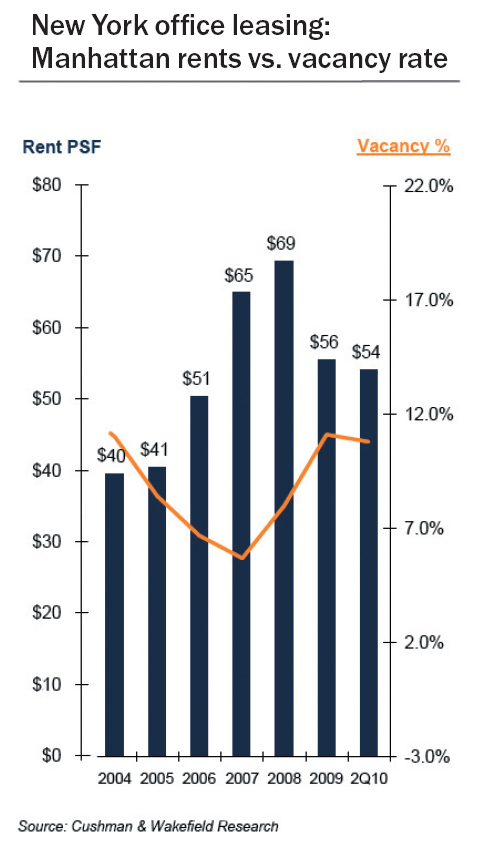

Click to enlargeAs everyone knows, the Lehman Brothers bankruptcy and the economic chaos that followed wreaked havoc on the Manhattan commercial market. On the sales side, two years later, premium assets in some central neighborhoods are again commanding big price tags, but conditions are nowhere near pre-Lehman levels. And the office leasing market continues to struggle with high vacancy rates and lower rents. According to data from the CoStar Group, vacancy rates have remained above 10 percent year-to-date, while average rents in Manhattan for Class A office buildings over 15,000 square feet slipped to $49.28 per square foot in the second quarter. By way of comparison, the vacancy rate was just 7.3 percent and the average rent per square foot was $75.01 in the third quarter of 2008. Cushman & Wakefield data shows that asking rents are still down 27 percent and 26 percent in Midtown and Downtown compared to their peaks in the third quarter of 2008. In Midtown, the office districts that have seen the steepest drops in asking rents since the 2008 peak include Park Avenue, the East Side and the Rockefeller Center/Sixth Avenue stretch. But still, “conditions in the Manhattan office market are much better than originally feared after Lehman collapsed,” said Hans Nordby, director of advisory services at CoStar. “We were forecasting negative absorption to continue into 2010, largely because a stock market resurgence of this scale was not our best-case scenario,” he said, noting that in late 2009 leasing activity surged along with stocks and bond issuance. CoStar now expects positive net absorption this year. On the building sales front, conditions have finally started improving after a period of severe darkness (see related Q&A, “Building-sale bounce”). In the quarter that ended on Sept. 30, 2008, 39 properties sold for a total of $5.8 billion, according to transaction data provided by CoStar. By the second quarter of 2009, it had fallen to seven buildings.

Click to enlargeAs everyone knows, the Lehman Brothers bankruptcy and the economic chaos that followed wreaked havoc on the Manhattan commercial market. On the sales side, two years later, premium assets in some central neighborhoods are again commanding big price tags, but conditions are nowhere near pre-Lehman levels. And the office leasing market continues to struggle with high vacancy rates and lower rents. According to data from the CoStar Group, vacancy rates have remained above 10 percent year-to-date, while average rents in Manhattan for Class A office buildings over 15,000 square feet slipped to $49.28 per square foot in the second quarter. By way of comparison, the vacancy rate was just 7.3 percent and the average rent per square foot was $75.01 in the third quarter of 2008. Cushman & Wakefield data shows that asking rents are still down 27 percent and 26 percent in Midtown and Downtown compared to their peaks in the third quarter of 2008. In Midtown, the office districts that have seen the steepest drops in asking rents since the 2008 peak include Park Avenue, the East Side and the Rockefeller Center/Sixth Avenue stretch. But still, “conditions in the Manhattan office market are much better than originally feared after Lehman collapsed,” said Hans Nordby, director of advisory services at CoStar. “We were forecasting negative absorption to continue into 2010, largely because a stock market resurgence of this scale was not our best-case scenario,” he said, noting that in late 2009 leasing activity surged along with stocks and bond issuance. CoStar now expects positive net absorption this year. On the building sales front, conditions have finally started improving after a period of severe darkness (see related Q&A, “Building-sale bounce”). In the quarter that ended on Sept. 30, 2008, 39 properties sold for a total of $5.8 billion, according to transaction data provided by CoStar. By the second quarter of 2009, it had fallen to seven buildings.

While smaller building deals are still dominating because buyers are having a tough time financing larger purchases, there has been an uptick in the number of larger deals. Indeed, 11 deals above $100 million have closed or are under contract so far this year, compared with just three such deals last year, said Helen Hwang, an executive vice president in the New York Capital Markets Group at Cushman. Thor Equities’ July deal for the Takashimaya Building at 693 Fifth Avenue for $142 million, and Rockpoint Group’s purchase of a nearly 50 percent stake in Park Avenue Plaza on East 52nd Street for $335 million, are two major examples. Despite the renewed activity, the office market still faces many hurdles, including high unemployment, which hampers companies’ need for additional office space. Investors want to park their money in premium neighborhoods, said Aaron Jodka, senior real estate economist at CoStar. “That’s what they are willing to pay for,” he said. The flight to quality neighborhoods, however, is resulting in a bifurcated market. Well-leased, well-located buildings are commanding high prices, but properties that aren’t fully leased or properties that have too many leases rolling over in the near future are selling at discounted rates. The $190 million purchase of the 650,000-square-foot Pfizer building at 685 Third Avenue last month by retirement group TIAA-CREF is a case in point, said Jodka. The property will be empty and require costly improvements, and so is reportedly fetching far less than other major office buildings. “Value-add deals [have] traded for low prices per square foot because of how much leasing and capital need to be plowed into the asset,” said Hwang.