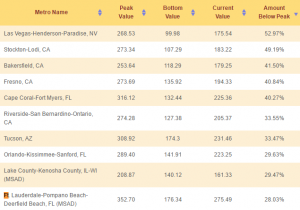

Even five years into a recovery from the pits of the housing market crash, the South Florida residential market is still well below the heights it hit during the previous peak, a new report shows.

Since 2011, home prices have shot upward, at times by double-digit percentages, but the tri-county area is still far from levels seen in 2006 and 2007, according to the report, prepared by mortgage and lending research site HSH using home price data from the fourth quarter of 2015.

HSH analyzed data from the Federal Housing Finance Agency and found Broward County was one of the country’s slowest markets to recover. Home prices in Broward are 28 percent below their 2006 peak.

Miami-Dade County, South Florida’s largest housing market, is also 27 percent below 2007 levels. The city of Miami, in particular, leaned heavily during the recovery on South American buyers, who amassed large residential portfolios when prices were still weak.

Out of South Florida’s three counties, Palm Beach is closest to its previous peak, about 22 percent below peak prices in 2006.

Recent turmoil in global financial markets has taken the wind out of South Florida’s housing economy. A strong U.S. dollar is pushing out a lot of foreign buyers, and the gap left by South American buyers dealing with sluggish economies back home has put downward pressure on residential prices in South Florida. — Sean Stewart-Muniz