Trending

IRS closes off remaining REIT spinoff loophole

Measure prohibits them from merging with other investment trusts, among other avenues

The Internal Revenue Service officially closed the last remaining legal avenue that allowed non-real estate corporations to spin off their property holdings into real estate investment trusts and reap tax benefits in the process.

Last year, Congress passed a law banning companies from spinning off their real estate assets into REITs after a wave of such deals by retailers, hotels and other non-real estate corporate entities – moves designed to benefit from the tax-exempt status carried by REITs.

While the measure banned such tax-free spinoffs from claiming REIT status for 10 years after their formation, it did not prohibit those spinoffs from merging with existing REITs or finding other ways around the law, according to the Wall Street Journal.

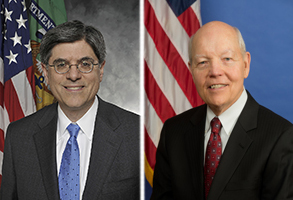

That avenue has now been closed off, however, after the IRS and Treasury Department announced new regulations deemed “necessary to prevent abuse.” Spinoffs that eventually gain REIT status would still be required to pay corporate taxes, undermining many of the benefits of becoming a REIT.

Neither Congress’ law banning spinoffs nor the new IRS and Treasury regulations prevent existing REITs from spinning off other REITs, nor do they affect REIT spinoffs that received permission from the IRS by last December – exempting the likes of hotel giant Hilton Worldwide Holdings. [WSJ] – Rey Mashayekhi