The tech world has plunged into the “Uber economy” with force. But how much office space does Uber, the taxi-app start-up, actually have in New York City?

This month, The Real Deal looked at the latest wave of start-ups in New York, from Uber to WeWork to the rapidly growing fantasy sports website DraftKings.

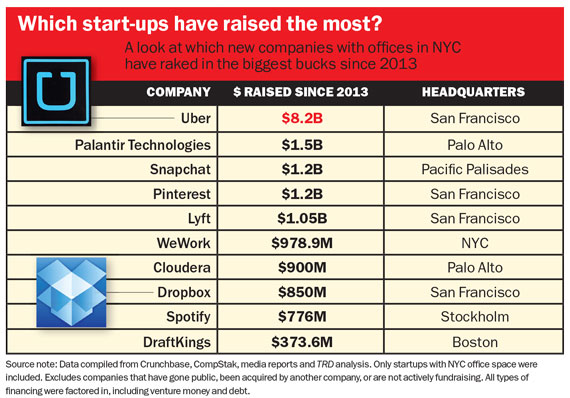

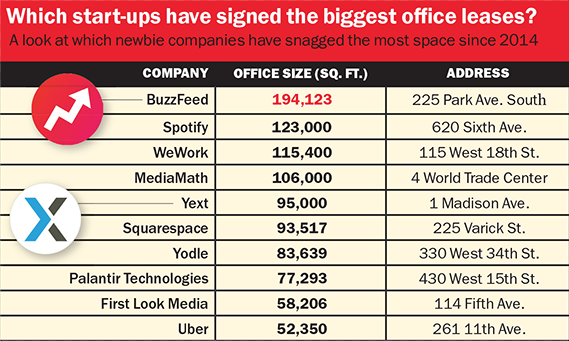

With help from real estate data firm CompStak, tech-tracking company Crunchbase and other sources, we looked at which start-ups (with NYC offices) have received the most venture funding since 2013 and which ones have signed the biggest NYC office leases since 2014.

We did not include long-standing tech titans — like Google, Twitter and Amazon — which have, of course, signed some of the city’s biggest and highest-profile office leases.

What we discovered is that Uber — currently the highest-valued startup in the world, at $51 billion — has a modest, partial-floor 52,350-square-foot office space (with an option for expansion) in Chelsea. The San Francisco-based company, which has raised $8.2 billion since 2013, pays a mere $36 per square foot at the Terminal Stores complex at 261 11th Avenue.

Interestingly, the company placed at the top of the pack for fundraising and at the bottom for office space.

JLL’s Brittany Wunsch — who along with colleagues Alexander Chudnoff and Dan Turkewitz represented Uber in its lease — said the company was using a conservative growth estimate to determine its real estate needs.

“I don’t think they expected to grow as big in New York,” said Wunsch, who also pointed out that Uber has an older office space in Long Island City.

The news-entertainment website BuzzFeed signed the biggest office lease among the start-ups, locking in a roughly 194,000-square-foot lease at 225 Park Avenue South.

Other firms that inked leases above 100,000 square feet included music-streaming site Spotify, office-sharing behemoth WeWork and advertising-analysis firm MediaMath, which moved into 4 World Trade Center late last month.

On the fundraising front, Uber’s $8.2 billion haul was the biggest of the bunch. Software and data analysis company Palentir Technology was the second-biggest fundraiser on TRD’s ranking, with $1.5 billion raised since 2013. Snapchat and Pinterest each raised $1.2 billion, followed by Uber rival Lyft, which raked in $1.05 billion.