Home buyers in Miami-Dade County put down some of the biggest down payments in the country during the first quarter of 2015, according to a RealtyTrac report.

Prospective homeowners in Miami-Dade paid 19 percent of their purchase prices in down payments on average, ranking sixth out of all counties in the country. Three counties in New York ranked higher, with average down payments reaching more than 25 percent of purchase prices. Two counties in California also ranked higher, with more than 20 percent down payments.

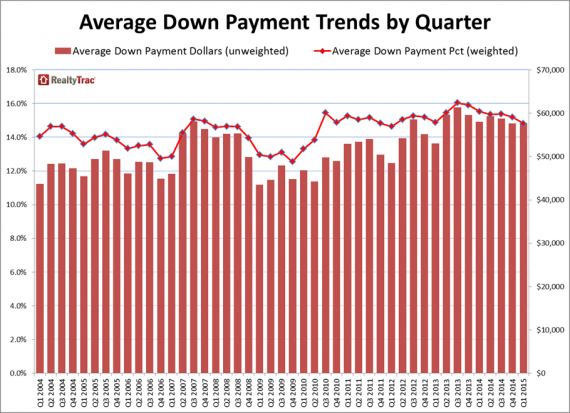

Meanwhile, the nationwide average for down payments decreased 0.4 percent during the first quarter of this year.

Loans with low down payments grew slightly across the U.S., while Miami-Dade and Broward County saw significant jumps in lenders issuing loans without prohibitive costs.

“A winning quinella is available today for the millennials and first-time home buyers. They have a plethora of low down payment options and unbelievably low interest rates available to them,” said Mike Pappas, CEO and president of the Keyes Company, in a statement. “It is encouraging to see this positive lending environment strengthen the real estate market.” — Sean Stewart-Muniz