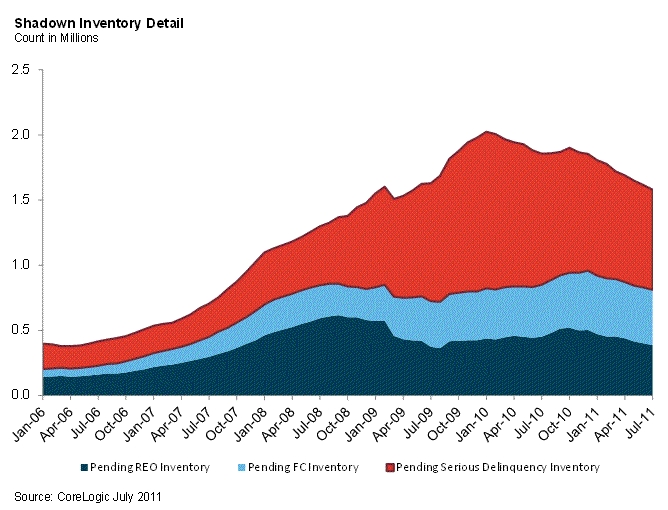

Thanks to a slowdown in the pace of new delinquencies, nationwide shadow inventory declined, according to a report released today by CoreLogic. Shadow inventory dipped to 1.6 million units in July, down from the 1.7 million units last measured in April and 1.9 million units a year ago. The current supply represents five months-worth of homes.

Shadow supply, which includes homes that are seriously delinquent, in some stage of foreclosure or are real estate owned, comprises 29 percent of the total July inventory of 5.4 million. Last year at this time the total visible and shadow supply was 6.1 million units.

Shadow supply is 22 percent below its January 2010 peak of 2 million units, lending some cause for optimism.

“The steady improvement in the shadow inventory is a positive development for the housing market,” said Mark Fleming, CoreLogic’s chief economist. “However, continued price declines, high levels of negative equity and a sluggish labor market will keep the shadow supply elevated for an extended period of time.” — Adam Fusfeld