nd Street opposite One Madison in mind, Eichner started putting together an assemblage in 2011. He didn’t, however, start by purchasing the site. Instead, his first move was to buy a block of some 65,000 square feet of air rights over a co-op building next door.

Around that time, sources said, Shapiro and Feldman were looking to acquire air rights to build their own tower, without Related.

Sensing other sharks in the water, Eichner said he made the move first to buy the co-op’s air rights, because it would plant his flag on that side of the block.

“I felt that the air rights were the key, also because once I had the air rights, I blocked anyone from doing anything,” he explained. “After that, who’s going there except me?”

The strategy did present a potential problem: “I bought their air rights with nowhere to go,” Eichner said.

“[It was] ballsy,” said Newmark Grubb Knight Frank’s Geoffrey Newman, who had been hired by the co-op board to sell the air rights. Feldman did not respond to a request for comment about the strategy.

All told, Eichner assembled eight different sets of air rights, including bonuses from an off-site inclusionary housing project, and dumped them on a shallow development site that fronts 100 feet and reaches just half way through the block. The total price tag was more than $100 million.

His equity partners, Dune Real Estate Partners and the Fortress Investment Group, have committed more than $80 million to the project, and Goldman Sachs is providing a $340 million construction loan.

“None of that is dumb money,” said Dolly Lenz, the broker who brought media mogul Rupert Murdoch to One Madison to buy his $57 million, four-floor penthouse. “In fact, I’d venture to say it’s some of the smartest money on the planet. That’s comforting to me and it’s comforting to buyers.”

Eichner’s Kohn Pedersen Fox-designed tower graduates wider as it grows taller, cantilevering over the co-op that sold the initial air rights, and stretching 777 feet in the air, more than 150 feet taller than One Madison.

“It’s very complicated, considering the size of site and the layout of building,” Newman added. “But it really works well, despite the limitations on the size of the site.”

One of the building’s amenities is a shared space for tenants on the 54th floor, dubbed the “Sky Club.”

The apartments on the market range from about $2.7 million for a one-bedroom to $19.9 million for a six-bedroom, four-bath unit. About 12 percent of the building’s 83 condos are in contract, according to StreetEasy. The penthouse, which is not yet on the market, will reportedly list at $42.5 million.

A rendering of 1800 Park Avenue

Aspirations and allegations

Eichner’s other current project, at 1800 Park Avenue in Harlem, is an 80/20 affordable housing tower that will be built in two phases. The developer bought the property from Vornado Realty Trust, which had long-stalled plans to build an office tower on the site, for $66 million in October 2013.

Eichner needs to pour the building’s foundation by June in order to ensure he receives a 421a tax abatement. He has a $200 million letter of credit from the Bank of China, which insures tax-exempt bond financing he’s receiving from the state in return for setting aside 20 percent of the units as affordable housing. Eichner said he is able to continue to secure financing despite his prior problems because banks expect him to complete his buildings, but don’t hold him at fault for troubles related to market turns.

The Harlem building will feature a long list of amenities, including a gym and spa, 24-hour doorman and indoor and outdoor communal spaces. Rents will range from $2,760 for an average one-bedroom to $4,315 for a two-bedroom.

“It’s pretty rare to have those kinds of amenities. They’re almost nonexistent in that rental market,” said broker Matthew Green of the Bohemia Realty Group, which specializes in upper Manhattan rentals.

Eichner is aiming high, though. Rents in the neighborhood’s mostly pre-war building stock, he said, typically top out around $2,000 for a one-bedroom and $3,000 for a two-bed unit.

The Park Avenue project came with some legal trouble, as well. The day after he closed on the property, the private-equity firm Cerberus Capital Management sued the developer, claiming he backed out of an agreement to accept a $65 million bridge loan for the property and was liable for a $1 million break-up fee.

After a year of motions, Cerberus, which declined to comment, discontinued the lawsuit.

The developer also faces legal problems at the Manhattan Club.

Last summer, the state attorney general accused Eichner of fraud at the time-share hotel at 200 West 56th Street.

The AG’s complaint stated that Continuum sells more shares than each room can accommodate on a yearly basis, making it “extremely difficult if not impossible” for owners to book rooms.

“The discrepancy between what Manhattan Club owners are getting, versus what they are paying for, is so extreme that a few owners have sold ownership interests back to the sponsor for only $1, just to escape the burden of paying the common charges,” the complaint read.

Eichner would not comment on the specifics of the charges, but said he expects to reach a settlement.

“We are cooperating fully with the attorney general’s office and we expect the matter is going to be resolved shortly,” he said.

As he sets off on this latest round of building in Manhattan, Eichner said he’s intimately involved with the day-to-day operations of his two developments.

“Chief cook and bottle washer,” he explained his roles.

The firm is staffed with some long-time stalwarts, including his wife of 30 years, Leslie Eichner, who is his chief marketing officer.

Another key player is Luk Sun Wong, the developer’s right-hand man as he built in the 1980s. When the market tanked, Eichner said, Luk Sun went off for about 20 years.

“When I saw that I was going to develop these projects,” Eichner said, “I called Luk Sun and I said, ‘So, are you ready for another run?’”

Correction: A previous version of this post incorrectly stated the figure media mogul Rupert Murdoch paid for his home at One Madison. The price was $57 million, not $47 million.