It’s a good sign for the market when a listing kicks off a bidding war like the one that recently took place for a four-bedroom waterfront home near Orient Point.

The end result was a closing price that was $400,000 above ask. Corcoran Group agent Sheri Winter Parker won the property at 1 Mulford Court for her clients — ultimately closing for $2.7 million after a three-day battle that sent the price 17 percent above its initial ask of $2.29 million.

While the overall market isn’t quite as strong as that outlier deal, brokers say that there’s intense competition in the area for updated homes that are priced right. At the same time, agents eager to maintain their share of listings and clients are keeping their cards close to their vests.

“It’s being taken a lot more seriously than it has in the past,” Winter Parker said of the residential sales market on Long Island’s northeastern peninsula.

Though competition among agents and brokerages is a constant, Joan Bischoff van Heemskerck, manager of Town & Country’s Greenport office (which opened last year), said that most real estate professionals work together peacefully on the North Fork. That’s not to say there aren’t a few who go for the jugular, though.

Some agents convince sellers that it’s better to keep their properties off Long Island’s multiple listings service to make them as exclusive as possible. Others use shadier tactics, he said, like hiding house keys from buyer’s agents with the hopes of preventing a sale until they can find a buyer themselves.

“Some bad eggs start violating their duties to their clients by making it difficult to show their listings,” Bischoff van Heemskerck said. “In doing so, they hope to earn commissions on both sides of deals, and fail to provide the best possible exposure of sellers’ properties.”

Bischoff van Heemskerck suggested that agents should rely on their local niche, pointing out how Town & Country’s only focus is on the East End. But Karla Dennehy, an agent with Douglas Elliman, said her firm benefits from referrals from its offices in New York City.

“It’s a wonderful mixture because we have people who are local, and we also have people who have lived in the city and then have come out here and made the North Fork their home,” she said. “I have people who have lived here for generations.”

Douglas Elliman is leading the market in new listings so far this year, securing 80 between January 1 and May 8, according to data collected by Town & Country. Daniel Gale Sotheby’s International Realty came in second, with 68 listings. Town & Country’s data showed that it had 20 listings in the first four-plus months of this year, while Corcoran had 17.

Douglas Elliman is leading the market in new listings so far this year, securing 80 between January 1 and May 8, according to data collected by Town & Country. Daniel Gale Sotheby’s International Realty came in second, with 68 listings. Town & Country’s data showed that it had 20 listings in the first four-plus months of this year, while Corcoran had 17.

The heat is on

Although brokers compete for listings, they’re seeing prices continue to rise.

In addition to winning a bidding war, Corcoran’s Winter Parker landed the two most expensive sales on the North Fork last year: a Jamesport vineyard that closed for $15 million and a six-bedroom home on 26 acres in Orient Point that went for $9.8 million. The latter sale broke the record for the hamlet, Winter Parker said.

She noted that buyers need to be nimble.

“If you see something on the market that you like and it’s in your price range, you don’t have time for it to haunt you because it’ll be gone,” Parker said.

This urgency is relatively new for the North Fork, which has long been overshadowed by the celebrity-studded Hamptons, where the top closing price last year was $40 million, according to an analysis by The Real Deal.

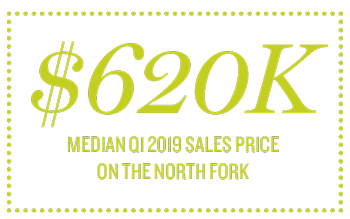

But North Fork prices are on the upswing. In fact, they’ve nearly doubled in the past five years, according to Town & Country. The median sales price grew 44 percent, from $430,000 in the first quarter of 2014, to $620,000 in the first quarter of this year. And that first-quarter median is a 6 percent increase from the median at the start of 2018.

The North Fork’s most recent numbers, however, are still far below this year’s first- quarter median for the Hamptons, which sat at $1.15 million, according to the data.

Prices to start out 2019 broke the $700,000 threshold in three of the North Fork’s four sections (Mattituck, Southold and Orient, for the first time in Town & Country’s reports), leaving only Jamesport trailing behind. Still, the number of sales on the North Fork remained mostly flat, decreasing slightly, from 83 last year to 77 in the first three months of 2019.

The decline in inventory is partially due to the market correcting itself after a boom in buyers during the recovery from the 2008 recession, brokers said. Another reason, noted Town & Country’s Bischoff van Heemskerck, is that property owners would rather keep their homes on the quaint and rural North Fork than sell them.

Since prices are relatively affordable compared to the nearby Hamptons, the buyers these would-be North Fork sellers attract aren’t looking for fixer-uppers. Instead, they are ready for bidding wars for turnkey properties.

“The people that buy houses on the North Fork have jobs, usually the younger families have small children,” Bischoff van Heemskerck said. “They don’t have time to renovate, they don’t know how to do it and they’re afraid of the cost.”

As for the rush that perspective buyers may feel about the North Fork market, Douglas Elliman’s Dennehy warned against comparing the area to its southern sister.

“The Hamptons has had celebrity for a very long time, those prices didn’t just jump up overnight,” she said. “The North Fork is more recently discovered.”