China is letting the renminbi devalue. The economy is slowing. Their debt is growing ($28 trillion!). And that means the Chinese are having more difficulty paying their US dollar-denominated debts as time goes by.

So how much money, exactly, is fleeing from China right now?

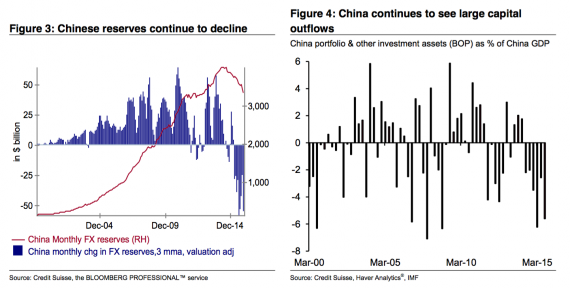

Credit Suisse analyst Helen Haworth and her team produced these two slightly terrifying charts showing the scale of capital flight out of China right now.

The left chart shows China’s reserves in decline, as banks there use their foreign currency holdings to buy all the renminbi everyone is selling. Note that the scales on the graph are in billions of US dollars.

The right chart shows capital leaving China as a percentage of GDP. Note that it is accelerating over time. We haven’t seen those dips since the 2008 crisis.

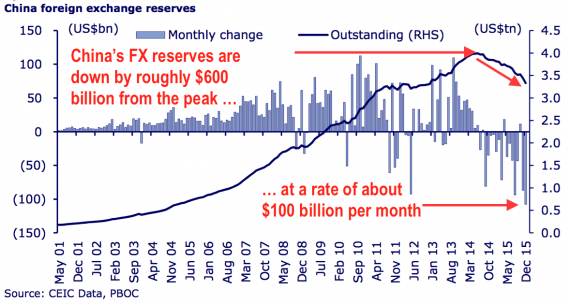

Christopher Wood and his Greed & Fear gang at CLSA have a similar chart that shows a little more detail. China’s foreign currency reserves have declined by what looks like roughly $600 billion from their peak and capital is fleeing at a rate of $100 billion a month, in some months:

Bear in mind, the FX reserve can go negative, as it was for much the early 2000s. It’s just that when that happens, the renminbi is relatively worthless. Analysts disagree about how much capital is exiting China. (It’s not the most transparent place, after all.) RBS, for instance, believes the situation is even worse, and that $170 billion in capital left China in December.