While The Real Deal’s annual ranking of top Long Island brokerages suggests little has changed over the past year in the race for supremacy, the continued strong standing of the stalwarts belies creeping anxiety surrounding new players in the market.

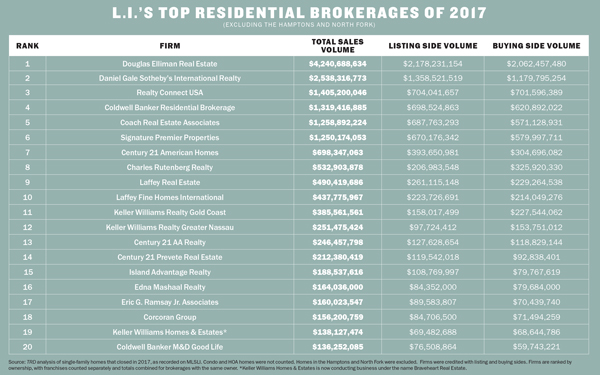

Douglas Elliman still leads the fray, posting a Long Island sales volume of $4.24 billion in 2017. And once again, Daniel Gale Sotheby’s International Realty took silver, this time with a bit less than $2.54 billion in sales in 2017, according to TRD’s analysis, which used MLS data to rank firms in Nassau and Suffolk counties — excluding the Hamptons and North Fork— by the value of their 2017 single-family home sales.

In a marginal uptick from their 2016 numbers, the top two firms closed nearly 25 percent of all Long Island single-family home sales in 2017. Below those giants, however, are familiar names but in slightly rearranged order, neck and neck in terms of market share and sales volume.

Realty Connect USA sold about $1.4 billion worth of homes last year, ranking in third place, with Coldwell Banker in 4th. Coach Real Estate Associates (No. 5) saw sales volume climb slightly year over year to $1.26 billion. Meanwhile, Signature Premier Properties fell to 6th place as Century 21 American Homes rose from ninth to seventh. A few smaller firms in the area, such as Re/Max Central Properties, were pushed out of the top 20 firms by newcomers like Braveheart Real Estate Enterprise (No. 19).

Cut-throat maneuvers

Even agents in top firms like Elliman and Daniel Gale report feeling jostled by the do-or-die fight for the top, in which every trick in the book must be employed.

“Broker poaching is the story of Long Island,” Ann Conroy, president of Elliman’s Long Island division, said. She noted that her top agents are constantly being approached by other firms and that she recently lost a few brokers to a Manhattan-based brokerage she declined to name.

“Recruiting is intense amongst all the companies. Everybody wants to attract the right people, and firms try to buy agents,” she added.

Conroy complains that Elliman is increasingly forced to compete with the sign-on bonuses and 90/10 splits being offered by some of the smaller regional brokerages. And brokerages like Compass — a firm with a $2.2 billion valuation — are known to offer six-figure bonuses to recruit top agents.

“I scratch my head, quite frankly, because I don’t know how they can build a business or be profitable offering what they are offering,” she said of the regional firms. “What it means for us is that when an agent is offered all these bells and whistles, they will come to us and negotiate.”

One strategy to cope with the ferocious vying for personnel is to be the chief offender. Daniel Gale banks on its prestigious reputation, marketing abilities and Sotheby’s International

Realty affiliation to pull agents away. The firm now boasts over 900 agents.

“I think we’ve been doing a pretty good job of it,” said Deirdre O’Connell, Daniel Gale’s CEO. “I don’t want to call it poaching, but I have found that agents want to work for a company that will give them full service. They want to come to us.”

Both Conroy and O’Connell say that in lieu of less-traditional splits, their companies provide enormous resources to their agents, including advertising, staging and marketing materials that help sell properties.

“That is where it is a little bit of a thorn in our side. I think we have a very aggressive and progressive compensation plan for our agents,” Conroy said. “We certainly spend a lot of money on marketing and branding. We really spend money on agents. So when they come to us with demands of higher splits and whatever else, it is a thorn.”

O’Connell insists that offering full-service support to brokers is ultimately the winning strategy.

She points to agents who had received large sign-on bonuses from other area firms but chose to pay them back when approached by Daniel Gale. Nevertheless, she admits the culture of hard bargaining and atypically generous splits for agents can make it difficult to bring on talent.

“I don’t like sign-on bonuses, not because I don’t won’t to pay them. But because I don’t want to pay them and then have people come to our company just for the money,” O’Connell said.

Realty Connect USA is exactly the kind of smaller regional brokerage Conroy and O’Connell are talking about. Realty Connect offers 90/10 splits for a mere $100 per month membership fee to its agents. Firms like this rely on large numbers of agents and fast expansion to survive. It’s a bargain too good for many brokers to ignore.

“We are in a growth pattern,” said John Fitzgerald, one of the broker/owners of Woodbury-based Realty Connect USA, which has roughly 800 agents and is less than a decade old. “We are growing, and we have more and more interest from agents in our model. We are averaging about 100 new agents a year. We have no transaction fees and no franchise fees.”

But poaching isn’t the only form the quest for market dominance took in 2017. Shock-and-awe expansion is another angle Long Island firms work.

Elliman recently opened or is in the process of opening offices in New Hyde Park, Rockville Centre and Sea Cliff. It currently has 23 offices in the area. Conroy says she hopes “that expanding into these additional marketplaces will have us positioned for the next decade.”

Elliman recently opened or is in the process of opening offices in New Hyde Park, Rockville Centre and Sea Cliff. It currently has 23 offices in the area. Conroy says she hopes “that expanding into these additional marketplaces will have us positioned for the next decade.”

“I am seeing a lot of the smaller regional players also expanding into markets we never expected them to,” Conroy said. “For instance, Signature Properties, which was in Suffolk County, moved into Nassau County. Daniel Gale, which was basically a North Shore brokerage, is starting to look at the South Shore locations. That is something really new.”

Signature Properties, which opened in 2007, told TRD that it plans to open offices this year in Medford and Massapequa Park, giving it a total of 17 locations. In 2016 alone, the firm opened seven offices, doubling its presence. Realty Connect USA now has 14 offices, opening about two a year. Daniel Gale now has some 27 offices and plans to open new outposts in Rockville Centre and Great Neck in 2018.

“Great Neck is a place we should have been in, but haven’t,” O’Connell said. “We don’t need to be in only the markets with the highest price points, but we want to represent the highest price points within the markets we are in.”

The market’s temp

But that kudzu-like growth wouldn’t be possible without a booming market.

The median sales price on Long Island, on a year-over-year basis, has risen for 19 consecutive quarters, according to Elliman reports. It is currently $415,000. Meanwhile, sales volume has grown year over year for three full years, or 12 quarters. And in a market with this much upward momentum, you would expect to see inventory falling, which it has: 11 times in the last 12 quarters, to be precise.

“Inventory is tighter than we have ever seen it,” said Conroy. “Agents are really shaking the trees to get something going.”

In fact, inventory on Long Island is currently at a record low, at least from when Elliman started tracking the market in 2003. Listing inventory fell 6.7 percent year over year in the fourth quarter of 2017.

“The suburbs surrounding the city, whether that it is Westchester, Fairfield or Nassau and Suffolk counties, are all experiencing heavy sales volume with rising prices,” said Jonathan Miller, who compiled the Elliman report. “And in many ways, what is happening on Long Island parallels what is happening across the U.S. If you look at the National Association of Realtors’ existing-home data, they are citing the same phenomena — rising prices, rising sales and falling inventory.”

The difference being that unlike the rest of America’s bedroom communities, Nassau and Suffolk counties are sandwiched between two of the most expensive real estate markets in the world.

Last year “was a record-breaking year for us,” Daniel Gale’s O’Connell said. “We have a lot of buyers coming from the city who are interested in being close to the villages. They are paying up for smaller, well-done, turnkey homes.”

However, O’Connell said not every property type is seeing a huge amount of interest: “We have larger homes on more property that you would think — as far as square footages — would have higher value. But we don’t have the pent-up demand for those properties. It’s causing some confusion in the market.”

But the overall luxury market on Long Island saw growth exceeding that of the lower end of the market. The number of Long Island sales overall in the fourth quarter of 2017 grew 3.7 percent year over year, while the luxury market, representing the top 10 percent of sales, grew 4.1 percent. However, the number of days a luxury home sat on the market during that period ticked up slightly, to 109 from 104.

The Manhattan invasion

That upmarket is also attracting sharks from the city.

Nest Seekers International acquired Shawn Elliott Luxury Homes and Estates on the North Shore late last year for an undisclosed sum (see page 38). It’s Nest Seekers’ first Long Island outpost. More telling still is the fact that the luxury Manhattan-based brokerage has set up an experimental office on the South Shore, where prices are significantly lower and homes are staunchly middle-class.

And it isn’t alone. Brown Harris Stevens, Corcoran and Compass have all bid for or at least put inquiries in to local Long Island offices, according to a source familiar with the discussions. However, spokespersons from Corcoran and

Brown Harris Stevens specifically denied any interest in opening an office in the area. A representative from Compass, which has a reputation for aggressive expansion, said the firm is “always actively considering expansion opportunities and is interested in growing our current business in Long Island.”

“We have heard the rumors. But rumors are rumors until we see it happen,” O’Connell said in regard to Compass’ rumored arrival. “We all know Compass wants to grow. These firms are focused on the big cities, and then they look to the suburbs around those cities. Nest Seekers just arrived, and they entered through a firm that had been here for a long time, so we aren’t feeling that quite yet. But I would never underestimate anybody.”

Conroy is also, as of yet, unperturbed. Elliman, the longtime kingfish of the Long Island market, is of course the outlier, which in a sense came from the suburbs to conquer the city when Dottie Herman’s Prudential Long Island Realty gobbled up the long-established city firm in the late 1980s.

“A lot of agents tell stories like this, saying, ‘So and so approached me and wants to start a business.’ But I don’t pay attention to that until it happens. We expected Compass to come last year, but it didn’t,” Conroy said.

Every firm on Long Island, big or small, is facing the fact that more firms and more agents are scrambling for an increasingly smaller pool of available properties. That situation has created opportunities for a few relative newcomers and perhaps future disrupters. Nevertheless, for the time being, the top firms are presenting a brave face and wait-and-see approach.

“Up markets breed competition,” O’Connell said. “That has always been the case, historically. The names might change, but the best usually survive.”