Cash Sales

A new report from CoreLogic shows that cash sales are down across the country, though Florida and Miami still showed more than half of February sales in hard currency.

Miami’s percentage of cash sales in February were 59.3 percent, down 4 percent compared to the same month last year, yet way above the national rate of 37.9 percent.

The city was topped by Detroit, Michigan, with 60.5 percent of its sales in cash. Detroit was followed by Cape Coral and Fort Myers in Florida with 59.4 percent, with Miami trailing in third.

Washington D.C. had the lowest share of 16.9 percent.

The report states cash sales have been dropping since 2013, and if the trend continues, will make up roughly 25 percent of the country’s home sales by 2018.

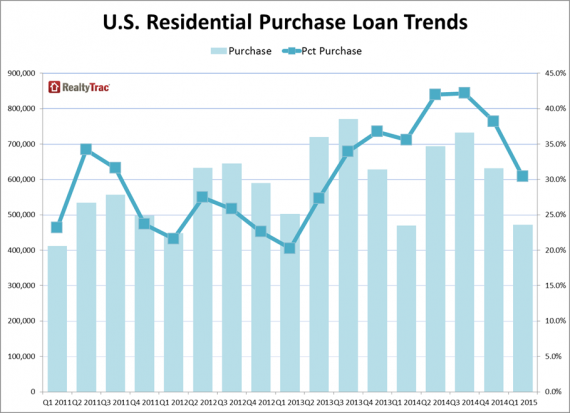

A graph of rates for national purchase loans

Loans for purchasing property

Miami saw a big increase in home buyers taking loans when picking up properties this year, while nationwide volume is stagnating, according to a RealtyTrac report.

The city ranked 11 out of the top 20 regions experiencing a rapid increase in purchase loans in the first quarter of 2015, compared to last year.

Nationally, loans coming from single-family homes and condos have grown 17 percent from the first quarter of last year, but the rate of purchase loans has risen by less than 1 percent.

“A dip in interest rates early in the year combined with lowered mortgage insurance premiums for FHA loans breathed some life back into the refinancing market in the first quarter,” said RealtyTrac Vice President Daren Blomquist in a statement. “Meanwhile the purchase loan market remained largely missing in action despite tepid growth from a year ago. The prime buying season still remains ahead, providing some hope that first-time home buyers and other traditional buyers relying on traditional financing will come out in the woodwork in greater numbers in the coming months.”