Michael and Brandon Miller needed cash to get their Tribeca condo project going.

Their company, Real Estate Equities Corporation, signed a 150-year ground lease in 2010 at 137 Franklin Street and had plans to build a new, three-unit luxury condo building with a $23 million sellout price. Brandon was in charge of the project, and his father rewarded him with a 99 percent membership stake in the entity that owned it, REEC 137 Franklin Street LLC, according to court documents.

“I was the day-to-day developer of the project, actively on site dealing with construction, architect et cetera,” Brandon said in a 2021 deposition.

Michael Miller turned to Long Island investor Donald Jaffe for a loan. In 2011, Jaffe provided a $2.5 million loan to REEC Franklin at a 12 percent interest rate that would come due in 2013.

More than a decade later, Jaffe is still trying to recover his money from the loan — and $3.6 million in additional loans he provided to the father and son between 2011 and 2014. Both Michael and Brandon Miller are dead, and Brandon’s widow is on the hook for $3.6 million of the remaining debt. Brandon also left behind a tangled web of lawsuits, unfinished real estate projects and $34 million in personal debt when he died by suicide on July 3.

His death touched off a frenzy of news articles and Reddit posts, mostly focused on his wife Candice, who broadcast the family’s extravagant lifestyle on Instagram as they hopped between picture-perfect homes in New York and the Hamptons, their money problems hidden.

Brandon’s troubled real estate dealings appear to be at the root of these problems. Unlike other industry scions, he did not inherit a real estate fortune. His father died with millions in debt. And Brandon seemed to develop the same habit as his father of highly-leveraging his personal assets — even as he tried to find his own path.

Court documents and conversations with friends and real estate players who worked with the Millers paint a dizzying picture of loans from a variety of sources, including large institutions, high-flying hedge funders, a sports medicine doctor and a cash advance company. As his projects faltered, Brandon appeared to grow more desperate, relying on last-ditch lenders and pledges from friends.

REEC has gone dark since Brandon’s death. The remaining principal, Mark Seigel, did not respond to multiple requests for comment. Michael and Brandon Miller’s former assistant, Christine Frangipane, declined to comment. And the company’s website is now hidden behind a password, raising questions about the future of REEC and its projects.

A boutique shop

Michael Miller founded his real estate development company in 1978 and was a developer of New Jersey shopping centers in the 1970s and 1980s. He once owned a Woodbridge, New Jersey, jewelry store. Brandon, a Brown University graduate, joined REEC in late 2006 after a brief career on Wall Street.

“I wanted to leave large institutions and get into a smaller platform,” he said in the 2021 deposition.

Michael Miller was the head of the company. In 2004, REEC added Seigel, who handled the finances, according to colleagues and partners. At first, Brandon and Michael worked separately on their own real estate projects, according to a 2021 statement from Frangipane, who handled Michael’s personal and business affairs for 15 years, then worked as Brandon’s assistant.

“They were operating in two separate real estate worlds, although they did share in some projects starting in 2011,” Frangipane said.

Around that time, REEC was plowing ahead with the Tribeca project. The elegant brick and steel building on the corner of Varick Street was completed in 2013. Brandon grabbed the first sale, paying $3.9 million for the 4,000-square-foot penthouse, well below market value. Although the property was pledged as collateral in the loan from Jaffe, he was not told about the sale, he alleged in a 2019 lawsuit.

But it is unclear if Brandon even knew about the loans. Jaffe testified that he never discussed the loans with Brandon, and the interest payments were made from Michael Miller’s personal accounts.

The loans never hit public records because Michael Miller told Jaffe “there were existing loans on the building and that we couldn’t file … our mortgages or notes or whatever against the building because the lenders wouldn’t want it and it’d be showing too much debt. So we did it without filing,” Jaffe testified.

The Tribeca property wasn’t the only one Michael Miller pledged as collateral. He also used three Hamptons properties to secure the Jaffe loans. One was at 25 Cobb Isle Road in Water Mill, just off Mecox Bay. REEC bought the property in 2011 for $3.2 million and developed it under the entity Cobb Isle Cottage LLC, which Brandon had 100% interest in. When the project was finished, Brandon transferred the sprawling seven-bedroom shingle-style home to his name.

Again, Jaffe was not told of the transfer, he alleged. The Millers developed and sold two more Hamptons properties and pledged them as collateral, including a 9,000 square foot house at 379 Ocean Road in Bridgehampton that traded for $14 million in 2016.

Michael Miller died suddenly at home that December, a few months later.

To the future

At Michael Miller’s funeral at the Riverside Memorial Chapel, Jaffe and Brandon met for the first time. Although Brandon’s name had appeared on the loan documents from Jaffe, the pair had never spoken, they both testified.

Michael Miller died with $15 million in debts and $12 million in assets, according to surrogate’s court documents. When the bills started to arrive from Jaffe, Brandon was blindsided, he claimed. His father never told him about the loans and he did not have the money to pay them after his father’s estate was wiped out, he later testified.

Frangipane backed up his account, saying that she routinely forged Brandon’s signature on loan documents from Jaffe, then notarized them and returned them to Jaffe’s lawyer without telling Brandon.

“I am positive that Brandon had no involvement in the loans that his father was getting from Donald Jaffe and did not know the extreme that Michael borrowed from him,” Frangipane said.

In addition to personal debt, Brandon inherited an ill-fated Chelsea office project from his father. Michael Miller was negotiating the ground lease for two adjacent properties near the High Line when he died.

A friend said that Brandon had resolved to do things differently from his dad by playing it straight financially.

He began to work on building offices in less traditional office neighborhoods.

REEC went ahead with the project, buying the leasehold at 118 10th Avenue in a deal valued at $21 million. But plans for an office building at the site stalled, and the leasehold was sold to another developer two years later.

The Chelsea property wasn’t the only office project that ran into trouble.

REEC amassed ground leases for office projects between 2017 and 2020 with a total value of more than $127 million. The firm broke ground in the East Village and Harlem just before the pandemic. At one point, REEC almost lost the East Village property to foreclosure and later it fell behind on loan payments; the development is now nearly done. The Harlem project is finished but has struggled to find tenants.

Months after it closed on the Harlem purchase, REEC took over the leasehold for a 15,000 square foot Nolita assemblage. That appears to be Brandon Miller’s final real estate play.

The ghosts

On a busy stretch of Bowery Street, graffiti covers a row of vacant low-rise buildings, the black metal security gates are shuttered and electrical wires dangle from open windows. REEC took over the Nolita property in a 2020 deal valued at $50 million, and landed a $60.5 million land loan from Raven Capital Management in 2022.

Although the firm filed demolition permits and plans for a 73,000 square foot life sciences building on the property, the project was never built. It’s unclear whether REEC still owns the property, or is current on payments. Land owner Ari Zagdanski did not respond to a request for comment on the development.

While the Nolita project floundered, Brandon got another shot at the Chelsea development first envisioned by his father. After the new developer’s plans for an office building were sidelined by Covid, the property was transferred back to Brandon in December 2023.

The same month, Brandon borrowed $1.5 million against the property from a wealthy friend, Douglas Teitelbaum, pledging his entire interests in the company that owned the leasehold to the Miami-based private investor, who ran in the same social circle as the Millers. Others in the group had loaned Brandon money for real estate projects over the years, sources said. A few weeks later, he asked Teitelbaum for an additional $50,000.

But Brandon never repaid him.

“We were well into default under my loan to Mr. Miller when I got a horrible phone call to learn that he had taken his life,” Teitelbaum testified in bankruptcy court.

Less than two weeks after Brandon’s death, Teitelbaum took over the property and filed for Chapter 11 bankruptcy. But with half a million dollars in unpaid rent due to the landlord and unable to access Brandon’s books or records, he is now seeking to have the bankruptcy dismissed.

Meanwhile, the overgrown lot at 118 Tenth Avenue languishes.

Legacy of debt

It wasn’t just Teitelbaum. Brandon had almost $34 million in debt and just $8,000 in his bank account when he died. Miller’s largest debt was an unsecured $11.3 million loan from an institutional lender, Chicago-based BMO Bank. But he also borrowed smaller amounts from an assortment of private investors — including $350,000 from sports medicine doctor Jerry Lubliner and $85,000 from cryptocurrency entrepreneur Daniel Erlich Schmerin.

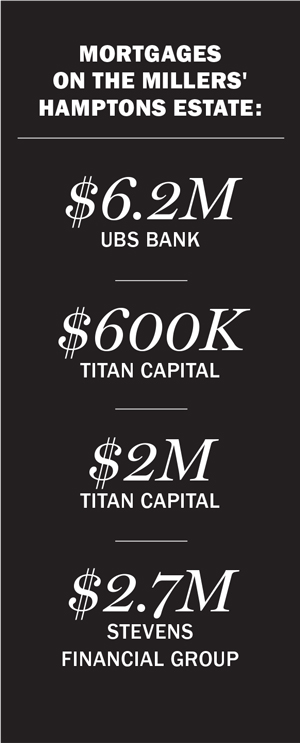

About $11.5 million of the debt was tied to mortgages on the Water Mill estate, according to a bond petition filed in surrogate’s court by Candice. Those debts do not include loans he took out under his commercial real estate firm that may have been personally guaranteed.

Meanwhile, an Upper East Side landlord is suing Candice for $195,000 in unpaid rent at the Upper East Side apartment where the family moved after selling their Tribeca penthouse for $9 million in 2021. (The family now lives in Florida.)

And just six weeks after Brandon’s death, Jaffe resurfaced. There was still a balance on the loan of nearly $5 million — more than the Millers had in their accounts or unleveraged assets, though still relatively modest for a real estate player.

Jaffe was claiming that Candice needed to hand over $3.6 million because she had signed a confession of judgment two years earlier, essentially accepting liability for a default in advance. A judge ruled that Candice had to pay, according to court documents.

There is also a third lawsuit against Candice, from a lender who sued her in July over missed mortgage payments on the Water Mill house, which is now on the market for $15.5 million.

The beautiful listing photos don’t show any signs of the family’s troubles, or the suicide that took place there. The immaculate rooms, furnished in shades of white, make it easy to envision the lavish life the Millers once lived. But debt was shadowing them; the lawsuits have pulled back the curtain on how Brandon was stringing along his lenders the whole time. The office empire he once imagined won’t be built, and instead of a legacy of development, there is a tragedy.