Eric Schneiderman’s resignation following multiple allegations of physical abuse threw the state’s top legal office into limbo. While Solicitor General Barbara Underwood has taken on the role of New York’s attorney general for the interim, Schneiderman’s more permanent successor remains anyone’s guess — with five candidates hoping to succeed him in an election this fall.

Against this backdrop, the AG’s Real Estate Finance Bureau, which helps regulate for-sale housing, is tackling a growing number of offering plans, seeking to broaden its enforcement efforts, and making a push to modernize its operations. And those concerted efforts have major implications for New York’s condo developers and other residential real estate players.

“We’re trying to do it all,” Brent Meltzer, the bureau’s chief, told The Real Deal about his staff of 44. “It puts stress on us, but we’ve been able to handle it so far.”

Being more thorough at the review stage on offerings, for instance, can prevent trouble down the road, he noted. It can stop litigation on the front end, so that it doesn’t turn into an enforcement issue later on.

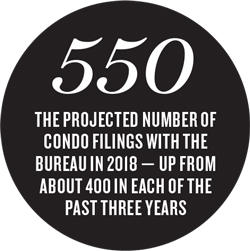

But while just over 400 condo plans were submitted to the bureau in each of the past three years, 2018 is on track to reach about 550, per Meltzer’s office. That’s a notably larger workload for the bureau’s 32-person review team, which is required to dig into the details of plans and examine disclosures.

At the same time, New York condo filings are becoming all the more intricate, according to the bureau chief and industry sources. Added complexities can come from developers offering customizable floor plans and unit designs, said David Kronman, a managing partner at Cape Advisors, which is building a 170-unit condo tower in West Soho and a 21-unit property in Tribeca. Filings can also be complicated by amenities tied to other businesses, such as valet parking with a public garage.

Though that warrants even more meticulous reviews, there are no immediate plans to expand staffing in that department or the bureau’s other three — enforcement, records management and public information.

All the while, Meltzer’s department also faces criticism for not doing enough when it comes to disputes in New York’s cushy condo market.

28 Liberty Street

“When there are buyer issues, the AG doesn’t make it a point to step in,” said Robert Dankner, co-founder of brokerage Prime Manhattan Realty. “The buyer and developer are forced to duke it out and see who has more stamina.”

Housing watchdog

Meltzer, who previously served as assistant commissioner at the New York City Department of Housing Preservation and Development for a year and a half, took over the AG’s Real Estate Finance Bureau in August 2016.

Prior to his role at HPD, he was a co-director of the housing unit at the nonprofit Legal Services NYC’s Brooklyn program. Meltzer’s work there dealt with tenant representation and issues that included rent stabilization rights and housing preservation — not exactly top priorities for condo developers and private landlords.

In announcing his appointment two years ago, the AG’s office noted that the Real Estate Finance Bureau “will expand to address complaints of civil frauds such as tenant harassment.”

That came as part of a broader effort under Schneiderman to strengthen enforcement efforts and focus on tenant issues, deceptive lending practices, deed theft and other housing-related issues. The former attorney general became known for aggressively targeting rental landlords accused of tenant harassment.

But then Schneiderman’s career as AG came to a screeching halt in May, and several candidates — from New York City Public Advocate Letitia James to Manhattan private attorney Keith Wofford — threw their hats in the ring to replace him.

Schneiderman’s departure “was obviously a bit of a jolt when it first happened,” Meltzer said.

But the bureau was back to normal in a week, he added, because that change “doesn’t affect how you look at cases.”

In part, that’s because Underwood hasn’t come into the office with a dramatically different vision, according to outside sources. But the stamp Schneiderman’s successor puts on the AG’s office would likely trickle down to the bureau, too.

“That’s probably a bit stressful for everyone,” said Erica Buckley, a partner at the global law firm Nixon Peabody who formerly headed the AG’s Real Estate Finance Bureau. “There is some level of uncertainty.”

James, one of the leading Democratic contenders, could potentially uphold Schneiderman’s focus on tenants’ rights — an issue she has plenty of experience with. Leecia Eve, another Democratic candidate, who served as a senior adviser to Gov. Andrew Cuomo before leading government affairs at Verizon, has been vocal about her interest in affordable housing. And Wofford, the sole Republican candidate, with a background in securities litigation and white-collar crime, could prioritize very different kinds of cases.

To that end, the bureau appears to be in a period of transition, said Jonathan Canter, a partner at Kramer Levin, and Meltzer and other bureau staff have had “a genuine willingness” to listen to input.

But the bureau’s job is to enforce part of the Martin Act — New York’s blue sky securities law — and to ensure the adequate disclosure of co-op and condo sales, and it should be careful about expanding beyond that, Canter said.

“There are a lot of bad actors out there,” he said. “But, as with many public offices, there’s probably a limit to what they can get involved in.”

Greater enforcement

But on Meltzer’s watch, the Real Estate Finance Bureau hasn’t been shy about expanding the range of enforcement issues it tackles — even if they don’t fall under the Martin Act.

One type of fraud the bureau can address, Meltzer said, is co-op properties that really function as rental buildings, with far more tenants than shareholders.

The AG’s office, for instance, filed a lawsuit in January 2015 seeking to dissolve a 44-unit co-op in Washington Heights that it said was “acting exclusively as a rental building.” The office alleged that after the building at 121-131 Fort George Avenue was converted from rent-stabilized apartments into for-sale units, the developer stopped selling shares and began renting out all of the apartments at market rate. The AG reached a settlement that year under which all tenants were entitled to rent-stabilized leases.

And just last month, Underwood announced a $190,000 settlement with a former cooperative corporation on the Upper East Side that the AG’s office alleged was using a co-op as a rental building for decades. The settlement also requires 417 East 60 Street to operate as a rental building and abandon the co-op plan; the $190,000 will go toward financing affordable housing in the city.

Other important casework for Melzter’s department includes building owners taking advantage of elderly, disabled and low-income residents, he said.

Last November, the bureau announced a $132,000 settlement with two Bushwick landlords over illegal buyout offers. The landlords, Graham and Greg Jones of GRJ Real Estate, began pursuing rent-stabilized tenants immediately after purchasing three buildings with 105 units in 2016, according to a statement from the AG’s office at the time. More than a third of the tenants accepted the offers — but the landlords failed to give them required written notices explaining their rights.

Last November, the bureau announced a $132,000 settlement with two Bushwick landlords over illegal buyout offers. The landlords, Graham and Greg Jones of GRJ Real Estate, began pursuing rent-stabilized tenants immediately after purchasing three buildings with 105 units in 2016, according to a statement from the AG’s office at the time. More than a third of the tenants accepted the offers — but the landlords failed to give them required written notices explaining their rights.

That was the first settlement under a New York City tenant buyout law that went into effect in 2015.

In another case led by the bureau last year, the AG’s office reached a $6.5 million settlement with the owners and operators of the Manhattan Club, a Midtown timeshare building. The settlement over the sponsors misleading potential and current shareowners was the “largest in recent history” for the bureau, according to a statement at the time.

Meltzer said he wants his department to take on an even broader range of cases, whether it’s asbestos disclosure, missing occupancy certificates — or something else entirely.

The bureau is also looking to further upgrade some of its systems and processes. Meltzer pointed to his “weird obsession with efficiency” and said he regularly solicits input from his team and outside consultants on how to speed things up.

While a full overhaul “takes a lot of time and thought,” he noted, he’s encouraged by smaller changes, like the use of electronic payments and e-signatures. The shift to email confirmations from paper letters once the bureau accepts a plan or amendment, for example, can save two or three days — a big difference for a developer racing against the clock.

“My dream is an e-filing system,” the bureau’s chief said.

And even though Meltzer’s efforts to digitize the entire filing system face a backlog, his department has become more accessible and more responsive to deadlines, Kramer Levin’s Canter said.

Digital submissions and email correspondence have made the offering-plan process faster and more efficient, said Kronman of Cape Advisors. His firm has three plans currently in the works, he added, and it helps not to wait around for the bureau to return calls. But the bureau’s review system could use more streamlining, Kronman said, as different staff members often interpret regulations in different ways.

“Our hope would be that things continue to move in the direction that they’ve been going,” he said. “But, also, maybe making sure there’s consistency among the parties reviewing plans — and things don’t become subjective.”

Back office blind spot?

And even as the bureau modernizes and broadens its scope, it can’t cover everything. One prominent complaint about the New York attorney general’s office in the real estate world has been its lack of oversight regarding construction defects.

While Schneiderman intently focused on tenant harassment and deceptive lending, some say he neglected problems with market-rate condos.

When Cuomo was attorney general from 2007 to 2010, the office would routinely take up construction-related complaints submitted to it, said real estate attorney Adam Leitman Bailey. In the past, the bureau frequently mediated these disputes, which is no longer the case, according to several sources.

“If mediation or settlement negotiations work, there’s no shame in doing that,” said Buckley, who worked on some of those cases during her time as the bureau’s chief. But it doesn’t always work or have the same kind of deterrent effect as litigation, she noted.

There’s plenty of poor construction, which means people are getting a raw deal, said attorney Barry LePatner. “People should get what they pay for,” he said.

A spokesperson for the bureau said it does take on construction-related cases, but that its enforcement role is to be a litigator — not a mediator. While the office won’t turn a blind eye to a legitimately dangerous situation, the spokesperson said, mediation can be time-consuming and still not result in a settlement.

Some complaints are also harder to deal with factually. If a roof is leaking, for example, it can be a challenge to prove whether that’s due to shoddy construction or poor maintenance over the years.

That’s become a source of frustration for those who see a need for more intervention. Dankner of Prime Manhattan said it’s difficult to resolve buyers’ issues with developers without someone else stepping in.

“There are issues that clearly could be breaches of responsibility. I have not found that they have been there to say, ‘the buyer is wrong’ or ‘the developer is wrong.’” Dankner added that he’s struggled to get the AG’s office to pay attention in those cases and has even had trouble pinpointing the person who reviewed a particular offering plan.

“To say that we’re not doing them is not true,” Meltzer said about construction complaints. He said his bureau has about nine pending cases that are solely or partly construction-related and that it has settled a few others. “Are we taking every one that comes in the door? No, we can’t,” he added. “But that’s the case for all issues.”

He also acknowledged that taking over the bureau has been an adjustment for him. While his background in tenant housing work has helped him work on cross-bureau cases on those issues, Meltzer didn’t have a background in the problems that can occur with luxury condos and co-ops.

“For other people, it’s a different language; for me, it was a different dialect,” he noted. “I probably still have an accent, but I can speak the language.”