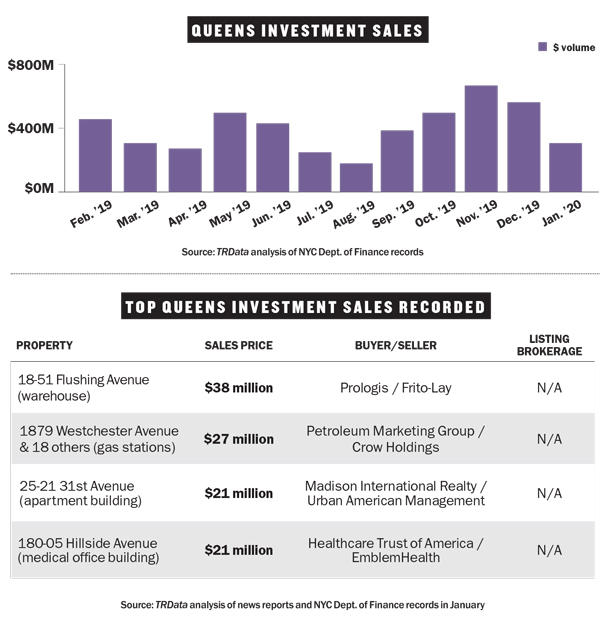

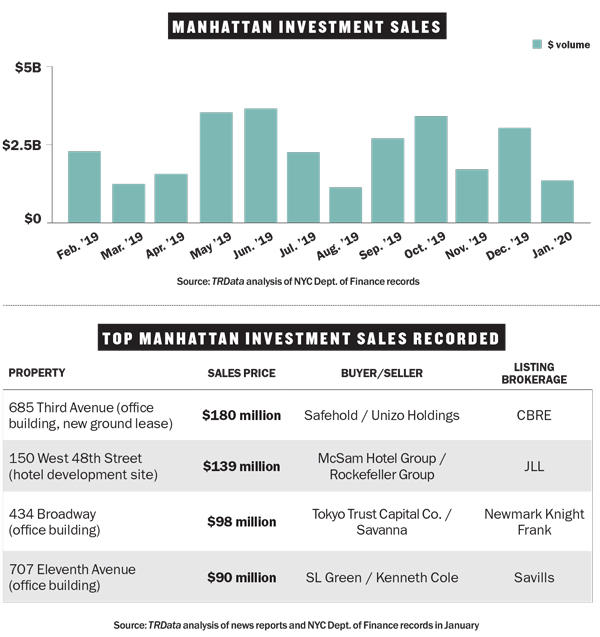

Investment sales in Manhattan and Brooklyn

Manhattan investment sales had a slow start to the year with $1.19 billion in deals recorded in January, down 60 percent from December and 45 percent below the 12-month average. Once again, the borough’s largest sale went to ground lease REIT Safehold, which acquired the land underneath Unizo Holdings’ 685 Third Avenue for $180 million as part of a deal that saw the Japanese firm fully withdraw from NYC. Brooklyn investment sales held strong with $947 million in deals recorded in January, 19 percent up from the month prior and 57 percent above the 12-month average. In the borough’s biggest deal, Nuveen sold an apartment building at 250 North 10th Street to TF Cornerstone and Trinity Place Holdings for $138 million.

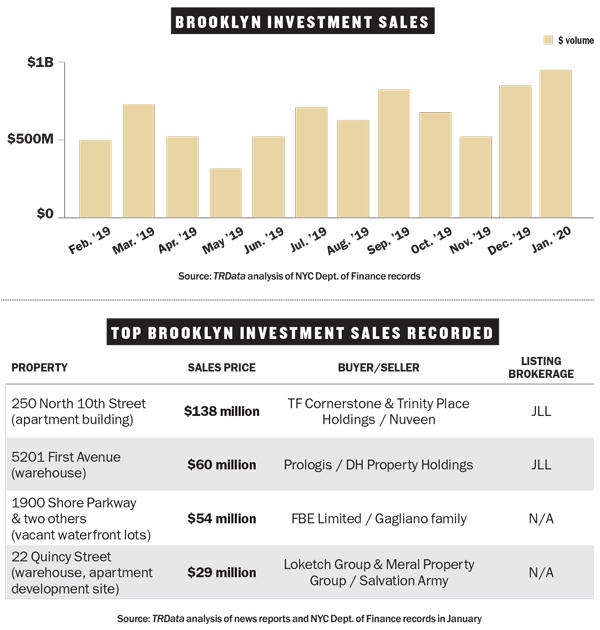

Investment sales in Queens and the Bronx

Queens’ investment sales market continued to slow in January with $288 million in deals recorded, 40 percent down from December’s total and 25 percent below the 12-month average. The borough’s largest deal saw logistics giant Prologis acquire a Ridgewood warehouse from Frito-Lay for $37.5 million. Investment sales in the Bronx rebounded to a nine-month high with $258 million in deals recorded in January, more than double each of the four months prior and 30 percent above the 12-month average. The borough’s top deal went to ZG Capital Partners, which acquired the South Bronx waterfront office building at 2417 Third Avenue, known as the Bruckner Building, from Savanna and Hornig Capital Partners for $65 million.