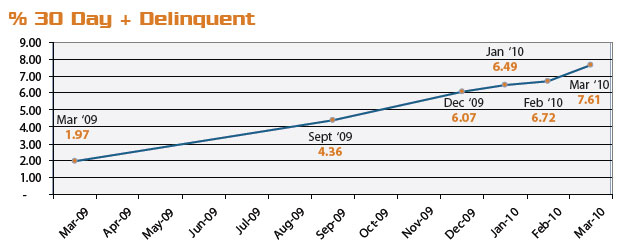

Source: Trepp

March ushered in a sharp rise in delinquencies on commercial real estate loans in commercial mortgage-backed securities, dashing hopes that February’s modest delinquency climb signaled the beginning of the end of the industry’s woes, according to a new report from analytics firm Trepp (see the full report below). The percentage of loans that were delinquent by 30 days or more jumped 89 basis points in March, which represents the highest month-over-month increase since the summer of 2009. That number was inflated by roughly 40 points because of the $3 billion loan on Manhattan’s massive Stuyvesant Town complex that is now in foreclosure, but even without the Stuyvesant Town loan, the delinquency rate rose by 0.49 percent in March, more than double the increase seen in February. TRD

Trepp Monthly Delinquency Report