As vacancies continue to evaporate at downtown Miami and Brickell office buildings, asking rents in both those submarkets are within touching distance of their peaks before the real estate crash, according to a new report.

When the Brickell office market was at its most expensive levels in 2008, asking rents were going for an average of $45.94 per square foot. Now, after eight years and a major recovery in the local real estate economy, rents are back up to $45.72 per foot.

Downtown rents have seen a similar resurgence: they peaked at an average of $41.37 per foot in 2008 and are now standing at $39.50 per foot.

The data comes from a 2015 end-year office market report authored by Lambert Advisory on behalf of Miami’s Downtown Development Authority.

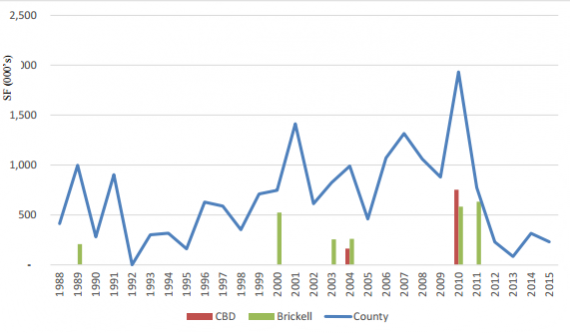

Part of the reason for those climbing rental rates: a lack of substantial office development in both markets in the last few years, according to the report.

The last major round of office construction wrapped up in 2011, and this latest cycle has seen developers focus mainly on condominiums, according to the report. That lack of new product weighing down the market, plus job growth from a strengthening U.S. economy have consistently brought down office vacancy rates in the Greater Downtown area.

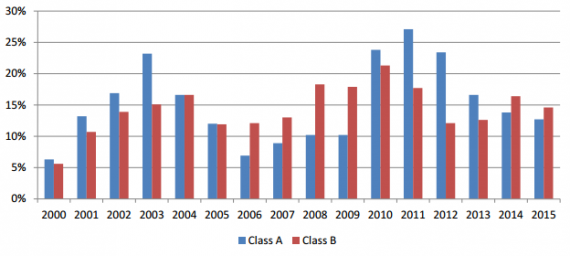

Brickell occupancy rates by office class

Brickell’s total vacancy rate stood at 13.3 percent in 2015, a strong improvement from its peak of 24.6 percent in 2011. Downtown Miami also saw strong gains, while not as dramatic. Its occupancy vacancy rate fell from 23 percent to 18.2 percent by the end of 2015, the report stated.

Despite the recovery, the report said those occupancy rates still don’t support new construction outside of projects that are already underway.

Roughly 385,000 square feet of offices are under construction in Brickell, largely thanks to Swire Properties’ Brickell City Centre project, and another 315,000 square feet are underway at All Aboard Florida’s upcoming MiamiCentral rail station. That’s about 600,000 square feet of new offices expected to hit the market within the next two years, though that’s about half the square footage delivered during the last building boom, according to the report.

“The scale and timing of these new buildings are unlikely to cause any significant disruption to the market,” the report stated.

As rents continue to grow, office tenants have begun choosing Class B and older Class A buildings where asking prices can be as much as 35 percent cheaper than their trophy-property counterparts, according to the report. Roughly 56 percent of the square footage in both markets is Class A space, with Class B and Class C buildings taking up minority shares.

The report postulates that this market shift will equalize itself: Growing demand will drive up Class B office space, in turn closing the price gap between it and Class A buildings.

Office deliveries by year in Brickell, the Central Business District and Miami-Dade County as a whole

As the downtown area continues to develop, the report expects 19,800 jobs will be created in the region over the next six years.

“Based upon employment growth and net absorption trends, we estimate that the [downtown area] should be in a position to support new office space being delivered to the market within the next five to six years,” the report stated. “Furthermore, we believe the trend to developing office buildings of under 200,000 square feet and introducing them every two to three years is a healthy evolution for the Downtown market as it allows for the introduction of office space at a pace which the market can tolerate based upon trends in historic and projected employment.” — Sean Stewart-Muniz