Trending

Broward housing market picks up pace during May: report

While much of South Florida’s housing market has struggled through a rough spring, May proved to be a bright spot for Broward County.

Sales for both homes and condos spiked year-over-year, all while inventory held mostly steady, according to a new report from the Greater Fort Lauderdale Realtors association.

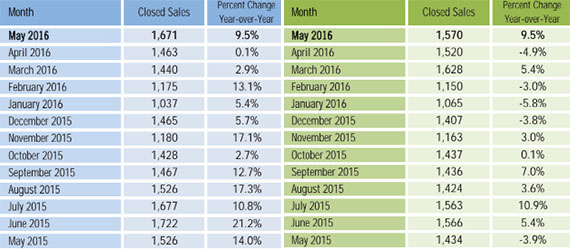

A total of 1,671 single-family homes were sold in May, up 9.5 percent from the 1,526 sales made during May 2015.

Sales for townhomes and condos also jumped by 9.5 percent, from 1,434 closed deals a year ago to 1,570 this May.

Closed sales for Broward single-family homes, left, and condo sales, right

Those spikes in numbers are also a considerable improvement from April, which saw the pace of home sales slow year-over-year in both Broward and South Florida in general.

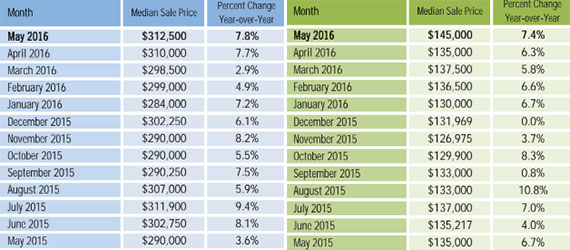

Despite the recent market volatility, prices are still rising at a steady clip. The median price to pick up a Broward condo or townhouse hit $145,000 in May, which grew by $10,000 from a year ago.

Median prices for a single-family home also rose by $22,000, from $290,000 per home to $312,000.

Meanwhile, homeowners took a breather during May, with only a slight rise in inventory for both sectors compared to last year. Listing inventory for single-family homes stood at 2,177 in May, an increase of only 1.2 percent year-over-year, while condo inventory showed even less growth with a 0.2 percent bump to 2,113 listings.

Median prices for a single-family home in Broward, left, and a condo, right

Fewer properties hitting the market and a faster sales pace could be a sign that Broward’s housing market is tightening, though it’s too early to tell if that trend will continue through the year.

To the south, Miami-Dade County has been hammered by declining sales and a surplus of inventory as homeowners look to cash in on ever-rising prices. Some analysts have said this will likely lead to a correction in the market and sellers start adopting more realistic pricing.