Unlike Wall Street, Y’all Street began as an idea.

A cheeky signifier for Dallas-Fort Worth’s rising prominence in the financial world. Maybe even a counterweight to New York City supremacy.

The moniker was first used in a 1998 Texas Monthly article about the success of Texas stocks, but it was reclaimed to describe Dallas’ growing financial power around 2016.

Today, the Metroplex is dotted with sprawling campuses for companies compelled enough by the state’s business-friendliness and lower cost of living to make the move to Texas.

Thirty miles northwest of Dallas, Charles Schwab, Fidelity and Deloitte have parked corporate campuses at Ross Perot Jr.’s 2,500-acre Circle T Ranch. Across the Metroplex in Plano, Toyota and JPMorgan Chase comfortably reside in the sprawling Legacy West development.

But these are not anonymous towers for back-office paper pushers hired just because they’re a bargain compared to their New York counterparts. These are top-tier modern offices that are also trophies reflecting Texas’ accomplishment in scooping up an outsized portion of the nation’s growth in financial employment.

That, plus the recent announcement of a fully electronic Texas stock exchange, has everyone wondering if Wall Street’s bronze bull may as well be a Longhorn.

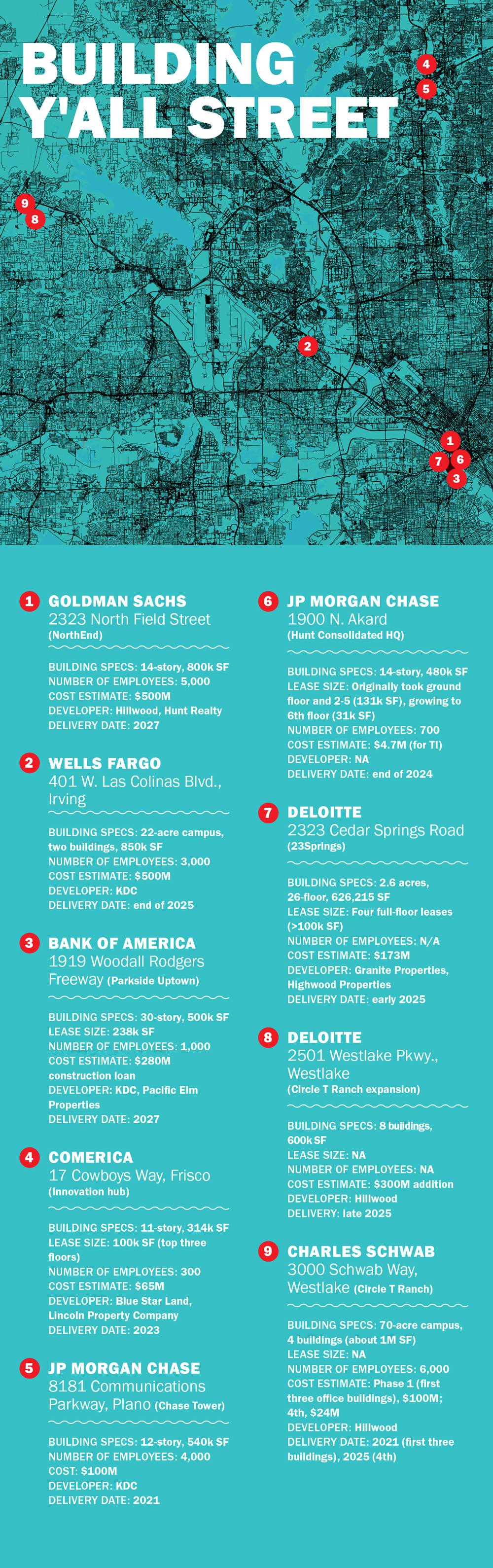

Dallas-Fort Worth’s decades-long evolution into a financial capital hangs on developments scattered throughout the Metroplex. But more than $1 billion in Uptown Dallas’ development pipeline means the neighborhood is poised to transform into headquarters for Y’all Street.

By 2030, a 150-acre patch of Uptown Dallas will be remade into stomping grounds for thousands of employees of Bank of America and Goldman Sachs and professional services firm Deloitte.

Hunt Realty hired Perot’s Hillwood to manage construction of a $500 million campus for Goldman Sachs. KDC and Pacific Elm Properties are building a 30-story tower that will house Bank of America. Granite Properties’ $173 million office tower recently signed Deloitte for four floors.

If you find it hard to imagine Uptown Dallas giving Wall Street a run for its money, you’re not alone. Currently, you could walk 20 minutes between the three sites and not pass a single coffee shop. There is no equivalent to Fraunces or Stone Street Tavern.

But the thousands of current and future finance professionals working in Dallas signal that the city isn’t the business backwoods it was 20 years ago.

Developers of Y’all Street promise: Transplants will love Dallas, too.

Metroplex migration

Bank of America and Goldman Sachs are part of a relocation wave years in the making.

Since the 2012 opening of Klyde Warren Park — the 5-acre deck park that covers Woodall Rodgers Freeway and connects downtown and Uptown — companies with Dallas offices have been abandoning their aging downtown digs for flashy Uptown towers.

In 2017, accounting firm PricewaterhouseCoopers moved from Trammell Crow Center on Ross Avenue to Park District, a $250 million development at Pearl Street and Woodall Rodgers (also developed by Trammell Crow).

The so-called flight to quality continued with Invesco and Akin Gump moving to the Union and law firm Gardere Wynne Sewell heading to McKinney & Olive.

“Deep down, there’s an understanding that there’s no reason for Dallas to really exist.”

Companies are drawn to the neighborhood, according to Jamee Jolly, the outgoing president of Uptown Dallas, an organization that manages the neighborhood’s public improvement district.

In a city dominated by cars, Uptown is a rare slice of classic urban life.

“There are tree-lined streets throughout the district, and it just has more of a pedestrian-friendly environment,” Jolly said.

Y’all Street is taking shape in a new way with three mixed-use developments: NorthEnd, Parkside Uptown and 23Springs.

NorthEnd, the largest of the trio, is being marketed as an “urban arboretum” and will feature at least four high-rise buildings sitting on 11 acres and centered on a 1.5-acre park. One of them — 14 stories, 800,000 square feet — will house Goldman Sachs.

A 10-minute walk takes you to the future site of Parkside Uptown, a 500,000-square-foot building that borders Klyde Warren Park. Bank of America is taking half of the building.

Less than a mile up Cedar Springs Road, 23Springs is taking shape. Future tenants Bank OZK and Deloitte have already signed leases. The 26-floor office building is on the north side of the Crescent, the mixed-use development that has anchored Uptown since 1986.

It wouldn’t have been possible outside the context of a decades-long national migration to North Texas.

Since the Partnership for New York City named Dallas a threat to the Big Apple’s “World Financial Capital” crown seven years ago, the Metroplex has only grown into a more worthy competitor.

Today, Dallas is home to so many people employed in finance-related industries that it ranks second to New York.

The pandemic put the rat race in more stark terms.

Since 2019, investment banking and securities employment jumped 27 percent in Texas, compared to 5 percent in New York, according to the Bureau of Labor Statistics.

It is what you make it

Unlike the more organic growth of Wall Street, Y’all Street’s transformation is a very deliberate one, and developers will decide how it takes shape.

Still, this mostly blank canvas has its challenges.

It wasn’t long ago that a transfer to Dallas seemed punitive. The region’s boom softened that stigma, but it’s still an image developers are trying to change.

Yet Hunt Realty President Colin Fitzgibbons admits that “Deep down, there’s an understanding that there’s no reason for Dallas to really exist.”

There are no mountains, no nearby seaports, instead just “the poor river that we have abused for decades,” he said.

“Well, Dallas is very business-friendly, and that’s sort of been our reason for being,” Fitzgibbons said. “But the underpinnings of all that is, look, this has to be a great place to build a career and to raise a family. I think that’s the secret sauce.”

In terms of branding, public-facing tenants give us a sense of the vibe developers are going for.

Granite Properties, the developer of Deloitte’s new home, 23Springs, has already signed leases with two concepts from Wish You Were Here Group.

Elephante, a high-end Italian restaurant, has a location in Santa Monica, California, and two on the way in Scottsdale, Arizona, and Laguna Beach. Little Ruby’s Cafe will open its fifth location in 23Springs. The all-day cafe has four locations in New York City.

It’s still too early for NorthEnd to announce retail tenants, but Fitzgibbons’ team has spent the last year researching what people want in their mixed-use spaces.

With an emphasis on outdoor space and retail that will appeal to everyone, not just the 9-to-5 crowd, they’re looking to develop an area that is lively during rush hour and on the weekends.

The rub

Like New York’s high cost of living, traffic and housing shortage, Dallas has its own systemic flaws.

Not only does the city fall short when it comes to public transit, but migration from downtown to Uptown means people are moving farther from the city’s scant transportation infrastructure.

Dallas Area Rapid Transit ridership hasn’t recovered from the pandemic. It was 70.5 million in 2019 and just 48 million in 2023. This summer, some of the Metroplex’s largest cities, including Plano, voted to reduce the tax allocated for the system.

Given the area’s reliance on cars, additional density in Uptown is sure to ramp up traffic for Y’all Street commuters.

Fitzgibbons is hopeful increased density will force a solution.

“The more people move here, the more traffic there will be, and at some point, using the DART becomes easier than driving,” he said.

As for travel between cities, Circle T Ranch’s website already touts a 90-minute trip from DFW to Houston via high-speed rail, but the $30 billion project is still years off.

Texas politics could also pose obstacles for Y’all Street.

The state’s business-friendliness has its limits — specifically, at the door of Attorney General Ken Paxton’s office.

In 2021, the state legislature passed a law that bans governments from contracting with banks seeking to divest from fossil fuels.

Since then, Paxton, who survived impeachment last year, has launched investigations into some of the world’s biggest banks, including Goldman Sachs and Bank of America. This year, he banned Barclays from underwriting Texas muni bonds after the British bank didn’t respond to information requests about its carbon emissions commitments.

While Fitzgibbons thinks Dallas comes out ahead of other markets, even in light of state politics, he warns against taking this advantage for granted.

“We can’t just rely on the lack of income tax and assume that will be enough,” he said. “We need to be careful and we need to remain competitive, and that includes state politics.”

Getting over the wall

If Fitzgibbons were dropped at the intersection of Cedar Springs Road and Akard Street in 10 years, here’s what he’d want to see:

More sidewalks. Increased walkability. More plazas and parks and fountains. Even more companies from around the globe moving to Dallas. Added density, specifically more people living in the city’s core.

“I think we’re already a great big city in the United States.” Fitzgibbons said. But there’s still a lot of room for improvement, and I think a lot of this in-migration is going to push us forward, too.”

Some of that density on his wish list is already in the pipeline.

Uptown and neighboring Victory Park and Turtle Creek will soon be home to at least 10 new multifamily projects, totaling nearly 3,000 units.

Fitzgibbons’ optimism is, in part, rooted in his belief that Dallas remains moldable. If you identify an issue in your community, it’s not hard to get involved and work to make it better.

For example, if you’re interested in increasing the city’s access to green space, “you might find yourself on the Parks Board,” he quipped.

Regardless of how it plays out, Fitzgibbons asserts: “The impact of Goldman Sachs choosing to locate at the NorthEnd in Uptown Dallas is going to reverberate for decades.”

If Y’all Street developers are right, they may end up wrangling Wall Street’s bronze bull.