It’s a hard pill to swallow for many in Miami’s real estate community.

The city is experiencing a significant slowdown in sales volume, according to the newly released Elliman reports, and even its most well-regarded markets like Miami Beach are seeing some of their first price cuts in years.

The reports, commissioned by brokerage Douglas Elliman, cover first-quarter data from several major housing markets in the U.S. including all three of South Florida’s counties.

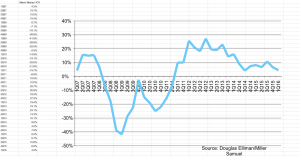

What the numbers show is that both mainland Miami and its barrier island Miami Beach are continuing to cool off as sales and price growth slow.

In the mainland, which covers neighborhoods east of I-95, 3,583 condos and single-family homes were sold in the first quarter, a reduction of 17.5 percent from the 4,344 closings made during the same period a year ago. Prices saw a small 2.7 percent bump, from a median of $393,343 per property last year to $404,020 in the first quarter.

The Miami Beach section of the report, which covers everything from Sunny Isles Beach to Fisher Island, shows an even larger dip. Sales reached 810 properties, down 21 percent year-over-year. And for the third quarter in a row, prices on the beach for both condos and single-family homes have dropped. Median prices fell from $437,750 a year ago to $408,750 last quarter, according to the report.

“We’re experiencing a slowdown after an extended period of intense activity,” Jonathan Miller, co-founder of research firm Miller Samuel and the author of the Elliman reports, told The Real Deal. “The pace is shifting down to something much more mundane.”

The slower sales pace is leading to a large buildup of inventory, which can further drag down the market. The report shows supply is up to 21.5 months for Miami Beach’s condos and houses, up from 12.8 months in the first quarter of 2015. For the mainland, the supply is a much more manageable 10.6 months, but even that has risen by 39.5 percent year-over-year.

And while the aggregate sales numbers could be blamed on the condo market in previous months, that’s not the case anymore. Both condos and single-family home sales were down significantly in the mainland and the beach during the first quarter.

Miller said prices typically lag behind sales trends by about 15 months. So while homes continue to become more expensive in the short term when you look at the market as a whole, Miami could start seeing prices flatten out as soon as next year.

As for why the market has curbed, Miller cited the same factors that industry members have come to memorize in recent months: weak economies in foreign countries, especially those in Latin America, have narrowed the buyer pools Miami relied on to fuel the market in previous years.

To make matters worse, a strong U.S. dollar also hurts the purchasing power of foreign nationals, making Miami real estate more expensive.

Also contributing to that slowdown in sales, Miller said, is a shrinking supply of distressed properties. Lender-owned homes and short sales made up 14.4 of all home sales three years ago — now, they have a market share of only 8.1 percent.

Even the fact that it’s an election year could cause hesitancy for home buyers, he said, as they wait for the new administration’s effect on federal mortgage rates to get hashed out in the months following inauguration day in January.

Though the short-term numbers paint a gloomy picture, Miller pointed out a statistic that could assuage some industry members’ fears for the future: in the years before the housing crash, when the market was healthy, Miami and Miami Beach averaged 2,558 home sales per quarter. Now, even amidst a slowdown, the first quarter saw nearly double that with 4,393 closings.

While the greater Miami area continues to slow, other South Florida markets are starting to show volatility. Home sales in Fort Lauderdale dipped 8.3 percent year-over-year, from 504 to 462 properties.

In Palm Beach, closings were cut in half year-over-year, from 90 to 45. Miller said the number of Palm Beach signed contracts jumped up in the first quarter, despite the huge dip in recorded closings.

The only South Florida market to show a positive sales trend in the report was Boca Raton, a wealthy city known for its golf course communities. Sales spiked by 20 percent year-over-year, from 503 closings to 607 in the first quarter.

“It’s not clear how long we’ll be in this period,” Miller said, “but the market has certainly changed from what it was a year or two ago.”