When Mack-Cali announced in 2015 that it would start selling off its Westchester holdings, Robert Martin Company was elated.

Robert Martin — an Elmsford-based real estate firm that has developed office parks across Westchester and Fairfield counties — had built most of a 56-property, 3.1 million-square-foot portfolio starting in the 1970s. But it sold it to Mack-Cali for $450 million in 1997 to pay down debt in the wake of the real estate crash earlier in the decade.

“My favorite quote from that time was Sam Zell’s quote: ‘Stay alive until ’95,’” Robert Martin partner and CEO Tim Jones told The Real Deal, referring to the mogul’s famed 1991 zinger.

Still, almost as soon as Robert Martin sold the portfolio, it wanted it back, according to Jones, who was at the table for the original deal. Finally, it started up negotiations last summer to get its baby back. The sale closed this past March, with Robert Martin and partner H.I.G. Realty Partners paying roughly $487.5 million for the portfolio — a record for the most expensive commercial real estate transaction ever in Westchester County.

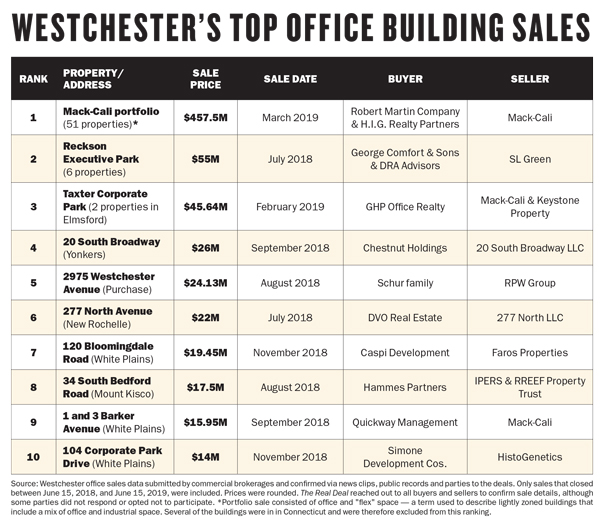

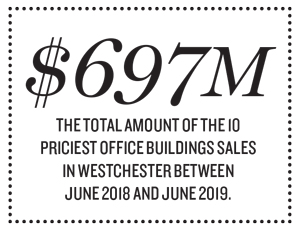

The trade was also the priciest closed deal by a mile for Westchester between June 15, 2018, and the same date in 2019, according to TRD’s ranking of the top 10 office sales in the county. The assets in that monster portfolio are a mix of office, industrial and flex space. TRD included the entire Westchester portion of the portfolio — $457.5 million — because it appears that a sizable portion of it is either already office or ripe to be converted to office use. (The remaining portion is in Stamford, Connecticut.)

The other deals on the ranking ranged in price from $14 million to $55 million.

Jones said the purchase was both a feel-good decision and a smart business move for the company.

“There’s a real need for this type of building in Westchester County,” he said. “And, to a lesser extent, in Fairfield County, as 300,000 feet of this is there.”

But he added: “We also wanted the properties back because they’re very familiar to us. We know how to run them. We know the tenants.”

In fact, the buildings, which are 90 percent occupied, have tenants that have been there since before the 1997 deal, including Emigrant Bank, Allstar Marketing Group and Westchester Broadway Theatre.

More broadly, the blockbuster deal speaks to increased demand for this kind of space in the area.

“Investors are looking for properties like these to add to their portfolios in the suburbs,” said Matthew Torrance, a director in Cushman & Wakefield’s Capital Markets Group.

“Investors are looking for properties like these to add to their portfolios in the suburbs,” said Matthew Torrance, a director in Cushman & Wakefield’s Capital Markets Group.

Around the region, demand for updated Class A office space, especially in areas with train access and walkable downtowns, is high. But the inventory is limited, sources said. A good chunk of Westchester’s existing office buildings is not up to today’s standards — including former headquarters for some big companies.

But developers have increasingly been looking for new uses for the outdated office space.

“Space is leasing a little bit better and buildings are being taken off the market, either demolished or removed for other uses such as residential multifamily, or even senior or student housing,” said Jeffrey Dunne, a vice chairman in CBRE’s Capital Markets Group who’s focused on New Jersey, New York and Connecticut.

Dunne cited a property on Corporate Park Drive in Harrison that will soon be a Wegmans grocery store.

That reduction of inventory has helped create a “moderate improvement” in Westchester’s office environment, Dunne said.

Office space availability in Westchester was down 460 basis points in 2019’s second quarter year over year, according to CBRE. And the first half of 2019 saw 405,000 square feet leased — up 9 percent year over year.

The Westchester market has one key selling point: It’s cheaper than New York City.

Average Westchester office rent was $28.23 for 2019’s second quarter. By comparison, the average rent in Midtown Manhattan was roughly $88 in June.

JLL’s Jose Cruz — a senior managing director on the team that represented Mack-Cali in the mega-sale — said Robert Martin wasn’t the only interested investor, noting that there were multiple groups vying for the properties.

“You don’t really have the opportunity to acquire that much real estate in one shot in Westchester and Fairfield counties,” said Cruz, who noted that HFF was recorded as the seller’s broker because the deal took place before JLL’s merger with the firm. “There’s just not enough for that product available, and that product is in high demand today.”

How to smash a record

In some ways, Robert Martin caught a lucky break because Mack-Cali was dealing with internal turmoil and looking to exit the Westchester market.

The REIT — which just ended a months-long proxy fight with an activist investor — has unloaded millions of square feet of commercial real estate in the county in the last few years as it’s shifted its focus to its home base in New Jersey.

In September 2018, it also sold two office buildings in White Plains — the 68,000-square-foot 1 Barker Avenue and the roughly 65,000-square-foot 3 Barker Avenue — for a total of $15.95 million. That joint deal clocked in at No. 9 on TRD’s ranking.

Robert Martin’s Greg Berger — a managing director and partner who, along with Jones, was part of the original sale — said his company is now working on upgrades throughout the Mack-Cali portfolio.

It’s also looking to repurpose some of the flex space to accommodate “nontraditional” tenants.

“Believe it or not, there’s interest in the markets for entertainment production, like movies and television shows,” Berger said. “We have a number of people looking for that kind of use, and as well as tenants in the ‘experiential economy.’”

Berger cited one current tenant at the firm’s Stamford Executive Park — RPM Raceway, a company that runs an arcade, bowling alley and go-karts — that’s looking to expand. And it’s one of a handful of companies planning to open family-oriented entertainment in Westchester.

He said the firm is regularly retrofitting space — whether it’s a flex space into a trampoline park or an office space that needs to be broken up for smaller companies.

“When you have 280 tenants and 3 million square feet, you always have people moving,” said Berger. “It’s like a puzzle.”

Berger and Jones both said they’ve seen an uptick in industrial tenants looking to buy in order to protect themselves from rent increases. Rents have risen about 40 percent for industrial space in the last three years, according to Jones. He said the firm has had “multiple inquiries” from tenants that want to own instead of rent.

“There’s a real demand by industrial users to own their own buildings,” Jones said, noting that the firm will entertain conversations about selling assets.

Beyond the blockbuster

Although Robert Martin’s deal was the biggest by a long shot, there were other notable office building trades during TRD’s June-to-June stretch.

Interestingly, only two of the top 10 sales took place in 2019. That jibes with the overall market: CBRE reported a “light second quarter in terms of leasing activity.”

CBRE’s Dunne said, however, that he’s currently working on deals in Purchase and White Plains.

His team also represented the buyer and seller in the second-priciest trade on TRD’s ranking: the sale of the 563,596-square-foot Reckson Executive Park portfolio in Rye Brook for $55 million, according to TRD’s data. (Data was submitted by commercial brokerages and confirmed through news clips, public records and the companies involved in the deals.)

The Reckson deal, which closed in July 2018, involved two major Manhattan players: SL Green Realty, which sold the six-building Class A office park, and George Comfort & Sons, the buyer.

The No. 3 deal came from the White Plains-based GHP Office Realty, a subsidiary of Houlihan-Parnes Realtors, which snapped up the 370,000-square-foot Taxter Corporate Park in Elmsford from Keystone Property and Mack-Cali for $45.6 million. Tenants include Montefiore Medical Center, which leased 120,000 square feet this spring, and glass manufacturer Schott North America.

From there, prices dropped off somewhat. No. 4 on the ranking was 20 South Broadway in Yonkers, which sold in September 2018 to the Bronx-based Chestnut Holdings for $26 million. The Art Deco-style building, with about 148,600 square feet of space, is just a few blocks from the Metro-North train station, which helped draw interest.

Yonkers has become a new hub for multifamily projects that appeal to people priced out of Manhattan and even the Bronx, said Torrance, who noted that he did not work on the deal.

Wilson Kimball, Yonkers’ planning and development commissioner, told TRD this year the city had more than 5,000 residential rental units completed or in the pipeline.

New Rochelle — which earlier this year had 3,500 residential units coming online — saw the sale of the former Bank of America at 277 North Avenue for $22 million last summer. The buyer was DVO Real Estate, which is planning a 28-story residential building.

Jeffrey Dunne

The other deals on the top 10 ranking, which collectively comes to roughly $697 million, each have their own backstory.

For example, the $17.5 million sale of 34 South Bedford Road in Mount Kisco, close to Northern Westchester Hospital, spoke to the interest among developers in the medical space. The building, which counts CareMount Medical Imaging and Surgery Center as a tenant, got a lot of interest from potential buyers, said JLL’s Cruz, who worked on the deal. It sold to the Milwaukee-based Hammes Partners, a health care-focused private investment platform.

“It was attractive because of the tenancy, its proximity to the hospital and the fact that you could add value to the assets,” he said.

Overall, the loss of outdated office supply — coupled with the fact that “nobody’s building more office buildings,” as Berger said — is helping the Westchester office market stay healthy.

“There are investment groups that wish more would become available, especially properties with train access,” Cushman’s Torrance said. “And White Plains is 20 minutes closer to New York City than Stamford.”