While industrial real estate might not share the glamour of high-rise offices and condos, warehouses and distribution centers play a huge part in the expansion of a region’s economy.

In South Florida’s three counties, the industrial real estate market continues to tighten as vacancies drop across the board and rental rates gradually climb, according to report by Avison Young.

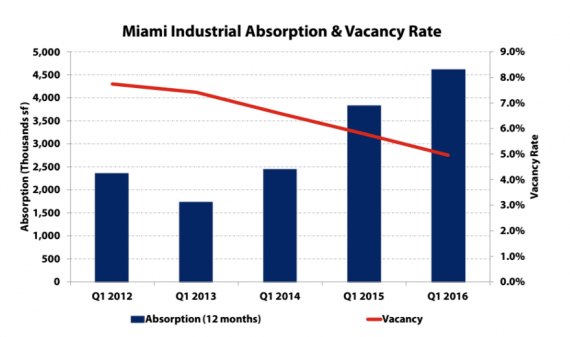

Miami-Dade industrial states

Miami-Dade has 2.5 million square feet under construction

With unemployment rates improving, developers are banking on a strong South Florida economy with roughly 2.5 million square feet worth of industrial development under construction during the first quarter.

According to the Avison Young report, that’s about 1 million more square feet than what was under construction during last year’s first quarter.

Vacancy rates nudged down less than a percentage point to 5 percent, with rental rates growing $0.50 per square foot to $8.95 per foot — the highest industrial asking rates since 2008. On top of that, absorption hit a whopping 4.6 million square feet.

The report said many of Miami’s tenants are looking to expand into more efficient spaces, which means speculative developers are building much more sophisticated projects with fire suppression systems, larger truck courts and bigger docking bays.

Miami-Dade’s largest industrial lease during the first quarter belonged to Amazon, which inked a 175,000-square-foot deal at the South Florida Logistics Center near the Miami International Airport. The lease marks the opening of Amazon’s second Miami-Dade distribution center.

Behind Amazon was freight management company Neutralogistics, which leased 105,900 square feet at the newly built Airport North Logistics Park.

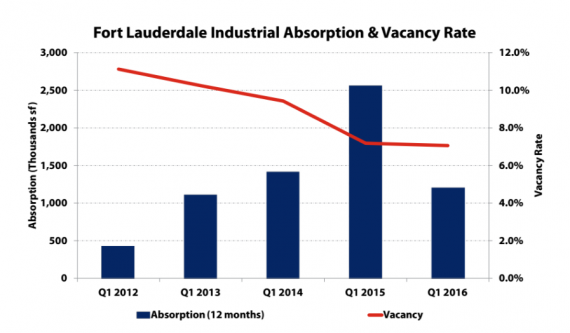

Broward industrial stats

Broward vacancies fall as new construction levels out

Despite several companies shifting into expansion mode in Broward County, according to Avison Young’s report, the amount of new industrial product under construction has all but leveled out year-over-year.

There were 800,000 square feet of industrial space in the construction pipeline during the first quarter, which held mostly steady from the first quarter of 2015.

Despite the stagnation in what’s breaking ground, just under 1.2 million square feet were delivered this spring — the most new product Broward has seen in a single quarter for at least three years.

On the flip side, asking rents for triple-net properties inched upward by $0.43 to $7.77 per square foot during the first quarter. Vacancy rates also dipped by a fraction of a percentage point to 7.1 percent. Absorption, however, dipped heavily from 2.5 million square feet to 1.2 million square feet year-over-year.

Broward’s biggest lease went to Aviation Inflatables, which agreed to occupy 128,100 square feet at the Sawgrass Technology Park in Sunrise. The company does repairs for airplane emergency equipment like the inflatable door slides that deploy after a plane crash.

Not far behind that lease was RTA Product’s deal for 93,700 square feet of space at the Seneca Industrial Park in Pembroke Pines. The company is a furniture distributor that specializes in desks, office chairs and TV stands.

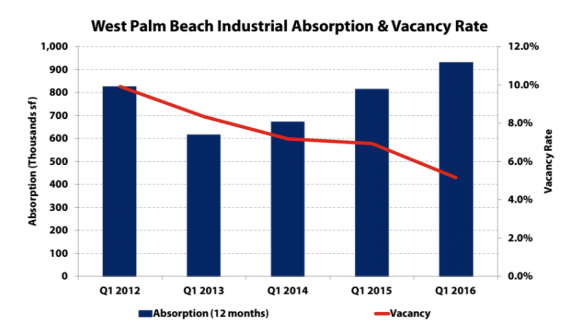

Palm Beach County industrial states

Palm Beach County shows demand despite sparse construction

Palm Beach County’s industrial market has a lot of positives working for it: 900,000 square feet of space was absorbed during the first quarter, vacancies continued a steady decline to 5.2 percent and triple-net rents grew $0.47 to $8.87 per square foot.

New construction, however, seems to be the market’s most volatile variable. Developers had 500,000 square feet under construction during the first quarter, up from a flat zero square feet in the first quarter of 2015. That will change pretty soon, according to the report, as more than 1 million square feet is in the development pipeline.

Duke Realty is planning to build 800,000 square feet as part of its Turnpike Crossings development in West Palm Beach, the McCraney Property Company has broken ground on the first portion of its 388,000 square feet of warehouses east of Florida’s Turnpike, and the Liberty Property Trust is already building its 218,200-square-foot Liberty Airport Center.

In terms of leasing activity, Palm Beach County’s first quarter didn’t see many large deals. The biggest lease was Coastal Screen’s 25,600-square-foot space at a Delray Beach building, followed by CJJS Holdings’ 24,500-square-foot lease in Riviera Beach.